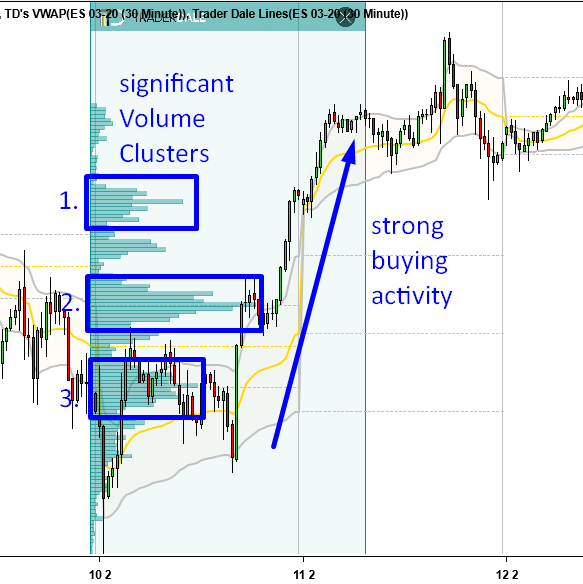

Trading Volume Clusters on ES (S&P 500 Futures)

There is a strong uptrend on the ES (S&P 500 Futures). Learn how to use Volume Profile to identify the strongest volume based support zones there.

Trading Volume Clusters on ES (S&P 500 Futures) Read More »