Hello guys,

My friend and professional trader Ziggy (the author of Ziggy’s alternative approach) was kind enough to keep track of all trades that I published since September 2016. He recently posted some very nice results of an extremely simple method of trading my levels. This method is ideal for for people who are starting trading my levels, looking for their way around and for people who are not able or don’t want to sit in front of their computer all day and micro manage their intraday trades like I do. Let me give you a summary of his research and the exact rules on this Easy 20/20 trading method. I am sure everyone of you will be able to trade with this approach and have a very positive results.

This method works with my intraday levels. Only the rules of trading them are different from my own rules.

Rules for Ziggy’s Easy 20/20 method:

- Profit Target: 20 pips

- Stop Loss: 20 pips

- Use all levels (even very old ones that still haven’t been tested)

- There are only 2 situations when you don’t trade level:

- When level is hit during (or immediately after ) high impact macroeconomic news

- If the level was tested few pips sooner – consider the level already tested if the market came 5 or less pips close to the level and made 15 or more pips reaction.

- No trade management – when you enter the trade don’t move your SL to secure your position. Just let it be so the position either ends up in +20 pips profit or -20 pips loss.

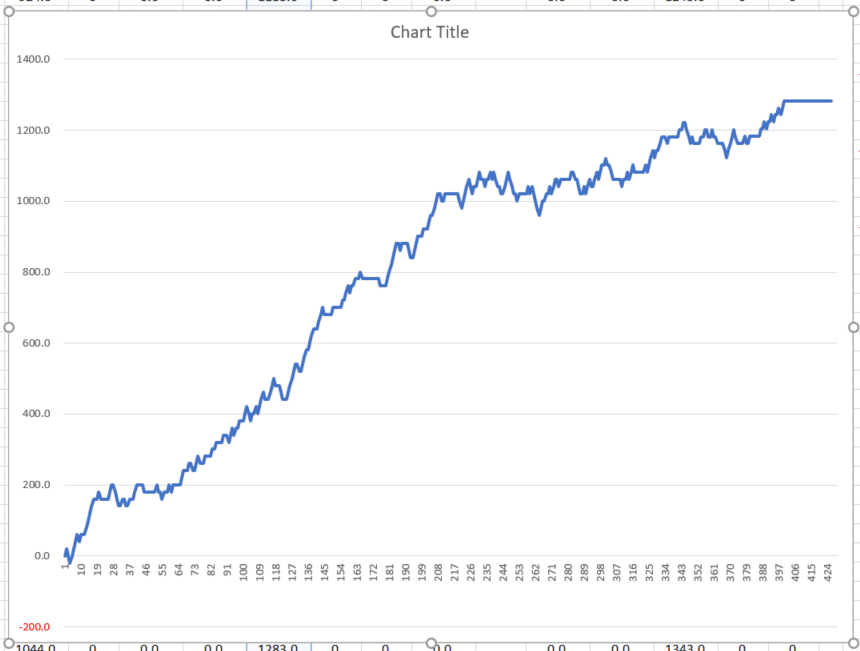

If you followed these very simple rules and took all my levels you would have about 400 trades and +1300 pips profit just in 7 months! I think those are a very good results considering we are talking about intraday trades. Strike rate for this simple method is around 66-68%. I think it is very high winning percentage considering that you practically just enter into your position and let it run into profit or loss without managing it any more.

Here is an equity chart in pips:

Results were generated using a Simulated Trading Account and are Hypothetical.

If you started with only $1.000 and traded with 5 % risk per trade then right now you’d have around $ 17.000.

If you would like to “turbo boost” (as Ziggy puts it) your account and started with $500 and risk 10 % per trade you would now have $100.000 – yeah really. Please note that this is just hypothetical and we don’t recommend it. There would have to be perfect trading conditions with no slippages and you would have to deal with very high drawdowns (and you would probably also lose your hair because of the stress :)).

Choose a good broker

Even though you stretch your PT/SL to 20/20 I would like to point out that it is absolutely crucial to have a solid broker. Even 0.5 pip wider spread can make a difference between winning and losing trade. Roughly speaking you need to have your spread below 1 pip and your broker shouldn’t “dick you around” as Ziggy put it nicely :). (btw. I hope I will be able to recommend you some solid broker/brokers soon and maybe even get you a discount).

Old levels

I would like to say that according to Ziggy’s vast and very thorough research there seems to be no correlation between how “old” the level is and its strike rate. In other words. Even very old levels from which the market run many pips away are working with the same strike rate as the fresh and new levels. Ziggy found out that even the oldest level (43 days old and with price that went up to 340 pips from it) worked so well that when the price returned back to this level it only went 2 pips against and after that made around 50 pips reaction!

Quick vs Slow trades

Lots of people were wondering if trades that run for many hours (and cause us to be nervous) are worse than the quick ones. Thanks to Ziggy’s analysis we now know that there is no correlation between how long the trade takes and its strike rate. This means that trades that are running for hours have the same strike rate as the trades that are finished just in few minutes. We just have to be more patient with them.

One more secret lesson

There is one more secret lesson to be learned from this my friends. As you can see Ziggy is a very good professional trader. But he achieved it through hard work. Look closely at what he does, what questions he asks and how thorough his research is. There is not really a shortcut to being a professional trader but asking the right questions, working hard and doing your homework really moves you forward.

I really hope you guys find Ziggy’s Easy 20/20 method as appealing as I do. It is very easy to trade and still very efficient. I would recommend it for people who are starting trading my levels, looking for their way around and for people who are not able or don’t want to sit in front of their computer all day and micro manage their intraday trades like I do :).

Thanks Ziggy for your effort and for sharing your work with us!

Happy trading!

-Dale

Hi, THANKS for great article!!!

Question to Ziggy – do you still trade the alternative approach (when the first 5 min candle closes in right direction and the 5 min candle closes below / over previous candle – we move the SL on high / low of this candle…)?

Ziggy could you state how successfull is the alternative aproach versus the solid 20 / 20 approach described here?

Thank you very much.

Thank you Dale for the very informative article and also want to thank Ziggy for the amount of time he must have put on to his research and to come out with some solid findings. I remember about the spread sheets he posted, and its mind bogging. And thank you both of you for the support to the trading community.

I thank you Dale and also Ziggy, i highly appreciate may God bless you and keep you safe at all times

Very interesting.

Keep it up 🙂

Hello

This strategy requires limit orders ?

Thanks in advance

You can trade it with limit orders an also manually. Both ways are okay.

Are reversal trades apart of it?

no, this statistics doesn’t cover reversal trades.

if i use a 20 pips SL with for example 6E it will be 6,25 USD * 20 = 125,00 USD… and if a want to risk just 5% I will need at least 2.500 USD account… so i don’t really understand the calculation with 1.000 USD account…

I believe this stats was using forex, not futures. Still, there should be no problem with $1000 account if your broker allows bigger leverage.

Dale do you know what the total profit for those 7 months (1300 pips) would be WITH commission and an average spread of 0.4 pips on a 1 lot size every single trade? Because 400 trades would mean a lot of commission.

If you have any idea of the net profit, that would be great.

which timeframe this strategy use for?

Hi, it’s for intraday trading, around m30.

Good and easy method. Seeing that this article was published in 2017, is it still working? And can I still use the strategy but include a trade management rules (move SL)?

Hi Tim, of course it’s working. That’s right, feel free to modify you to suit your desires. 🙂

Thanks so much for the reply. It means a lot to me considering am a newbie and am not a member of your trading community yet. Working on becoming a member soon. Lest I forget, what was the actual trades of this backtest (excluding tested levels and macro news hits)?

Hi Tim, glad to hear that. They were my daily trading levels. 🙂

I know they are your trading levels. But my question is, how many of the 400 levels were actual trades (trades that got triggered)? Or is it all the 400 levels that got triggered?

All the trades shown are the ones that got triggered, of course.

If that is true, then that means something doesn’t add up. If our RRR is +20:-20 and the actual trades is 400 and total pip profit is 1300 pips, that means only 65 trades hit tp. What happened to the remaining 335 trades? Losses? I don’t get……

I would say the total pips should be higher.

400 trades

66% wins = 264 x 20 pips = +5280 pips

34% losses = 136 x -20 pips = -2720 pips

Total = 5280 – 2720 = +2560 pips, not 1300.

Dale, what I’m interested is how is it possible to have 400 trades in 700 months?

That would be 2-3 trades a day, but if I look on the Daily levels page, there are are only a few levels and quite far away from the current price, so they don’t get triggered so often. Or do I miss something and the levels are somewhere else too?

Hello Peter,

this article was written by my friend a few years back I don’t know how exactly he calculated it. Maybe he deducted trading costs so you have net number. Yea, currently I have less intraday trades on Majors. This changes over time though. Sometimes there is more to trade, sometimes less. I look at this as a sort of long-term cycles.