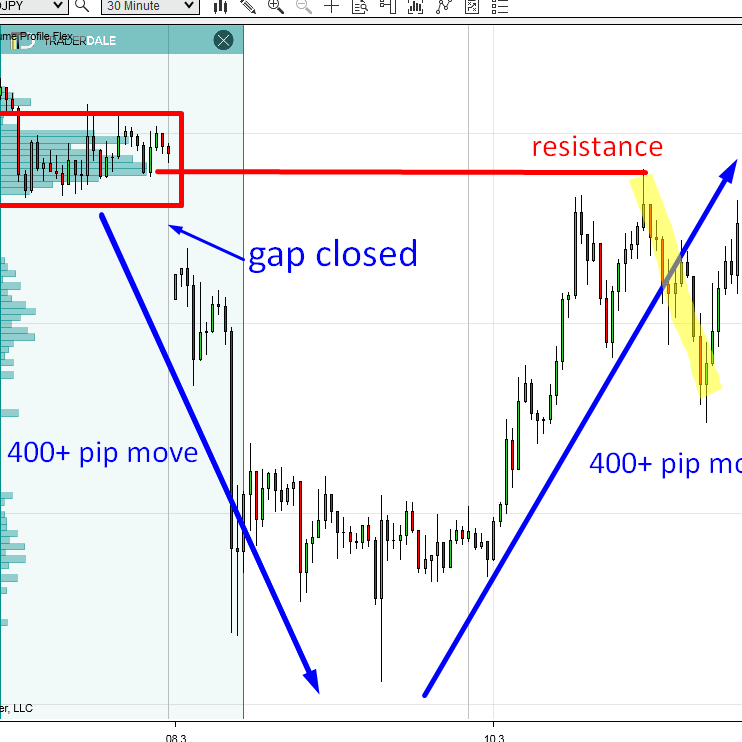

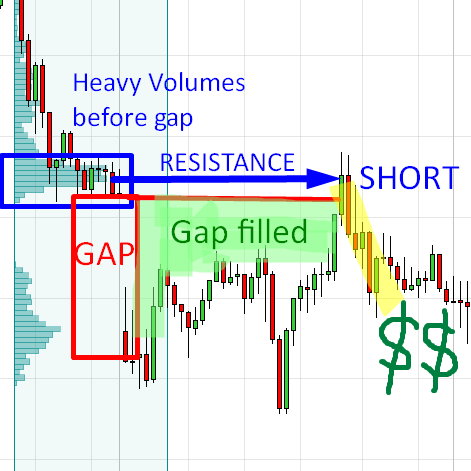

WTF happened on JPY? – EXPLAINED

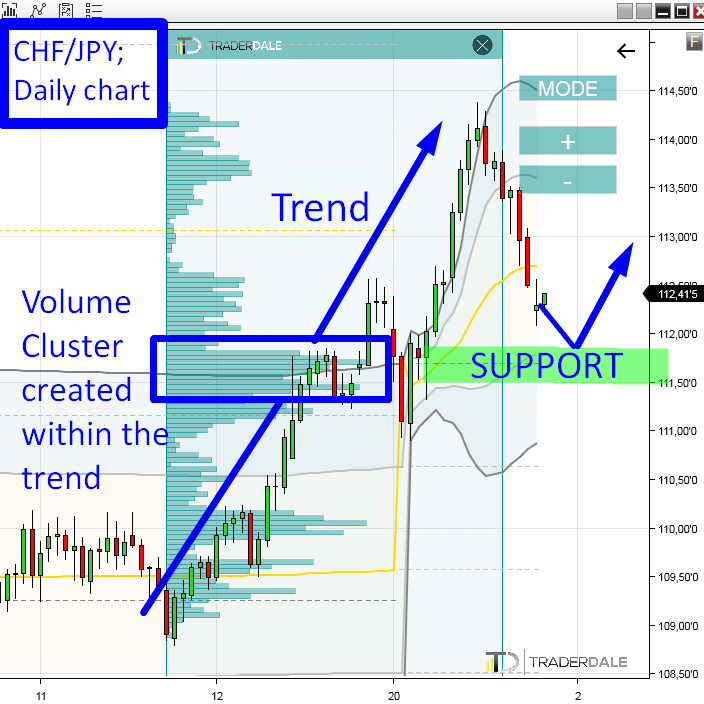

There was a crazy selling on JPY on Monday. The next day it all got negated and the price made over 400 pips upwards. Learn what happened here and how to identify strong trading levels in such a situation.

WTF happened on JPY? – EXPLAINED Read More »