Video Transcript:

Hey

everyone, it’s Dale here. Welcome to the new video from the Recent Trades

series. In this video, I’d like to talk about two trades I took recently on EUR/USD.

The reason I want to discuss these two specific trades is that many people

think that when they are trading old levels, the older those levels are, the

less relevant they become over time. But I want to show you that markets have

great memory, and even if you trade very old levels, they can still hold

significance. The two levels I’m going to show you are supports that were

formed a month ago, and the market still made strong reactions to them. So,

let’s check them out.

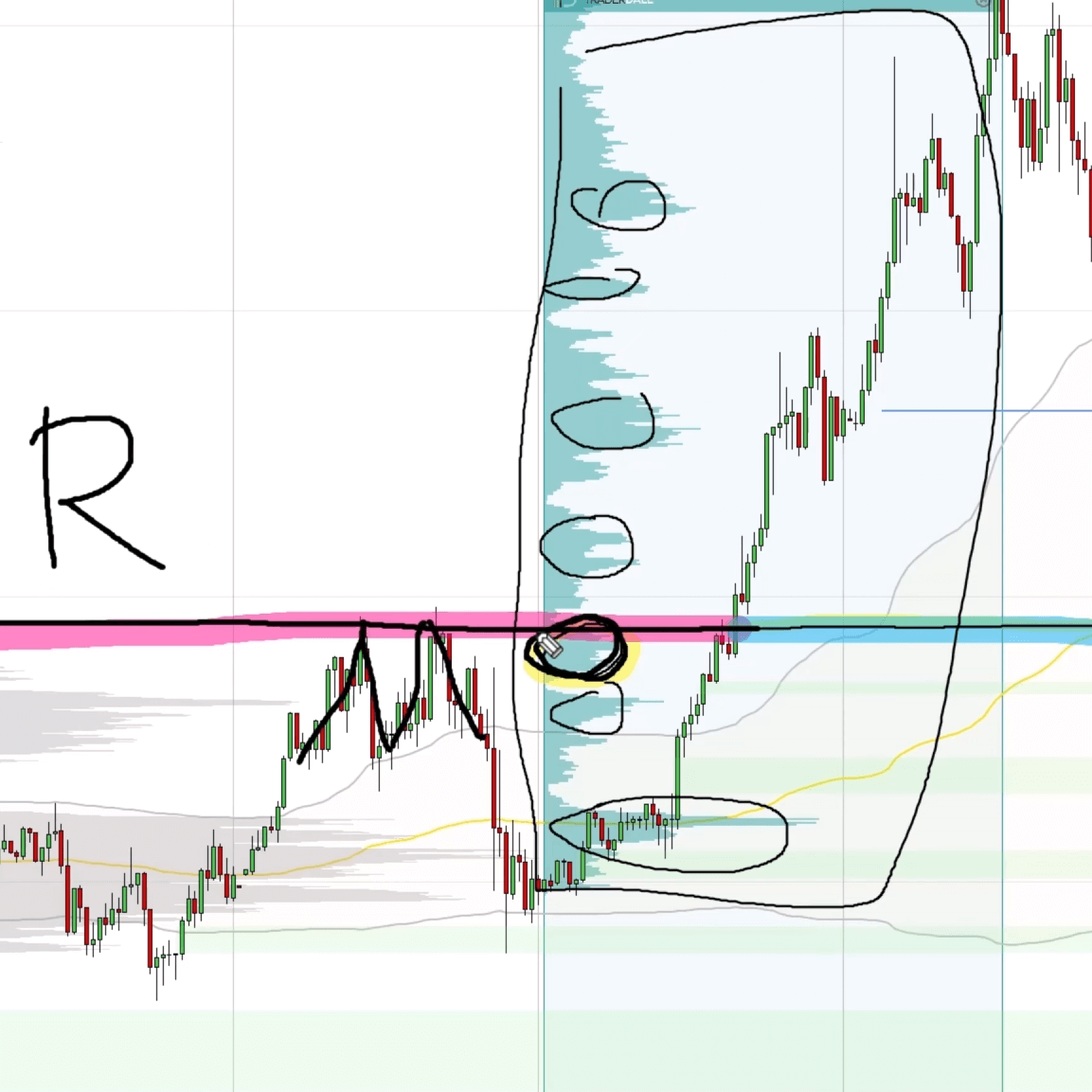

The

first level was based on a heavy volume zone from April 10th, which was a month

ago. This level hadn’t been tested for a month, and let me show you how the

price reacted to it on Friday, exactly one month after the level was formed.

The price reacted precisely to the pip, even though the level was a month old.

This is clear evidence that old support and resistance zones can still work

effectively. This is proof that markets have a great memory and do remember

strong levels.

Now,

let me show you the second long level and explain the reasoning behind it. This

was the second support level, based on a volume cluster. As you can see,

there’s a strong uptrend, and within that uptrend, there were several

significant volume clusters. So why did I choose this particular cluster? The

reason is that it’s not always about the size of the volume cluster — how big

the volumes were — but also about finding strong confluence.

By

confluence, I mean identifying another trading setup that points to the same

level. In this case, there was a beautiful confluence. If I extend this level

back a bit, you can see that the price reacted to it in the past — here, here,

and here. This indicates that the level acted as a strong resistance in the

past. The price then broke through that level, turning the resistance into a

new support. And all of this happened at the beginning of the volume cluster.

So,

even though this volume cluster wasn’t the heaviest in the uptrend area —

nowhere near the largest volume cluster — it was still one of the strongest due

to that confluence. That’s why I chose this volume cluster to trade from,

rather than the others. Let me now show you the reaction. The reaction occurred

on Monday, right here, again to the pip.

What

we have here is further proof that markets have great memory and that it’s

perfectly fine to trade very old levels — in this case, levels that were a

month old. As you can see, the market still reacts to them.

The

takeaway from this video is that markets have great memory, and you shouldn’t

be afraid to trade support and resistance zones that are a bit old. If you’ve

identified a strong level, the market will remember it and will likely react to

it. This applies to both intraday trading, as I’ve shown you here on the

30-minute chart, and to swing trading or position trading, where I’m fine

waiting even a year or two for a level to be hit.

By

the way, the levels I mentioned in this video are from the members’ area. I

publish my levels there daily. Let me quickly show you. This is the members’

area, and here is the post from four days ago. The first long level was 1.1988,

and the second long level was 1.1084.

If

you want to join us, head over to my website at trader-dale.com. Click the button that

says “Trading

Course and Tools” and you can join us and get one of my educational

and indicator packs. We have the Volume Profile pack, Order Flow pack, VWAP

pack, and Smart Money pack. You can get them separately or scroll down a bit to

get them as a bundle for a discounted price.

Alright, that’s it for today. I hope you found the video helpful, and I’ll be looking forward to seeing you next time. Until then, happy trading!