Trading Videos

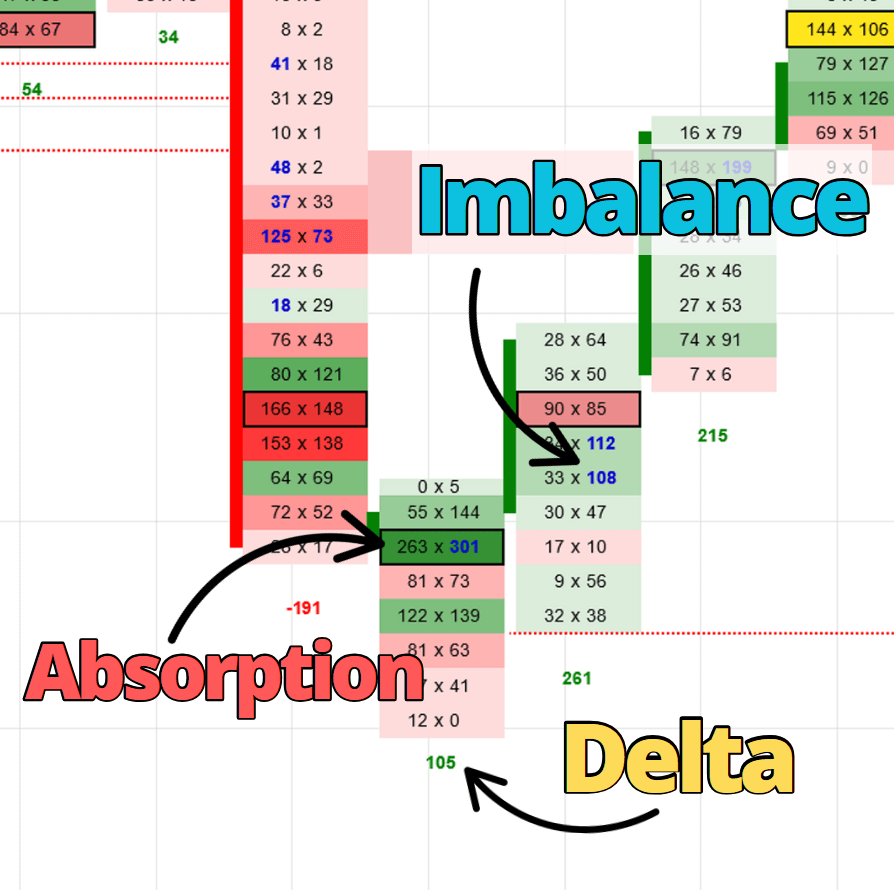

ORDER FLOW: 3 Key Patterns to Spot Reversals

In this video, I’ll show you 3 powerful order flow patterns I use to spot trend reversals — patterns that work across any instrument and on fast intraday timeframes like 1min, 5min, and 15min charts.

How to Get Futures Data in NinjaTrader 8 for Just $4/Month (2025 Guide)

In this video, I’ll show you how to get official CME futures data in NinjaTrader 8 for just $4/month — and walk you through the entire setup step by step.

🚨Trap or Trading Opportunity? How to Use Volume Profile to Reveal the Truth

In this video, you’ll learn how to spot good trading opportunities vs. traps using rejections.

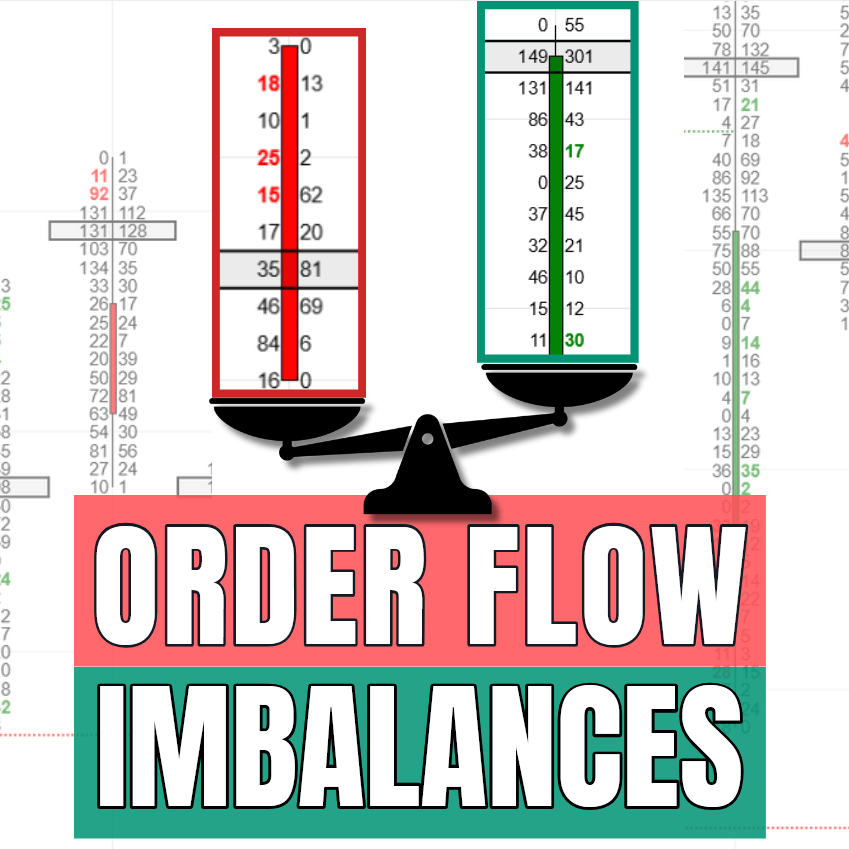

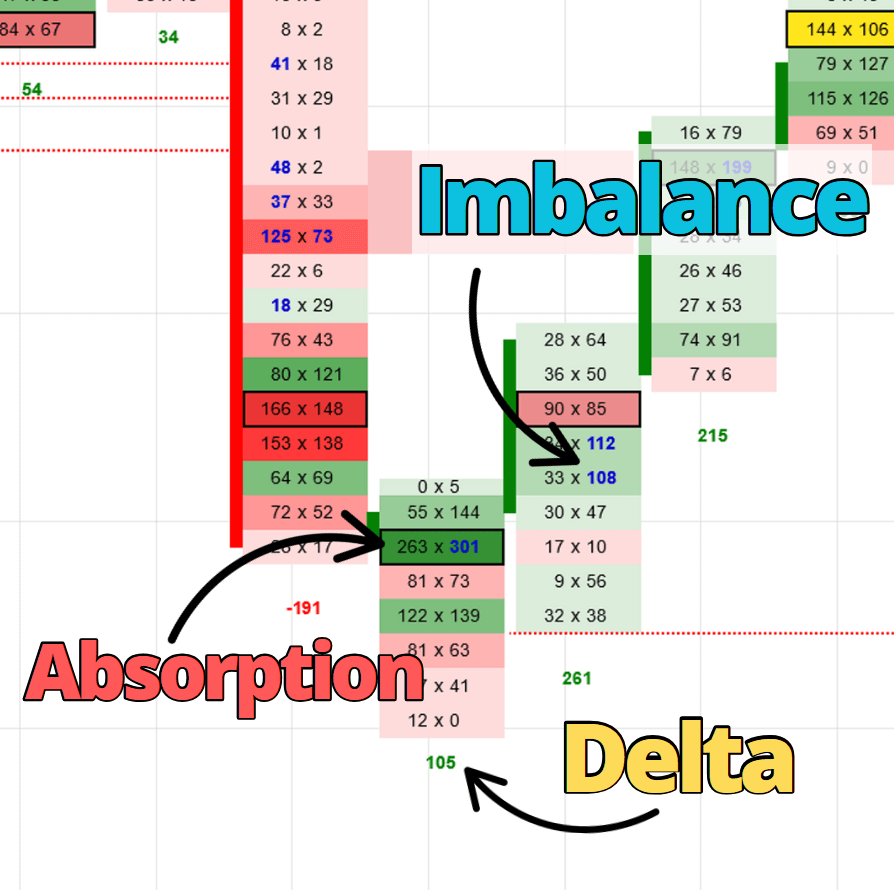

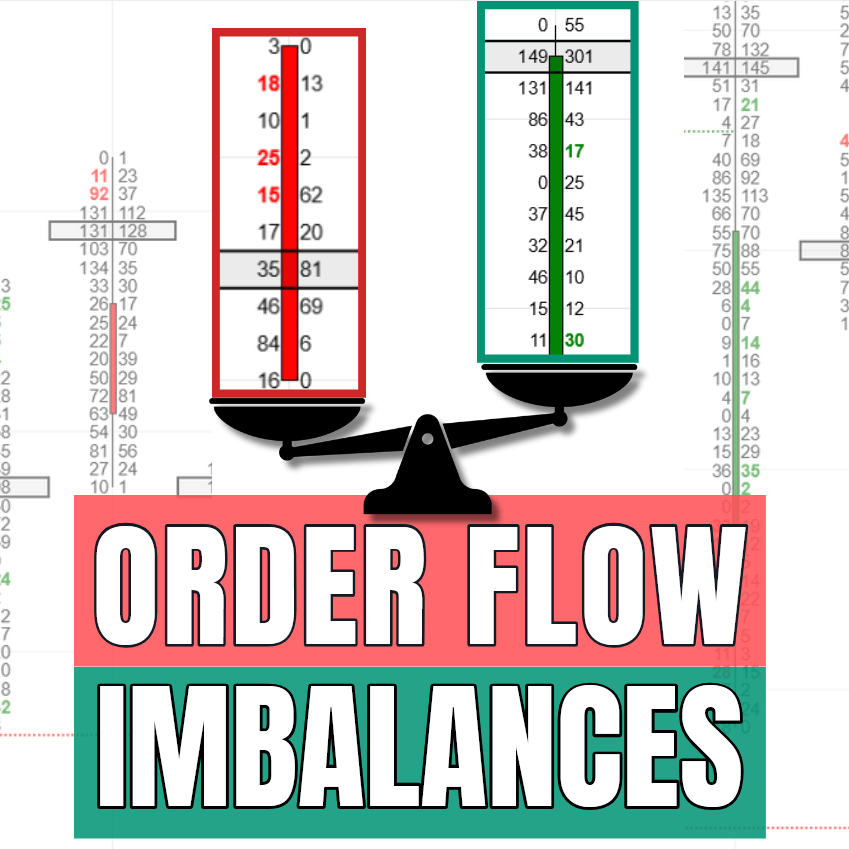

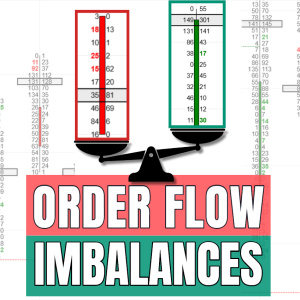

🔴WEBINAR: Order Flow Imbalances – How to Spot and Trade Hidden Market Strength in 2025

Video Transcript: Have you ever wondered what really causes big market moves and, more importantly, can you learn how to spot it, how to understand

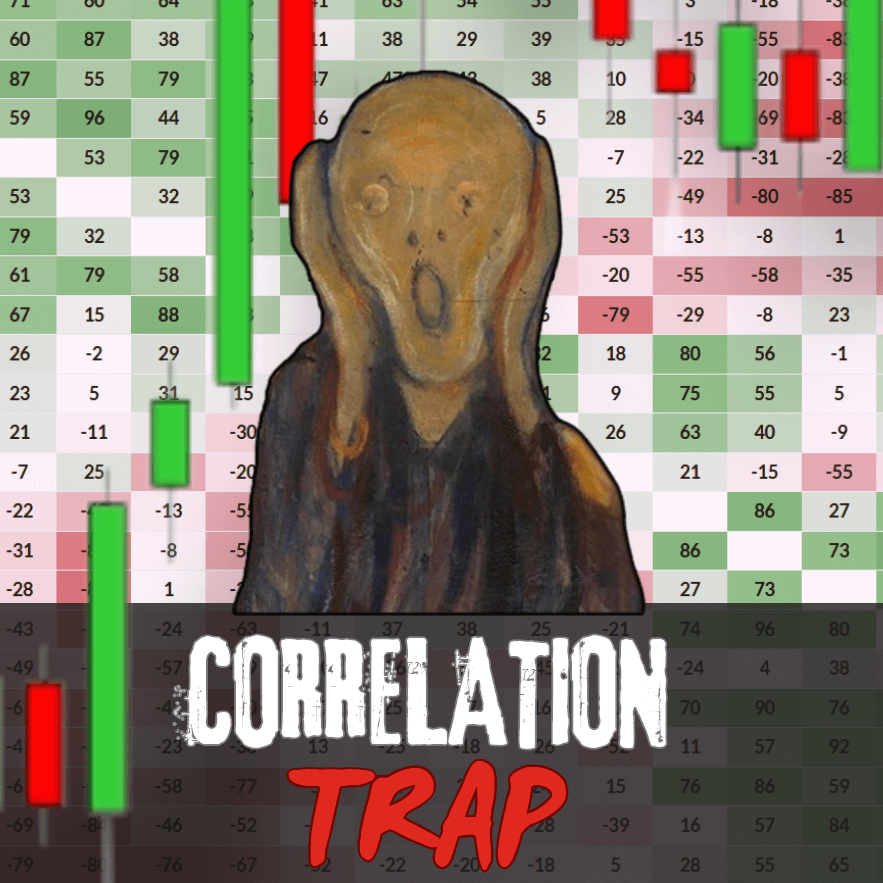

Double Trouble: Correlated Markets Wreck Trades – Here’s What to Do

In this video, I break down the correlation table in simple terms. It’s the key to avoiding trades that move together and wipe out your gains.

Succeeding with Prop Firms: Why Most Traders Fail After Getting Funded

Succeeding with prop firms isn’t just about getting funded—it’s about staying funded and consistently making profits. This video covers 11 crucial steps that top traders follow, from risk management and trade selection to psychology and journaling. Apply these strategies to avoid common pitfalls and build long-term success in the prop firm environment.

Succeeding with Prop Firms: Why Most Traders Fail After Getting Funded

Unlock the path to long-term success with prop firms by learning the key strategies that separate profitable traders from those who lose their funded accounts. Based on data from 177,000 traders, we reveal the critical factors like risk management, trade selection, and psychological discipline that determine who gets consistent payouts. Whether you’re new to prop trading or struggling to maintain your account, this guide will help you trade smarter and stay funded.

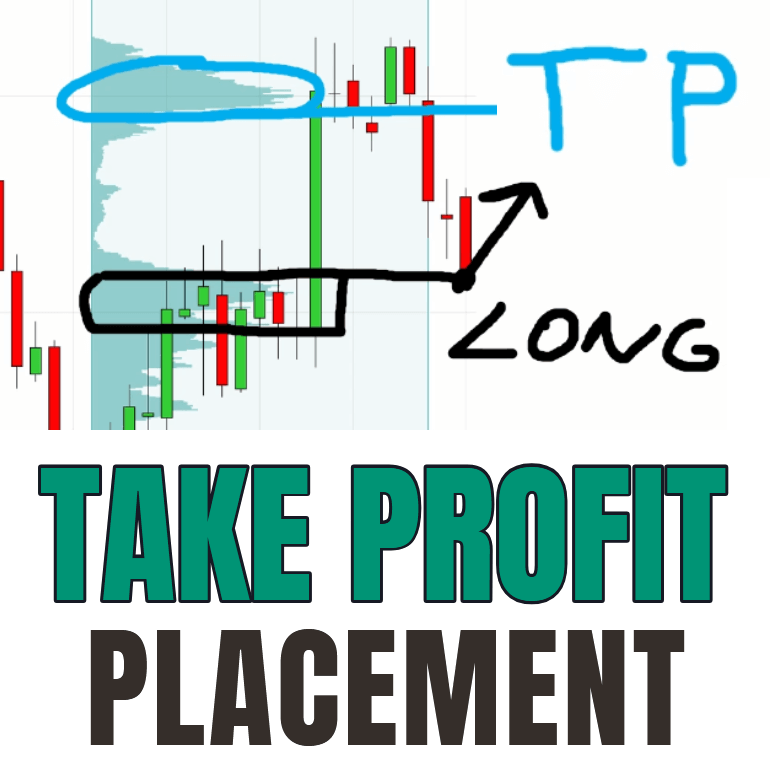

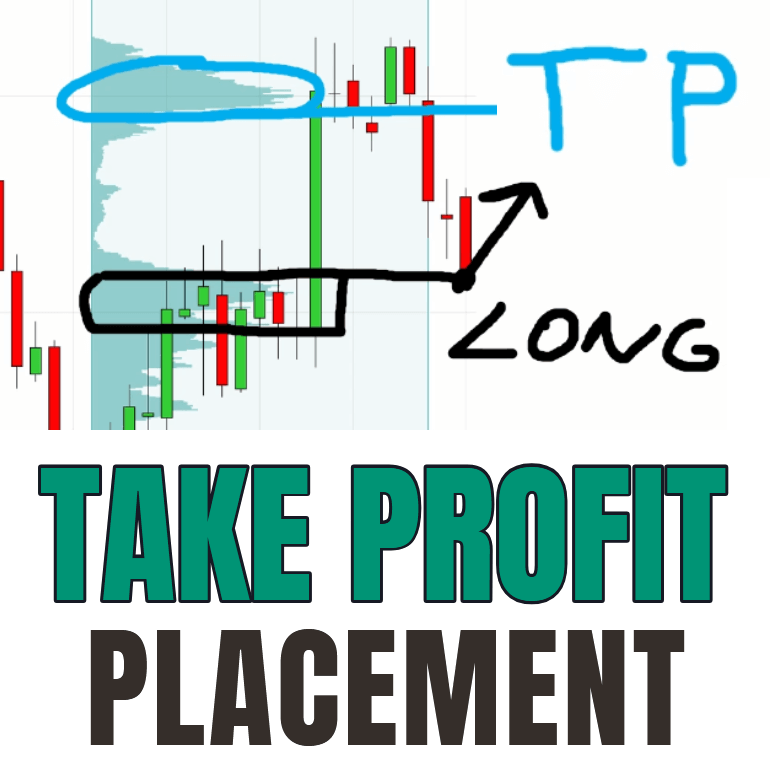

Advanced Take Profit Strategy: Where to Exit Your Trades!

In this video, I break down smart take profit placement using Volume Profile and key market barriers to help you exit trades with precision. You’ll see real trade examples and learn when to switch to lower time frames to find the best profit targets. Stop leaving money on the table—watch now to improve your trade exits!

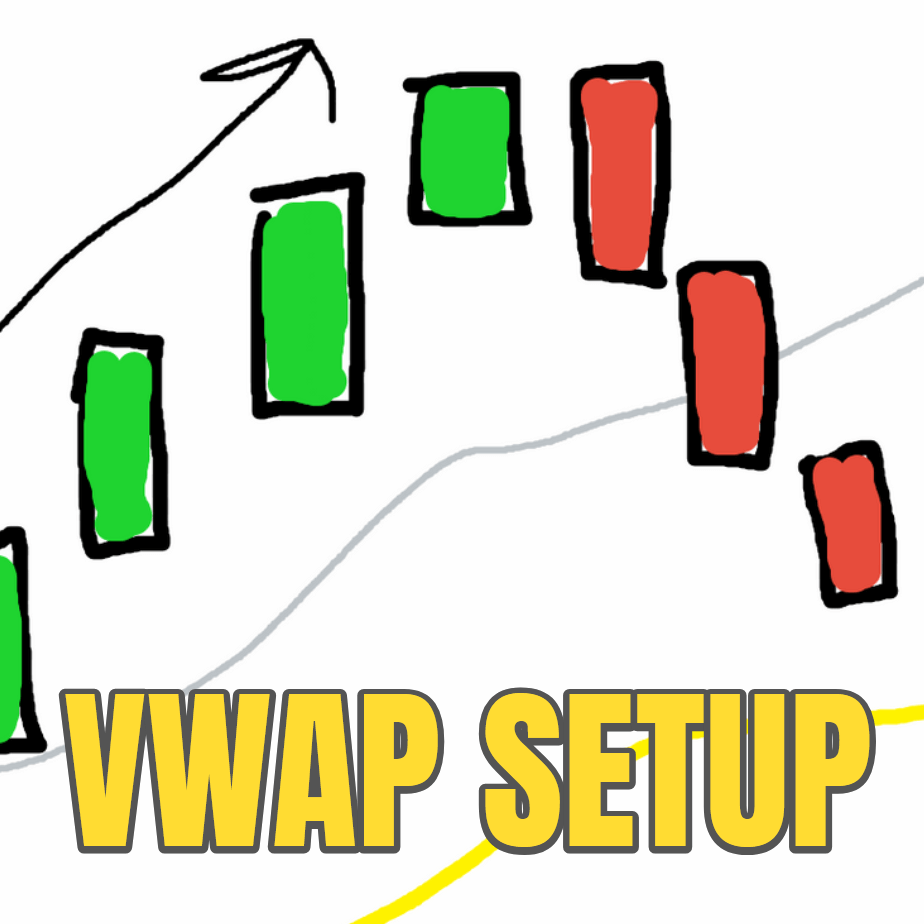

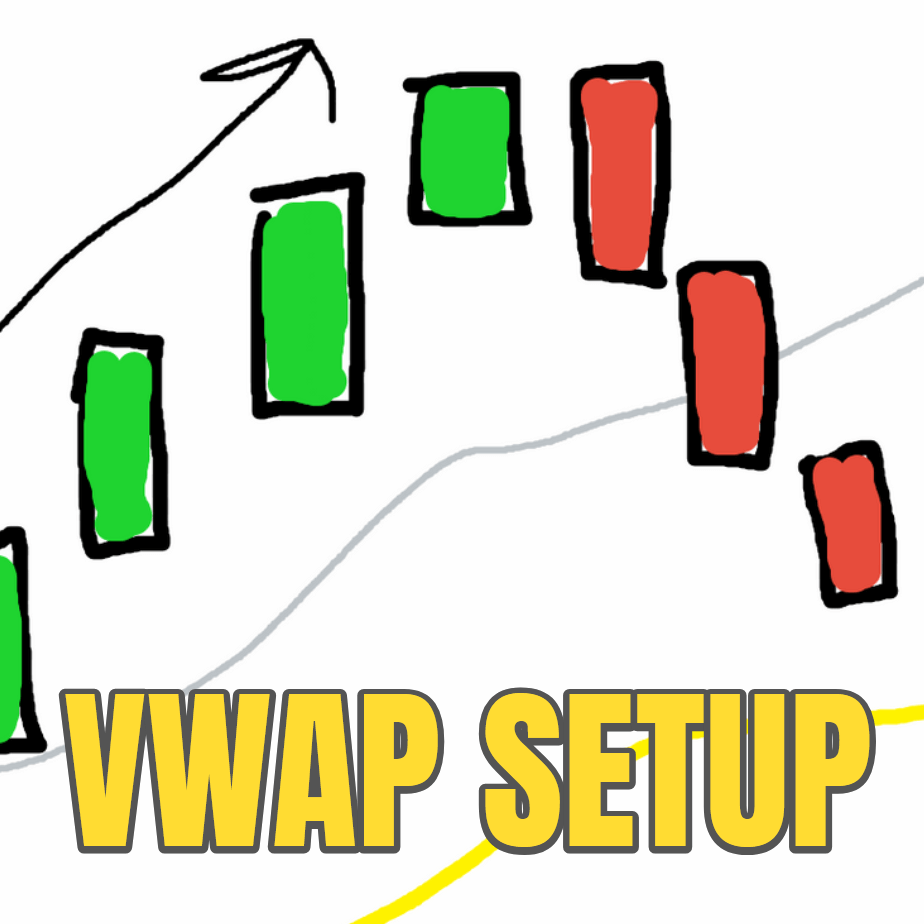

Master This ONE Powerful VWAP Setup TODAY

Learn how to trade the Trend Failure Setup, a simple yet powerful VWAP strategy for identifying trend reversals. Watch a live example from our trading room and discover how combining VWAP with Volume Profile can significantly boost your trading accuracy. Start using this proven combo in your own trading today!

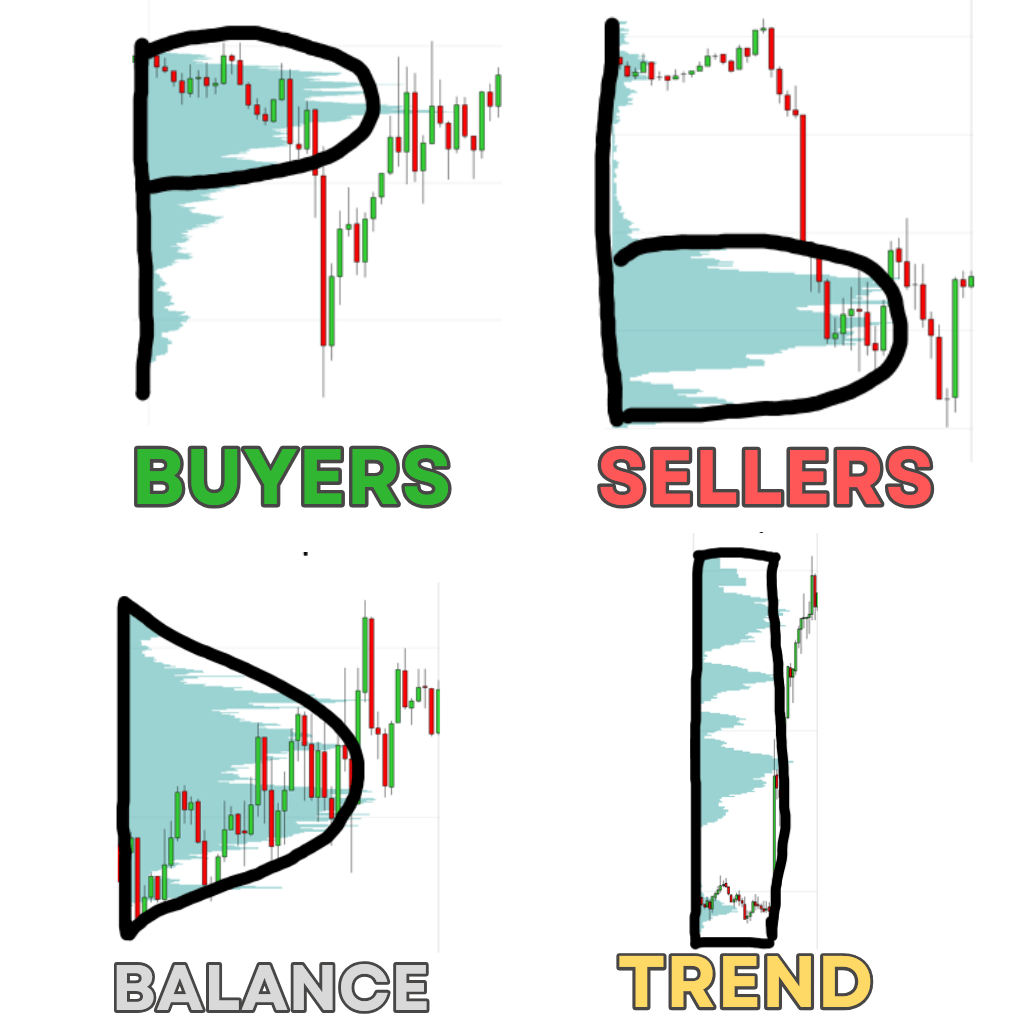

How to Read Market Moves with Volume Profile

Discover how to decode market movements with Volume Profile and master the 4 essential profile shapes—D, P, B, and Thin. Learn what these shapes reveal about market sentiment, institutional activity, and high-probability trading opportunities. Watch now to see my favorite trading setup in action and start trading smarter today!

ORDER FLOW: 3 Key Patterns to Spot Reversals

In this video, I’ll show you 3 powerful order flow patterns I use to spot trend reversals — patterns that work across any instrument and on fast intraday timeframes like 1min, 5min, and 15min charts.

How to Get Futures Data in NinjaTrader 8 for Just $4/Month (2025 Guide)

In this video, I’ll show you how to get official CME futures data in NinjaTrader 8 for just $4/month — and walk you through the entire setup step by step.

🚨Trap or Trading Opportunity? How to Use Volume Profile to Reveal the Truth

In this video, you’ll learn how to spot good trading opportunities vs. traps using rejections.

🔴WEBINAR: Order Flow Imbalances – How to Spot and Trade Hidden Market Strength in 2025

Video Transcript: Have you ever wondered what really causes big market moves and, more importantly, can you learn how to spot it, how to understand

Double Trouble: Correlated Markets Wreck Trades – Here’s What to Do

In this video, I break down the correlation table in simple terms. It’s the key to avoiding trades that move together and wipe out your gains.

Succeeding with Prop Firms: Why Most Traders Fail After Getting Funded

Succeeding with prop firms isn’t just about getting funded—it’s about staying funded and consistently making profits. This video covers 11 crucial steps that top traders follow, from risk management and trade selection to psychology and journaling. Apply these strategies to avoid common pitfalls and build long-term success in the prop firm environment.

Succeeding with Prop Firms: Why Most Traders Fail After Getting Funded

Unlock the path to long-term success with prop firms by learning the key strategies that separate profitable traders from those who lose their funded accounts. Based on data from 177,000 traders, we reveal the critical factors like risk management, trade selection, and psychological discipline that determine who gets consistent payouts. Whether you’re new to prop trading or struggling to maintain your account, this guide will help you trade smarter and stay funded.

Advanced Take Profit Strategy: Where to Exit Your Trades!

In this video, I break down smart take profit placement using Volume Profile and key market barriers to help you exit trades with precision. You’ll see real trade examples and learn when to switch to lower time frames to find the best profit targets. Stop leaving money on the table—watch now to improve your trade exits!

Master This ONE Powerful VWAP Setup TODAY

Learn how to trade the Trend Failure Setup, a simple yet powerful VWAP strategy for identifying trend reversals. Watch a live example from our trading room and discover how combining VWAP with Volume Profile can significantly boost your trading accuracy. Start using this proven combo in your own trading today!

How to Read Market Moves with Volume Profile

Discover how to decode market movements with Volume Profile and master the 4 essential profile shapes—D, P, B, and Thin. Learn what these shapes reveal about market sentiment, institutional activity, and high-probability trading opportunities. Watch now to see my favorite trading setup in action and start trading smarter today!

ORDER FLOW: 3 Key Patterns to Spot Reversals

In this video, I’ll show you 3 powerful order flow patterns I use to spot trend reversals — patterns that work across any instrument and on fast intraday timeframes like 1min, 5min, and 15min charts.

How to Get Futures Data in NinjaTrader 8 for Just $4/Month (2025 Guide)

In this video, I’ll show you how to get official CME futures data in NinjaTrader 8 for just $4/month — and walk you through the entire setup step by step.

🚨Trap or Trading Opportunity? How to Use Volume Profile to Reveal the Truth

In this video, you’ll learn how to spot good trading opportunities vs. traps using rejections.

🔴WEBINAR: Order Flow Imbalances – How to Spot and Trade Hidden Market Strength in 2025

Video Transcript: Have you ever wondered what really causes big market moves and, more importantly, can you learn how to spot it, how to understand

Double Trouble: Correlated Markets Wreck Trades – Here’s What to Do

In this video, I break down the correlation table in simple terms. It’s the key to avoiding trades that move together and wipe out your gains.

Succeeding with Prop Firms: Why Most Traders Fail After Getting Funded

Succeeding with prop firms isn’t just about getting funded—it’s about staying funded and consistently making profits. This video covers 11 crucial steps that top traders follow, from risk management and trade selection to psychology and journaling. Apply these strategies to avoid common pitfalls and build long-term success in the prop firm environment.

Succeeding with Prop Firms: Why Most Traders Fail After Getting Funded

Unlock the path to long-term success with prop firms by learning the key strategies that separate profitable traders from those who lose their funded accounts. Based on data from 177,000 traders, we reveal the critical factors like risk management, trade selection, and psychological discipline that determine who gets consistent payouts. Whether you’re new to prop trading or struggling to maintain your account, this guide will help you trade smarter and stay funded.

Advanced Take Profit Strategy: Where to Exit Your Trades!

In this video, I break down smart take profit placement using Volume Profile and key market barriers to help you exit trades with precision. You’ll see real trade examples and learn when to switch to lower time frames to find the best profit targets. Stop leaving money on the table—watch now to improve your trade exits!

Master This ONE Powerful VWAP Setup TODAY

Learn how to trade the Trend Failure Setup, a simple yet powerful VWAP strategy for identifying trend reversals. Watch a live example from our trading room and discover how combining VWAP with Volume Profile can significantly boost your trading accuracy. Start using this proven combo in your own trading today!

How to Read Market Moves with Volume Profile

Discover how to decode market movements with Volume Profile and master the 4 essential profile shapes—D, P, B, and Thin. Learn what these shapes reveal about market sentiment, institutional activity, and high-probability trading opportunities. Watch now to see my favorite trading setup in action and start trading smarter today!

Facebook Posts

Check out my latest market commentary, where I will show you the strongest Volume Profile trading levels to trade this week!

Enjoy!

www.trader-dale.com/top-volume-profile-levels-to-trade-this-week-on-eur-usd-gbp-usd-usd-jpy/

Weekly forex market analysis and trade ideas for the week starting 23rd June 2025. Pairs covered this week include EUR/USD, GBP/USD & USD/JPY

P.S. Ready to trade with the same powerful tools I use? Discover my top educational & indicator packs here:

www.trader-dale.com/volume-profile-forex-trading-course/

Want to trade LIVE with me and my team of prop-firm-funded traders?

Claim your free consultation call now: www.trader-dale.com/funded-trader-academy

... See MoreSee Less

- likes 2

- Shares: 0

- Comments: 0

0 CommentsComment on Facebook

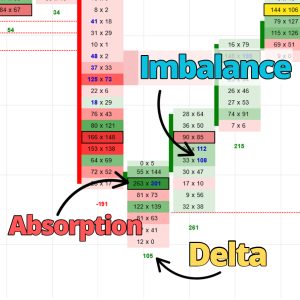

Another video from our live trading room — this time, Head Trader Dan walks through a breakout trade on ES that required patience, precision, and confirmation.

He explains exactly why he waited for the first 30-minute candle to close, how he used Delta and Order Flow to gauge initiative buying, and what finally gave him the green light to enter.

📌 In this video, you’ll learn:

✅ Why waiting for the first 30-minute structure can save you from false moves

✅ How Dan uses Delta (2,000–3,000+) to confirm breakout aggression

✅ What a triple buy imbalance and clustered block orders reveal

✅ How he managed the trade live, scaled partial profits, and adjusted his stop

🎥 Watch it here:

www.trader-dale.com/es-breakout-trade-from-live-trading-room-using-delta-order-flow-volume-profil...

If you’re looking to sharpen your breakout strategy, this is the kind of trade walkthrough that will change the way you think about confirmation.

PS: If you're serious about becoming a professional trader, take a look at our 🎓Funded Trader Academy. You'll get daily access to our prop firm team, one-on-one mentorship, and a step-by-step plan to get funded. Click the below link for more details:

trader-dale.com/funded-trader-academy

... See MoreSee Less

0 CommentsComment on Facebook