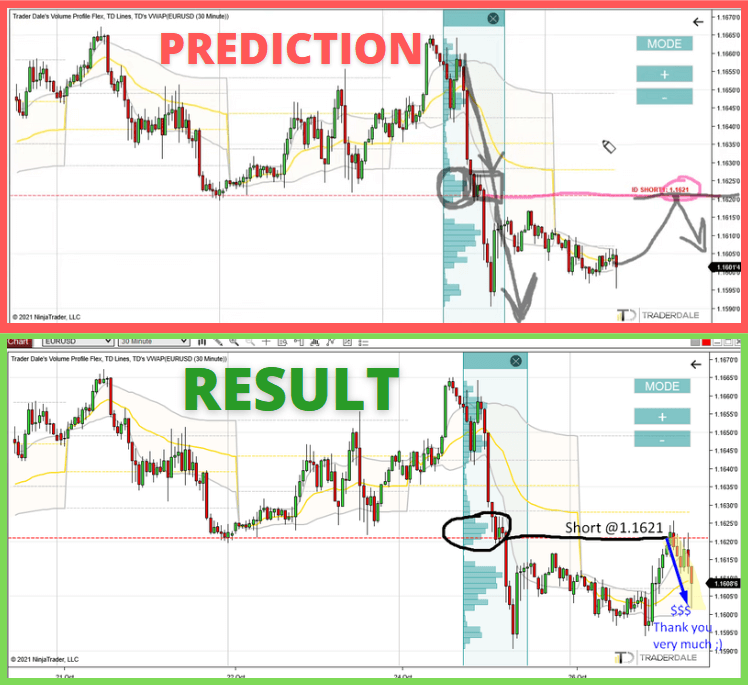

The trade is now over. A nice one!

Here is how it went

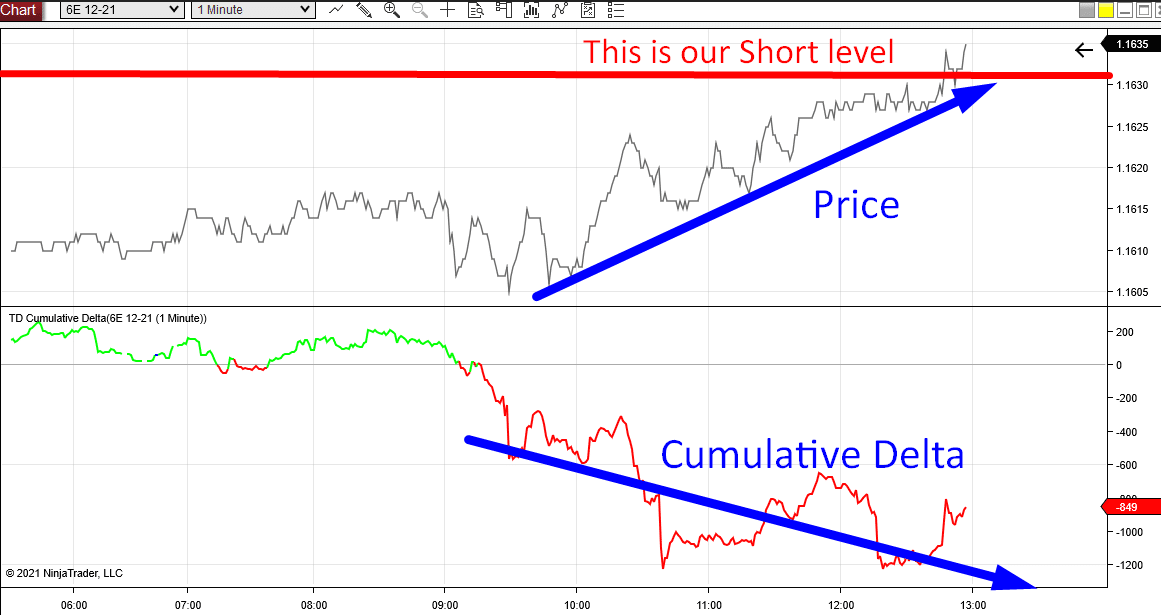

Order Flow Confirmation

There was a beautiful confirmation on Order Flow (Cumulative Delta) indicator.

It showed a divergence between Price and Cumulative Delta. This means that even though the price was rising, strong Sellers were entering their Short trades. I took this picture for you (Futures chart). as the price hit our level.

This is the divergence between Price and Cumulative Delta at the time the level got hit:

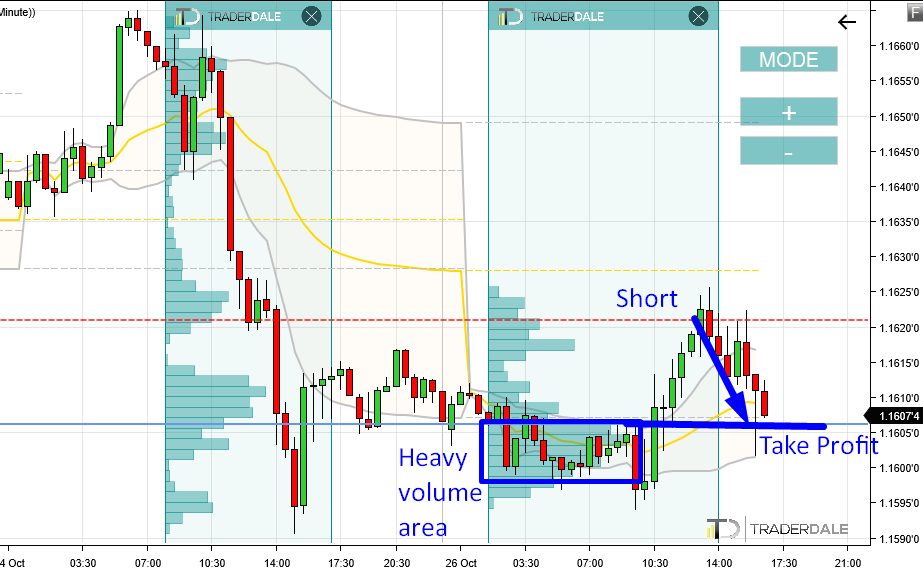

Trade Management

I took a Profit of 14 pips there. I used volume-based Take Profit – I quit the trade before it reached heavy volume zone (I was afraid it could work as a Support):

Do you want ME to help YOU with your trading?

Join one of my Volume Profile Educational courses and get my private trading levels, 15 hours of video content, my custom made Volume Profile indicators, and more!

Hi Dale

Great clips as always. I spotted that same level using your VP tools but didn’t spot the 100 contract on the OF side. So very useful to add that to my learning. Thanks.

What I’m struggling to understand is how the 100 contracts will add to the strength of the [now] Resistance level. The 100 contracts are either Aggressive Buying or Passive Selling. The position on the candle (near the bottom of a long down trend) suggests it’s aggressive buying rather than someone waiting for price to slide and then enter a limit sell order.

I’d be very keen to hear your thoughts on this and how you see the 100 contracts adding to the strength of the resistance level.

Thanks in advance

Hello,

100 contracts is quite a lot since it was a single order (not an iceberg). With Trades Filter I don’t pay too big attention if the order was on bid or on ask. Yea it looked more like aggressive buying at that time but we cannot be sure. What I focus on with trades filter is only big orders, no matter if Bid or Ask.

Thanks for a great question!

Hi Dale,

Are your entries always on the 30 minute time frame only?

What if we try get an entry in a lower TF ? 5-min or even 1-min?

I have tried short TF entries with your ideas and they worked but I am just wondering if they worked out of pure luck and I should avoid doing it, and get entries only on the M30 instead?

Thank you in advance

Hello Jim,

time frame does not play that huge role with Volume Profile. The reason is that there are only more candles, but volume distribution is still the same if you get my meaning.

I prefer 30 minute TF as it shows the bigger picture. 5 Minute chart would also be good, but I would need to zoom out a bit to see more candles and the bigger picture.

My trading setups work on 5 minute chart as well, it wasn’t luck 🙂