Video Transcript:

Hello

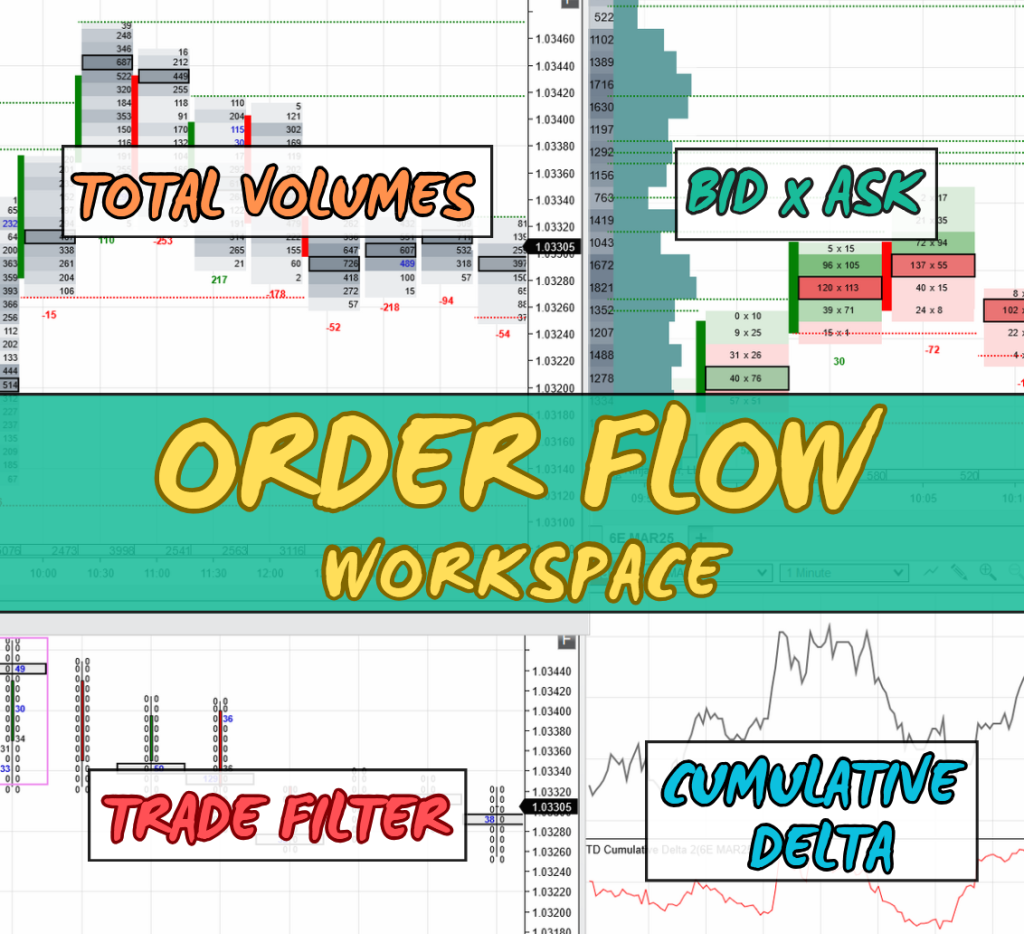

everyone, it’s Dale here, and in this video, I’ll show you how to set up an

Order Flow workspace. I’ll be demonstrating this on my custom-made Order Flow

software, but you don’t need this exact software. You can use any other

software you already have or prefer. However, I recommend using my software

because I think it’s a very good piece of software at a reasonable price.

Anyway,

this is how my Order Flow workspace looks. Many people, when trading with Order

Flow, only have a workspace that looks like this: just one chart. It’s a

detailed chart where they can see all the orders coming in. However, this is

not really what you want when trading with Order Flow. Even though you’re

trading intraday and taking quick scalp trades, you still want to see the

bigger picture. You need to understand the broader context, so a workspace like

this is not sufficient. Let me go back and now show you how I set up my

workspace and how I recommend you set up yours.

We

can divide my screen into two areas: the one on the left, which shows the big

picture, and the one on the right, which shows the details. You can obviously

use more screens for this, but for recording this video and showing you

everything, I’ll be using just one screen. Let me now go through the charts I

have here and explain why they are important.

Starting

with this chart, it’s a 30-minute footprint chart that shows the big picture.

On the left side of the chart, there’s a daily Volume Profile, which displays

how volumes were distributed throughout the day. This is important because it

gives me the bigger picture. The footprints you see here are 30-minute

footprints that show total volume, combining both bid and ask. This helps me

identify zones where traders and trading institutions were most active, as well

as where the highest volumes were traded. My software highlights these zones

with darker colors. For example, in this footprint, there are two heavy-volume

zones, and in the previous footprints, you can see similar zones. This allows

me to identify the most important areas at a glance.

Below

that is a very similar chart, but this one doesn’t show all the volumes. It’s

still a 30-minute chart, but it only shows the largest orders. I call this the

filtered chart because it filters out the market noise and highlights only the

biggest orders. If I zoom in, you’ll notice that most cells show zeros, but

occasionally, there are large orders, which are crucial because they often

indicate the intentions of big players or institutions. These single large

orders, such as selling 38 contracts with one market order, are displayed here.

These

two charts—the footprint charts—show the bigger picture. Let’s now talk about

the detailed charts. There’s one more chart I couldn’t fit on this screen. It’s

on another screen and is a simple price action chart with a Volume Profile and

VWAP. This chart also shows the bigger picture and helps me identify trading

levels and understand the broader market context. I typically start my analysis

on this chart before moving to the more detailed charts.

Now,

let’s discuss this chart. I’ll go full-screen so you can see it better. This is

a 5-minute chart that shows footprints with bid and ask. This is especially

useful when the price reaches a strong support or resistance level. It allows

me to see the details of where traders are placing their orders, whether on bid

or ask. For instance, when the price reaches a level I want to trade, this is

the main chart I use. You can also customize the chart’s appearance to resemble

candlesticks, but I prefer the default view with colors, as it indicates

whether buyers or sellers are more aggressive. Green cells show that buyers

were more aggressive (higher volumes on ask), while red cells show that sellers

were more aggressive (higher volumes on bid). This gives me an instant visual

understanding of the market activity.

This

chart also provides additional details, such as Delta values, failed auctions

(or unfinished business), and heavy-volume nodes, which are marked with a black

bracket. These nodes show where the highest volumes were traded within each

footprint. While there are more features, I won’t go into too much detail here

since this video focuses on setting up the workspace.

Finally,

let’s move to this last chart. It looks different from the others because it

shows cumulative Delta. It consists of two parts: the top is a simple 1-minute

chart, and the bottom is the cumulative Delta chart. I use this to identify

divergences between price and Delta. Typically, price follows Delta—if Delta

goes downward, price usually follows. However, when there’s a divergence, such

as price moving up while Delta is dropping, it can signal a potential reversal.

I pay close attention to this chart when the price reaches a strong support or

resistance zone. If I spot a divergence, I take the trade. It’s a simple yet

effective approach.

That’s

my trading workspace. I believe you can easily replicate it on your own, even

if you’re not using my custom-made Order Flow software. However, if you have my

software and are a member of our trading course, our tech support team can set

up this exact workspace for you in no time.

If

you’re interested in joining us or getting my custom-made Order Flow software,

visit my website at Trader-Dale.com.

Click the “Trading

Course and Tools” button to find the Order Flow pack, which includes

the Order Flow video course, my custom-made Order Flow software, and

custom-made Volume Profile software. You’ll also get free tech support to

install everything for you, so you can start trading immediately. If you’re

interested in day trading with me and other prop firm traders daily, click the

“FTA”

button, which stands for Funded Trader Academy. There’s a video there

explaining everything in detail, and you can book a one-on-one call to see if

it’s the right fit for you.

Thanks for watching, and I’ll see you in the next video.