Video Transcript:

Hello

everyone, it’s Dale here. In this video, I’d like to show you how to trade when

the volatility dramatically changes—and that’s exactly what we are experiencing

right now. The volatility has spiked quite a lot because of the tariffs, and we

need to adjust. If we don’t, then we’re probably going to lose a lot of

money—and we don’t want that.

Now,

the reason for the increase in volatility is the tariffs. That’s the big topic

all across the board. But you know, it doesn’t need to be the tariffs. The

reason for the change in volatility could be a rate decision, uncertainty, a

crisis—it could be anything. But the important thing is that volatility

changed, and we need to adapt.

The

first thing I’m going to show you is a volatility index. This is the chart of

the volatility index. It is a daily chart, so each candle shows one day. As you

can see, the average was somewhere around, let’s say, 15 to 20—that’s the

average volatility. Right now, there’s this massive spike. So, you can track

the volatility through the VIX index right here, and this will show you how the

volatility changes over time.

But

we don’t need to look at this specific index. We can look, for example, at EUR/USD.

This is a daily chart, and what I’ve loaded up here—this indicator at the

bottom—that’s the ATR indicator. The way I set that indicator is just for a

5-day period, so it adapts to changes quickly. Let me show you. If I go to

indicators and to the ATR settings, then I set it for a 5-day period.

Let

me scroll back a bit so we can see the bigger picture. As you can see, in the

past, it was roughly around 70. This is like average daily volatility on the

euro, right? 70, maybe 80 pips average daily volatility for a very long time.

But now, we are around 72 pips per day—that’s the average volatility on the

euro.

Where

I’m going with this is: if you were trading EUR/USD with, say, a fixed

10 pip stop loss and 10 pip take profit, and you used that kind of setup, then

yeah—during this calm period, it was quite fine. But what do you do when the

volatility changes dramatically like this? You can’t really use this setting anymore,

because you’d simply get stopped out too soon. Your take profit would be too

small, and your trading would just be terrible, right?

So,

what to do? How do you quickly adapt to changes in volatility like this?

Now,

what I’m going to show you is a method I’ve been practicing for many years, and

it has never let me down. Let me switch to an intraday chart, and I’ll

demonstrate on two trades which I took earlier today. The main message here is

that you want to place your stop loss and take profit at logical places on the

chart—not fixed take profit and stop loss like 10 or 15 pips or whatever. It

needs to be at a logical place.

What

I recommend is placing your stop loss behind a support or resistance zone, and

your take profit before a support or resistance zone. The cool thing about this

is that when the volatility changes, the support and resistance zones also get

wider or tighter. So, they adapt—the chart adapts—and this automatically adapts

your stop loss and take profit according to the volatility.

Let

me show you with those examples—it will be way clearer.

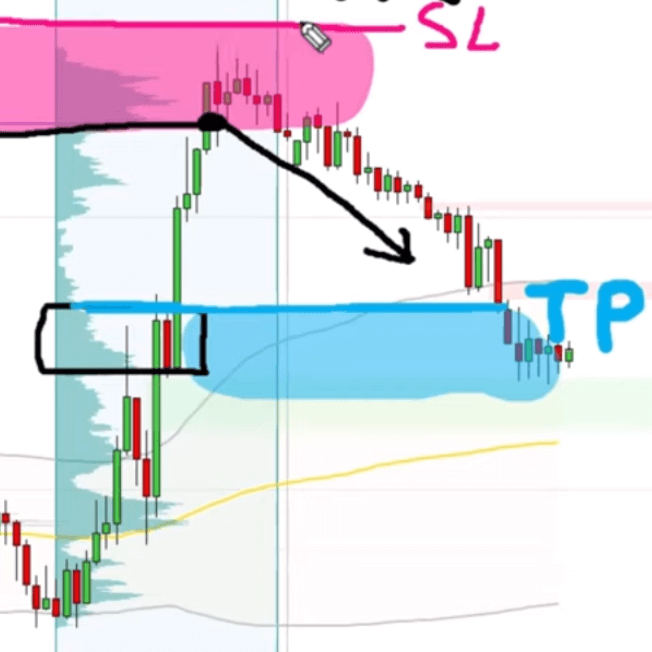

This

trade, which I took on USD/CAD, was a short—right here at this line.

This was a short. Because I placed my stop loss behind a barrier, I placed it

behind this heavy volume zone. The heavy volume zone represents a barrier.

Strong heavy volume zones always represent strong barriers—or in other words,

support and resistance zones. So, the way I placed my stop loss was behind this

heavy volume barrier, also at the top of this swing point. That’s what I also

do—ideally, the stop loss goes behind a heavy volume zone and at the top of a

little swing point like this. So, the stop for this trade was right here. The

barrier—or, in other words, the resistance zone—was this whole zone, and the

stop goes behind it. This is the stop loss which is behind the barrier. The

volume cluster here—that’s the barrier.

Now,

the take profit needs to go before a strong support or resistance zone. In this

case, there was a heavy volume zone standing in the way of my short. I entered

the short in here, like this, and then this heavy volume zone was standing in

the way—presented a potential support—starting in here. But the whole support

zone was obviously wider. It’s always a zone, not just one level. But this was

the beginning of that support zone, and that’s why I took the take profit right

here.

So,

as you can see, I followed this rule: stop loss went behind resistance, and

take profit went before support. The cool thing is that the volatility doesn’t

really matter. As you can see, I never really cared how many pips this was. I

can tell you now it was roughly 25 pips—but I don’t really care. Because the

volatility increased, and the barrier—based on this volume cluster—increased as

well. That’s what determined that the stop loss would be here.

Let

me show you the other trade, which I took earlier today. It was this one on USD/CHF,

and the trade was based on this strong rejection of higher prices and on this

significant volume zone within the rejection. This red line you see here—this

dotted line—I’ll just mark it in black. That was the place where I went short

from. The stop loss, again, was according to the volumes here. I want to place

the stop behind the significant volume zone and also at the top of the little

swing point—the same approach as with the previous example. So, the stop was in

here.

Again,

the volatility dictates where the stop loss goes. I don’t really care how many

pips this is. The chart tells me where to place the stop loss—behind this heavy

volume zone. Take profit was before this heavy volume zone. I took the take

profit right here. Looking at this retrospectively, it should have been

somewhere in here—closer to the weekly VWAP, closer to this volume peak—but I

was asleep at that time when it hit the take profit. I wasn’t able to manage

the position actively. So, when I sleep, I just prefer to be safe than sorry.

That’s why I took the take profit in here. Again, it would’ve been better to

take it here, but it was close anyway. It was before a potential support. The

price did not react to that support—sellers just dominated the market and went

past it—but still, this was a good place to quit the trade.

Again,

the market shows the place—not the pip count. I don’t really care how many pips

this is. What matters is that the take profit was in a logical place based on

this potential support.

All

right, those are the trades I took earlier today. Let me show you one more.

This is a trade that hasn’t played out yet. It’s a trade I plan to take on AUD/USD.

The level I want to trade is this support at 0.6295, based on this rejection of

lower prices—a strong rejection where buyers aggressively took over. If you use

the Volume Profile like this to see how the volumes are distributed in that

rejection, then you can see there was this heavy volume zone right here.

Again,

I’m not really counting pips. I know that I want to place my stop below this

heavy volume zone and behind this little swing point. So, the stop will be in

here—no matter how many pips that is. That’s the cool thing about this

strategy: you don’t need to adjust your fixed take profit and stop loss every

time the volatility changes. You just look at the chart, set the stop loss and

take profit according to the chart, and that’s it.

Now,

this is the stop loss. Regarding the take profit—I simply don’t know where it

will be, because I’ll want to place it based on how the volumes look in this

area where the price makes the pullback. So, I need to see how the volumes are

distributed in here, and I’ll place my take profit according to that. At least,

it should be somewhere in here—but ideally bigger than a 1:1 risk-reward ratio.

I

hope that this approach makes sense and that you like it. By the way, those

levels I’m showing you—those are levels from the members area. I’m publishing

those levels every day. Let me show you real quick. So, here is our backend.

This is a table I published yesterday. This is the level on USD/CHF

which I was showing you. The level on USD/CAD was from yesterday’s

prediction—this one.

If

you guys want to join us, then go to my website: www.trader-dale.com. This is it. Click

the button “Trading Course

and Tools” Currently, I’m running a sale on my best educational and

indicator packs. These are the Volume Profile Pack, Order Flow Pack, VWAP Pack,

and Smart Money Pack. You can get them separately here, or if you scroll down a

bit, then you can get all those packs together for a discounted price.

All right, that’s about it. Thanks for watching the video. I hope you found it useful, and I’ll be looking forward to seeing you next time. Until then, happy trading!