SL/PT

There are many ways how to trade intraday trades. Here are some good ones

10/12 approach

I use PT 10 pips, SL 12 pips. Reasons for this are:

- It simply suits me to trade with RRR around 1:1

- Even when the market goes in a strong trend against your position it could make small (10 pip) correction and I can catch it and profit on it. It is not that usual that this strong counter trend would make bigger corrections than about 10 pips.

20/20 approach

There is not just one right way to this. It is also possible to trade my intraday levels with PT 20 pips and SL also 20 pips. I have backtested this idea and it is also very profitable. Some of my fellow traders sucessfully use this 20/20 approach.

Advantages of this method:

- You can trade this way even with a broker that has not so tight spreads.

- Possible slippage isn’t such a big deal (compared to 10/12 approach)

- Trading this way isn’t that quick and stressfull and sometimes gives you more opportunities to quit a bad trade.

Disadvantages:

- There is possible risk that the level works nicely and makes the 10 pips move but the reaction isn’t strong enough to make 20 pips. Remember this is intraday trading and 20 pips could just be too far.

- Longer trade duration. In my trading I prefer quick intraday trades because longer ones can be mentally quite hard to handle.

Other approaches

You can for example trade with a 12 pip SL and when you hit +10 pips in profit you quit half of your position and try to get +20 pips with the second half (securing the position at BE).

You can also trade with much smaller SL (for example 6 pip SL).

There are many profitable ways to approach this. There isn’t just one which is best and the others are bad. You should chose the one that suits you trading style and psychology the most.

Managing your losses

You manage you losses mostly by moving your SL. I distinguish three kinds of approaches – agressive, neutral and conservative. You can chose which one suits you best:

- Agressive approach: trade without moving your initial SL. If you put for example 12 pips SL don’t move it. There are only two outcomes of the trade: full SL or full PT.

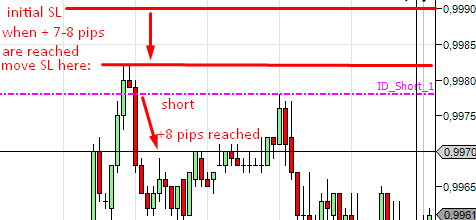

- Neutral approach: When the market makes 70-80 % of your profit target move your SL below/above the reaction:

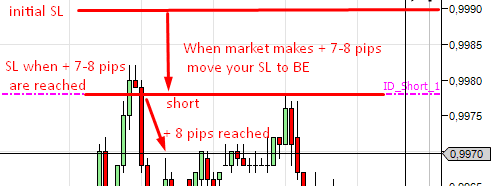

- Conservative approach: When the market makes 70-80 % of your profit target move your SL to break even point so this trade isn’t a loss.

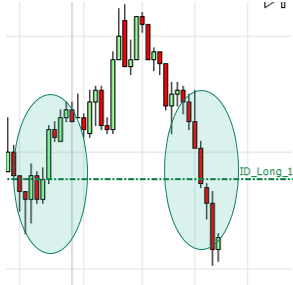

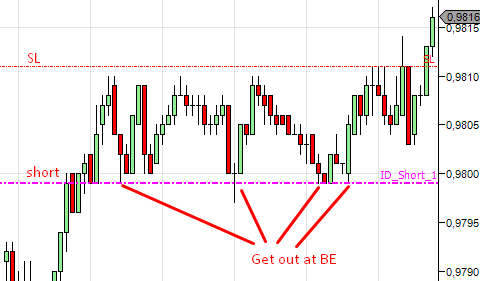

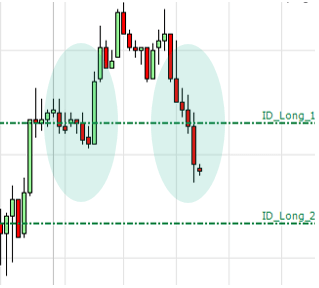

Quitting the position earlier: You can apply this rule in all three approaches I mentioned. The basic idea is to quit the position at BE when you see no reaction to the level and when the market makes a long rotation in red numbers (below your long entry or above your short entry). For example if there is little or no reaction for more than 10 – 20 minutes you try to get out ideally at BE or in green pips. For example like this:

Manage your profits

You manage you profits mostly by defining your PT. There are many ways how to approach this. I will mention three possible profit target methods that work well with my intraday levels.

- PT = 10 pips

- PT = 20 pips

- PT 1 = 10 pips, PT 2 = 20 pips. Get rid of half of your position when it reaches +10 pips. Go for +20 pips with second half of your position.

TIP: Don’t exit the trade earlier just because you are scared. Always stick to your planned profit target. Only exception is previously mentioned quitting when the position goes nowhere and makes a rotation in red numbers.

Adapting your position management to market behaviour

You can adapt your trading to markets behaviour. Here are some examples what you can do.

- Trading againts a strong trend: Don’t try to go for more than +10 pips profit. Be carefull and use neutral approach or conservative approach. Secure your position by moving your SL after the market makes +7 pips.

- Trading in the direction of a strong trend: You can be more agressive with tightening your SL and use agressive approach or neutral approach. Don’t secure your position too soon or with too tight SL. In this case trend is your friend. You can go for more than 10 pip profit when following a trend but don’t get too greedy!

Macroeconomic events

You can use for example this macroeconomic calendar: http://www.forexfactory.com. The most significant events are in red colour. Never trade during such events. Always wait until volatility subsides. If there is strong trend that started with high impact macroeconomic event it is better not to place intraday trades against such trend at all. If you are extremely agressive and place the trade anyway make sure you manage your SL accordingly and trade with tight SL.

Correlation

Sometimes it happens that there is very simillar level at two (or more) forex pairs. If you see that price is approaching both of the simillar levels and that it will most likely hit both of them in the same time it is better to halve your trading volume in both positions. If you didn’t halve your positions you would be betting too much on 2 highly corellated trades which will probably both end up in loss or a win. Here is an example of 2 heavily corellated tredes that both ended up in the same way (loss).

AUD/USD EUR/USD

What RRR & BE stand for ?

RRR = risk reward ratio

BE = Break even (for example when you quit your position at BE it means that you quit it at the place where you opened it and you have 0 profit from it)

how long do we leave the orders open for? What if they are not hit within the session? Also, if macro news is approaching and the order is there still not triggered, do we remove it or leave it? ANd once removed, past the new event, do we then re instate the order if its still valid?

You can leave orders open even after session ends. They are still valid. If macro is approaching then safest thing to do is cancel the limit order. If it isn’t hit during the macro news release or shortly after you can put your limit up again.

Dale,

This may be a stupid question but on the daily levels, if the EURUSD hits 1.1750 I should buy and then if/when it hits 1.848 I should sell.

Thanks

Hi Dale, so much grateful for sharing your informations and technics, I’m enjoying so much and making finally profitable trades. I feel that in many trade I lost much of the pips left on the trade, when market is strong trending, there is some sound motive or risk using some simple trend following sma / ema (or alligator etc) clearly always supported by market analisys as you clearly explain? thanks in advance.