Video Transcript:

Hello

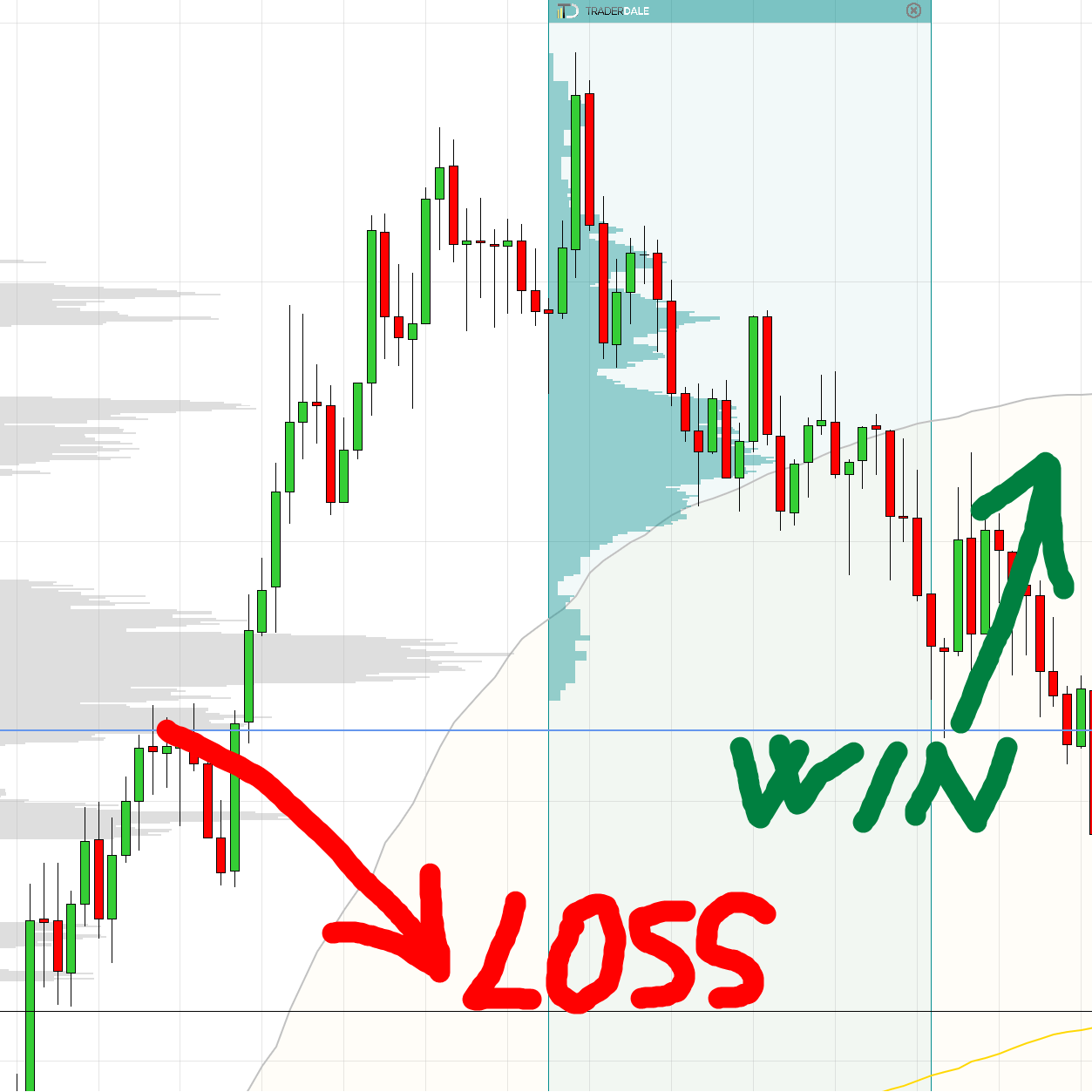

everyone, it’s Dale here with a new video from the Recent Trade series. In

today’s video, I’d like to talk about a losing trade I took yesterday on the EUR/USD.

The reason I want to show you this specific losing trade is because I want to

show you a little trick you can use after taking a loss — a reversal trade

where you have a very high chance of winning your money back.

Let

me first show you that losing trade I had. It was a trade from a prediction I

sent out to everyone through email, so maybe you saw it too. It was a level

based on this heavy volume cluster, which formed within a strong rejection of

higher prices. In my opinion, it was a pretty solid level to trade from, and I

thought the sellers would defend this place. When the price reached the level

again, I expected a reaction — but there wasn’t. So I took a loss there.

But

you know, the information the market gave me at that time — when I took the

loss — was that buyers were in control. When you have a strong Volume Profile

level like this one, and the price goes past it, it doesn’t mean it was a

terrible level or that you made a bad call. No, it means the opposite side of

the market is simply too strong. Yesterday, there was strong buying activity,

which was caused by the Moody’s downgrade of the US rating. But the important

thing is that the market reacted strongly, and the price simply shot past the

level.

This

gave me the information that there were strong buyers — and that maybe those

buyers would react to this level again, but from the opposite side. So, after

taking the loss from this level — I went short and took a loss — I waited for

the pullback. When the price hit that level again — the same level, exactly to

the pip — I entered a long. This is something I call a reversal trade. Reversal

because at first, it was a short, and then it was a long — I took the opposite

position.

What

you want to see to take these reversals is: you have a strong level like this

one, and the price needs to go past it with no reaction at all. If there is no

reaction and the price just shoots past it, then you trade the level from the

other side. You wait for the pullback and enter a long position from there. In

the end, this was a winning trade. I was trading this in the live trading room

with members of the Funded Trader Academy, and the take profit for this trade

was right here — because there was a heavy volume zone.

I

better show you on the 5-minute chart; it was more visible there. So this was

the level — this is where I went long. At that time, this is how the situation

looked. Let me zoom this in — there was this massive heavy volume zone. This is

where I went long, and the take profit was at the Point of Control of this

zone. The reason I placed the take profit there was that this volume zone could

potentially represent significant resistance — which, as you can see, it did.

In the end, the price reacted there and just went into a new sell-off. So, it

was a good place for a take profit. As I guessed correctly, this was a

resistance zone, the price reacted to it, and this is how I made my money back.

I

lost my position here where I went short, then had a winner here.

All

right, so this is what you can replicate in your trading as well. This works

very nicely with my Volume Profile setups, which you can learn more about in my

Volume Profile course available on my website. Let me show you real quick. If

you go to Trader-Dale.com and click

“Trading

Course and Tools” it will take you to a page where you can browse my

trading education and custom-made trading indicators. There’s the Volume

Profile Pack, Order Flow Pack, VWAP Pack, and Smart Money Pack. You can get

those packs separately here, or if you scroll down a bit, you can get them in

one discounted bundle.

And

if you guys are interested in trading with me and other prop firm traders live

every day in the live trading room, you can join us. If you click the FTA tab — which

stands for Funded Trader Academy — there’s a video where I explain everything.

If you’re interested, book a one-on-one call there. We’ll walk you through the

service, and then you can decide whether or not it’s right for you.

All right, thanks for watching the video. I hope you found it helpful, and see you next time. Until then — happy trading.