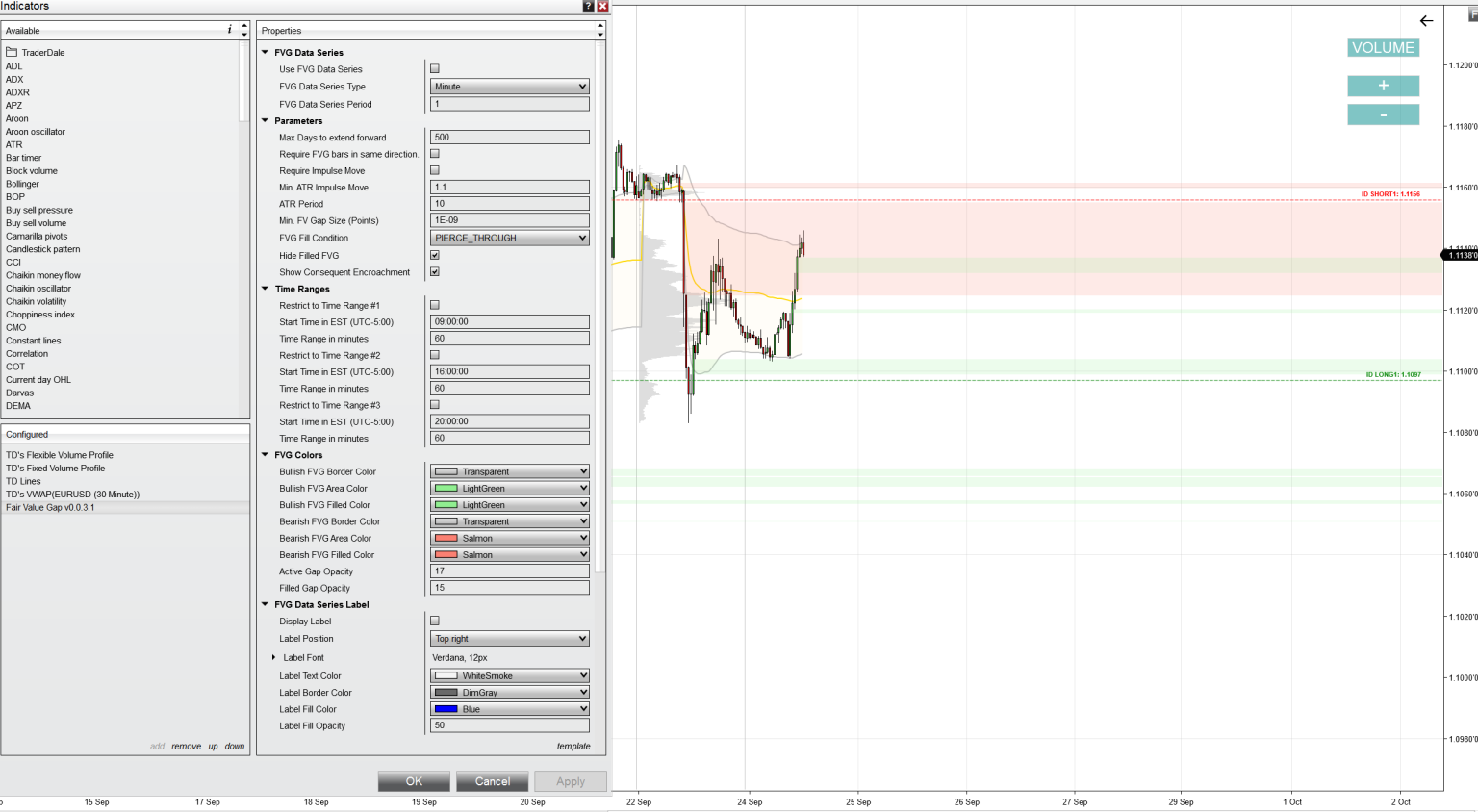

This is the indicator setting I use:

Video Transcript:

Hello everyone, it’s Dale here. In

today’s video, I’d like to talk about the Fair Value Gap. A Fair Value

Gap is a concept from Smart Money analysis, and I also use it in my Volume Profile

trading. Today, I’d like to show you how you can implement it into your trading

as well.

Let me start with a little

definition of what the Fair Value Gap is. I’ll do a little drawing here.

Basically, this is based solely on price action, and you need three candles.

Let me draw them real quick. This is a bullish scenario of a Fair Value Gap.

Here is candle number one, candle number two, and candle number three. What you

need to see here is the gap between the low of this candle and the high of the

first candle, right? If there is that gap, and they don’t overlap, then this

whole area is a Fair Value Gap. It’s important that the wicks don’t overlap. If

the wicks, for example, overlap like this, then there would be no Fair Value

Gap, right? This was the bullish scenario. Now let me draw the bearish

scenario. It’s the same, only reversed. Here’s candle number one, candle number

two, and candle number three. Now, because the low of the first candle and the

high of the third candle don’t overlap, the space between them is a Fair Value

Gap. This whole zone is a bearish Fair Value Gap. Again, if the wicks overlap

like this, then there would be no Fair Value Gap. But because they don’t

overlap in this case, we have a Fair Value Gap.

Now, why am I talking about the

Fair Value Gap? Because the Fair Value Gap represents a strong support or

resistance zone. In a bearish scenario, you would wait for a pullback, and this

would be a resistance zone, so you would expect the price to react somewhere in

this zone. The way I trade this bearish scenario is to go short from this

place, from the border of the Fair Value Gap. This is the short zone.

Now, let me quickly draw the

bullish scenario again. For example, in this case, this is the Fair Value Gap.

You wait for a pullback, and this should work as a support, allowing you to go

long from there. I personally take my long position from this place, from the

beginning of the Fair Value Gap. Alright, so this is the bullish scenario, and

this is the bearish one.

The Fair Value Gap represents a

place of aggression where sellers or buyers were really pushing the price

aggressively in their direction. That’s why the price tends to react to this

place, especially to the beginning of the Fair Value Gap, which is where I

trade from the most. Now, I don’t trade the Fair Value Gap as a stand-alone

setup, but I combine it with Volume Profile setups.

Let me just go to the chart and

show you this indicator, which automatically draws the Fair Value Gaps. I currently

have it set to only show Fair Value Gaps that are still active and haven’t been

tested yet. For example, if you look here, let me zoom in some more. This is

candle number one, below that is candle number two, and the next one is candle

number three. As you can see, there is that gap between the low of the first

candle and the high of the third candle. This whole zone is the Fair Value Gap,

and the indicator draws that automatically.

Now, for a bullish scenario, you

can look here. This is the first candle, this is the second, and this is the

third. The gap is here, between the high of the first candle and the low of the

third candle. This is a bullish Fair Value Gap. So, this is how the Fair Value

Gap looks. As you can see, the indicator draws them automatically. It only

shows Fair Value Gaps that haven’t been tested yet—those are the ones I’m

looking to trade.

I like to combine this with Volume

Profile setups. Let me show you a couple of trading levels that I currently

have. Let me start with the trade I sent you a couple of days back on the EUR/USD.

This was the gap in this zone. The indicator no longer shows it because it has

been tested here, but there was this gap. I also used Volume Profile here, and

the Volume Profile showed me that there was a heavy volume zone with a strong

rejection of low prices, which is an important sign of strong buyers. At the

same time, there was that Fair Value Gap, and the low of the Fair Value Gap was

here. This very nicely aligns with the Volume Profile here, with that volume

cluster. It was the combination of these two—the Volume Profile and the Fair

Value Gap—that told me this was a strong level to go long from. That’s why I

entered the long position from here, as I showed you in that video a couple of

days ago.

Alright, so that’s how I combine

Volume Profile and the Fair Value Gap. But this is a trade that has already

played out. Let me now show you a couple of examples of levels that I currently

have and that haven’t been tested yet. If you look here on the EUR/USD

30-minute chart, there are two levels. The short one is this one at 1.11156,

based on the heavy volumes in this area and the beginning of that Fair Value

Gap. This is the Fair Value Gap, and this is the beginning of the Fair Value

Gap. So, there’s a nice combination of Volume Profile and Fair Value Gap. Now,

I just wait for the pullback and go short from there.

There’s also a long level at 1.1097,

again based on Volume Profile with those heavy volumes here and the Fair Value

Gap, which is this greenish zone here. The bottom of that green zone is here.

As you can see, it very nicely aligns with the Volume Profile setup. My level

is just a couple of pips below the Fair Value Gap because if the price comes

here, I think it will want to at least touch those heavy volumes here. That’s

why I place the level a little bit lower. So, that’s my long level. I expect

the price to react from there and go upwards.

Now, here is another chart—this is the AUD/USD. Again, the software shows the Fair Value Gaps, so they’re nicely visible here. In this case, the long level that I have at 0.6750 is based on heavy volumes formed within this rejection of lower prices and also on that Fair Value Gap here.

Let me show

you one more thing. As I was saying, if you remember, this is a formation of

three candles, but sometimes there are actually two gaps, one after another,

like here. There could be a gap like this one, and another gap like this one.

The first gap would be based on these three candles, and the second gap would

be based on the next three candles. If you see two gaps like this one on top of

each other, then I look at it as one big Fair Value Gap. In a long trade

scenario, I trade from this level, from the beginning of that gap. That’s where

my long level is. It’s a combination of the Volume Profile and the Fair Value

Gap.

Now, another market is the USD/CAD.

Here we have a bearish scenario with a huge gap. Again, I count this as one

large gap—the bigger the gap, the better, because the bigger the gap, the more

strength was behind the move the gap is based on. This already shows the

aggression and strength of sellers, which is what I like to see when trading

shorts. Here, I have this heavy volume cluster within this rejection zone as

well as that Fair Value Gap. For a short trade scenario, this is the place I

want to go short from, the beginning of that Fair Value Gap. So, that’s the

Fair Value Gap—actually, just this—this is the Fair Value Gap, and I want to

trade shorts from the beginning of that Fair Value Gap, like this.

A very similar case, just really

quickly, is on the USD/JPY. Again, I have a long level here, based on

this Fair Value Gap. This is the beginning of that Fair Value Gap at 142.30.

Again, we have a nice heavy volume zone here, so that’s why I picked this level

to trade from. Now, I’m just waiting for the pullback, and then I’ll go long.

I’m not sure if I mentioned this

before, but gaps that have been tested in the past don’t interest me anymore,

and they don’t show on the chart. The indicator doesn’t show them. I’m only

interested in gaps that haven’t been tested yet. Those are the ones that the

indicator prints.

Now, let me show you one more

example of a trade I had. It was on the NQ, and it was actually a

prediction I sent you earlier. The level I had here was this one from this

place, and it was based on those heavy volumes and the Fair Value Gap. As I was

saying, the software doesn’t show it anymore because it has been tested, but

I’ll draw it for you. The gap was from here to here—this was the Fair Value

Gap, and the beginning of that Fair Value Gap was here. As you can see, this

again very nicely aligns with the heavy volumes in this volume cluster. The

price made a pullback, went all the way to the bottom of the Fair Value Gap, and

from there, a beautiful reaction.

Alright, so that’s the Fair Value

Gap, one of the Smart Money concepts. If you guys are interested in learning

more about combining Volume Profile and Smart Money concepts, then you may want

to check out the Funded

Trader Academy. Here, my team and I meet every day in a live trading room,

where we teach traders how to trade, how to get funded, and how to become

professional prop firm funded traders in less than 12 months. Below this video,

there’s a link that will take you to the Funded Trader Academy

page. There’s a video there that will show you everything that’s included. If

you’re interested, you can then book a call to see whether this would be a good

fit for you or not.

Alright, so that’s about it. Thanks

for watching the video; I hope you guys liked it. Below this video, I’ll also

drop a link to download this Fair Value Gap software for the NinjaTrader 8

platform. So, that’s about it. Thanks for watching, and I look forward to

seeing you next time. Until then, happy trading!

Hi Dale

There doesn’t seem to be a link to the FVG indicator on this page

Can’t find the download for FVG??

There’s a location to put your name and email address. Fill those in and the indicator is emailed to you. I just did it and got the email instantly with the indicator in the email.

Cheers

FVG are very interesting, likely to represent similar traders (buyers/sellers)

HI

I subscribe in your youtube ,thanks for videos.

I want FVG Indecator please.

Thank you.

Hi Dale

i have installed the indicator. will have to wait for it find fvg’s i guess.

@TraderDale…..Big Follower of yours. Please mail to me the FVG Indicator for Trading view platform

I can’t download the FVG

I can’t locate the download file for the FVG

Nothing is sent to my e-mail.

fvg indicator, please

FVG indicator Please

Do you have a version for TV?

Does not work

The indicator has not been sent to my email. Was was sent was the link to the video on Fair Value Gaps + Volume Profile: The Perfect Combo for Smart Money Trading. This was the place that I originally got the information about the indicator. Please send the link to the actual indicator.

Your link for the FVG Indicator does not work!

Hello Dale, received FVG indicators. Please can you share your settings inNinjatrader8 with a larger picture than the one enclosed? Also for MNQ Futures you used a 30 Min Chart.

If my chart is 2000 Tick, do you recommend using FVG on a separate 30 Min Chart or use it on 2000 Tick Chart?

Where do you begin the volume profile for this application? Start of the swing?