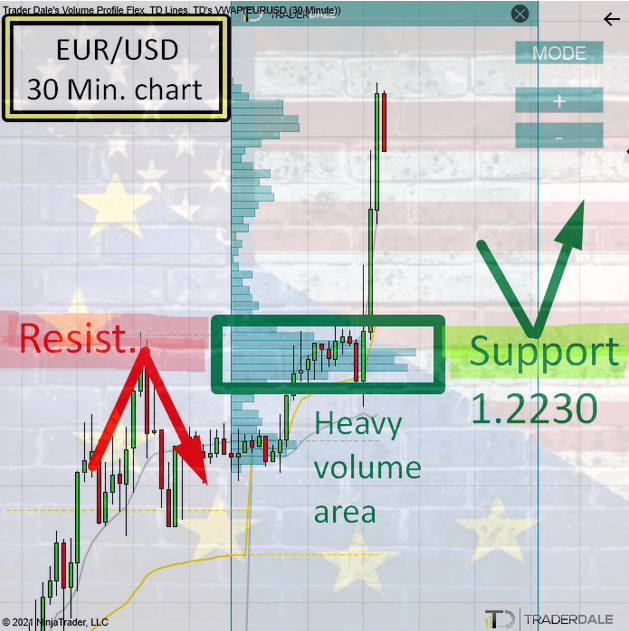

EUR/USD: Volume Profile, VWAP, And Price Action Analysis

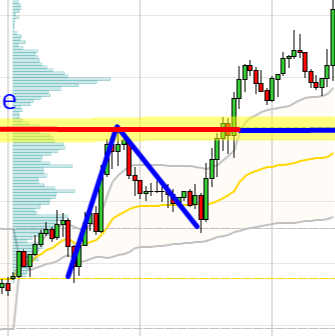

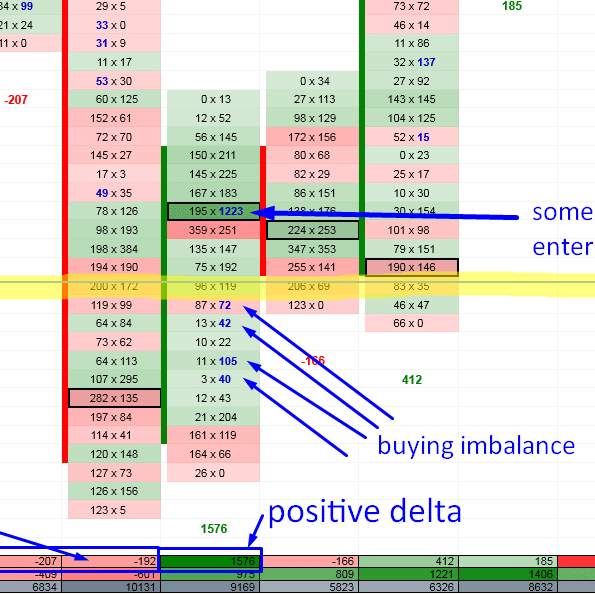

This day trading analysis will show you how to use Volume Profile, VWAP, and Price Action Setups to identify a strong institutional Support on EUR/USD.

EUR/USD: Volume Profile, VWAP, And Price Action Analysis Read More »