Here are some basic rules to give you an idea how to work with my intraday levels. These rules can be sort of a starting point for you. You can develop your own trading style and approach using my levels.

Understanding levels

I trade all my levels when the price reaches them. If I have for example 2 short levels it doesn’t mean that price will go up to reach those two levels nor does it mean that I think the market is going down. What it means is: If the price reaches 1st short level – I go in the short trade. Using rules I wrote below. If the price reaches the 2nd short level I go again in a short position using the same rules.

Profit Target/Stop loss

Profit target: 10 pips.

Stop loss: 12 pips.

I use this PT/SL because it suits me personally. It is also possible to go for much bigger profit targets because there is strong reaction to my levels quite often. I recommend trying 1st profit target 10 pips and 2nd profit target for example 20 pips (or use some type of trailing).

Securing your position

If the market went your way at least 7-8 or more pips it is possible to move SL. This way you can prevent turning a winner into a loser. You can move SL either to the place where the market turned or to Break even level. If you move the stop loss or not depends on your own judgement and your risk aversion.

When I consider the level already “tested“

If the market turns 3 or less pips before reaching the intraday level and makes 8 or more pips consider the level already tested and do not trade it anymore. This rule is not so clear-cut. For example if the market turns 2 pips before my level and makes 12 pip reaction – I won’t take the trade anymore. However if the market turns 3 pips sooner and makes not so strong 8 pip reaction I may still take the trade.

Macroeconomic news

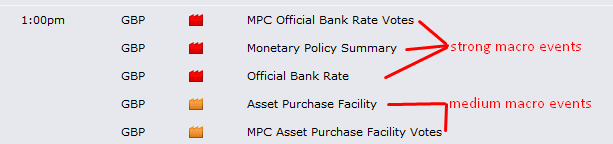

Never trade during significant macroeconomic news. Close all intraday trades at least 3 minutes before the announcement no matter if they are in open profit or losing. You can trade again if you see that there is no reaction to the news or wait about 10 minutes after the announcement (or better – after the macro volatility subsides). You can find all the news in the macroeconomic calendar for example here: www.forexfactory.com. The strongest events are marked in red colour. The less significant ones are orange and yellow. My rules apply for the red ones. If you want to be extra carefull apply the rules also to the orange marked events.

Limit vs. market orders

For intraday trades I use market orders only. I use alarms that I put few pips before the levels so I don’t miss any.

It is possible to use limit orders but you need to be aware of these factors:

- Macroeconomic news

- Situations when market turns a bit sooner making the level not valid anymore.

- Sometimes with market order you can jump in the trade for a slightly better price.

- Securing the position is harder when away from computer.

How long levels are valid

- My intraday levels are valid until they are tested or until the next levels are published.

- My levels work for EU, US and ASIAN trading session.