Do you prefer a video? Check this out:

This article is a part of a four-part Beginners Guide to Volume Profile. Here are links to all four parts:

In this article, I am going to show you my three most favorite Volume Profile setups.

All the setups can be used with any timeframe. I prefer 30-minute charts for intraday trading, 240-minute or Daily charts for swing trading and Daily to Monthly charts for planning long-term investments.

Setup #1: Volume Accumulation Setup

This is my favorite trading setup. You can trade it in three steps:

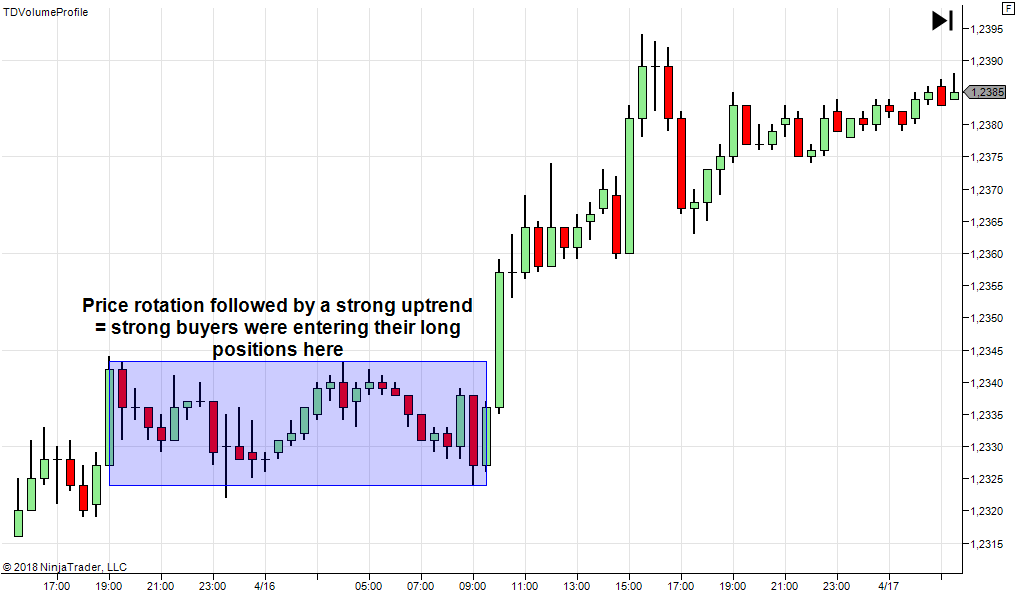

1. To trade this setup, you must first look for a price rotation/tight channel, which is followed by strong uptrend (or downtrend). What happens in such formation, is that big institutions are accumulating their trading positions (in the channel) and then they start an aggressive trend. A Long scenario would looks like this:

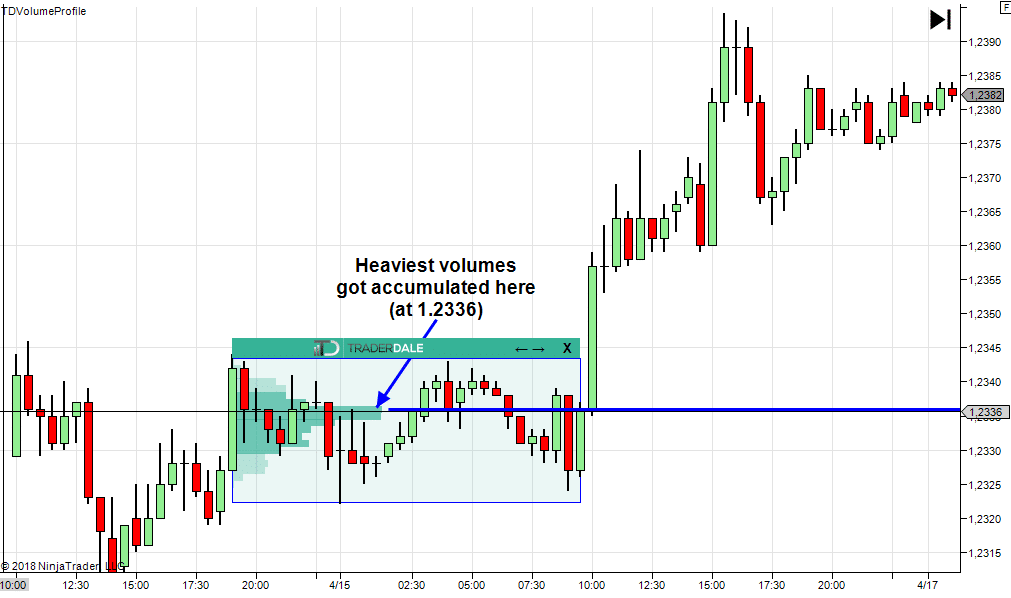

2. Use Volume Profile in the rotation area to identify where the heaviest volumes were. Draw a line there. This line will be your support (long trade scenario).

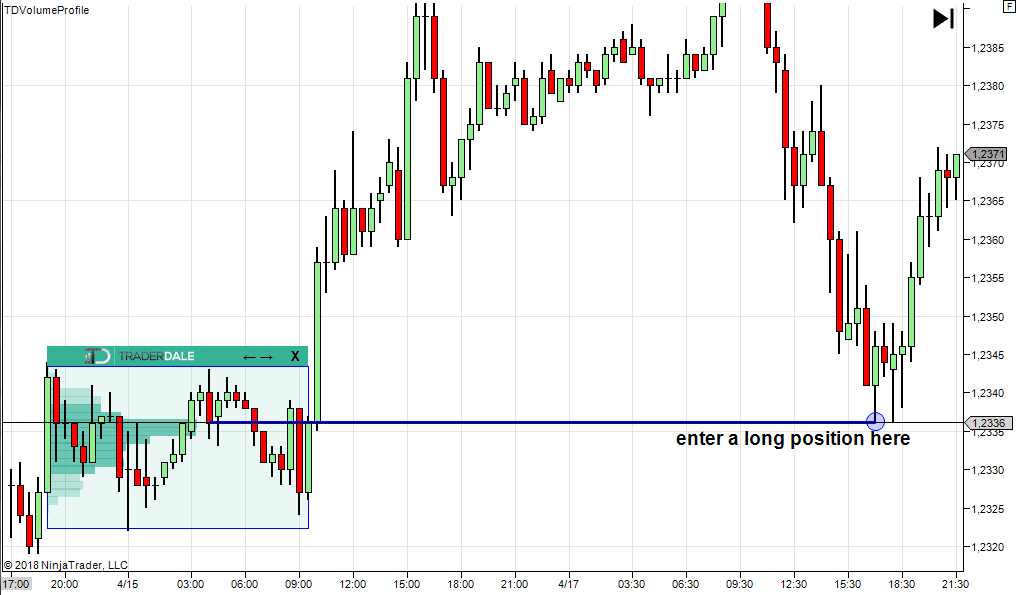

3. Enter your long trade when the price hits this support. No need to wait for any sort of confirmation, simply enter at first touch. It is also important to note that I only trade a level once.

Logic behind the Setup #1

Let me now explain the logic behind this setup. There are two reasons (factors) why the price reacts to these volume zones so well. This reasoning also applies to all the other volume setup I am going to show you later.

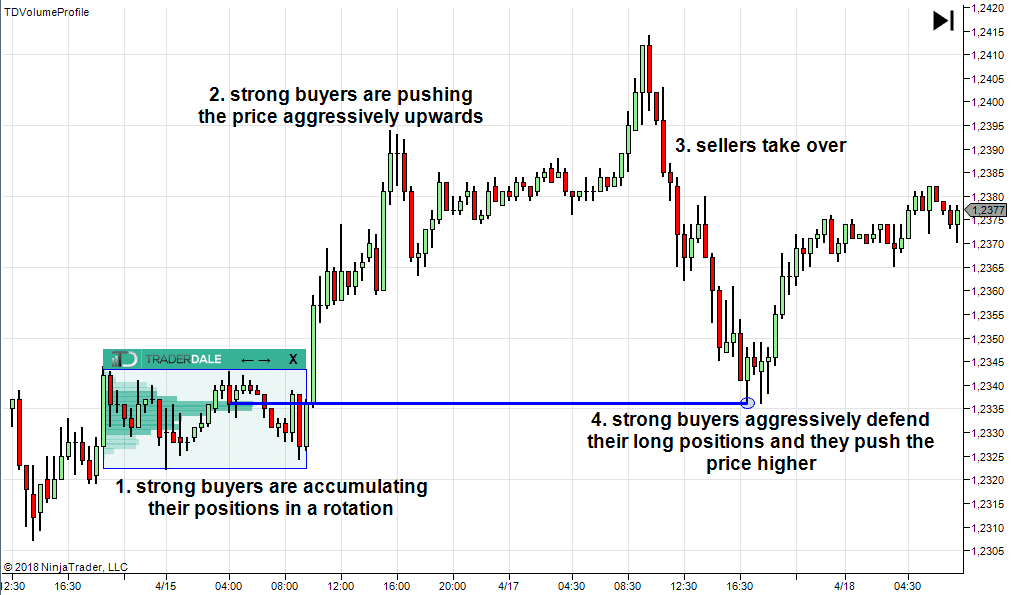

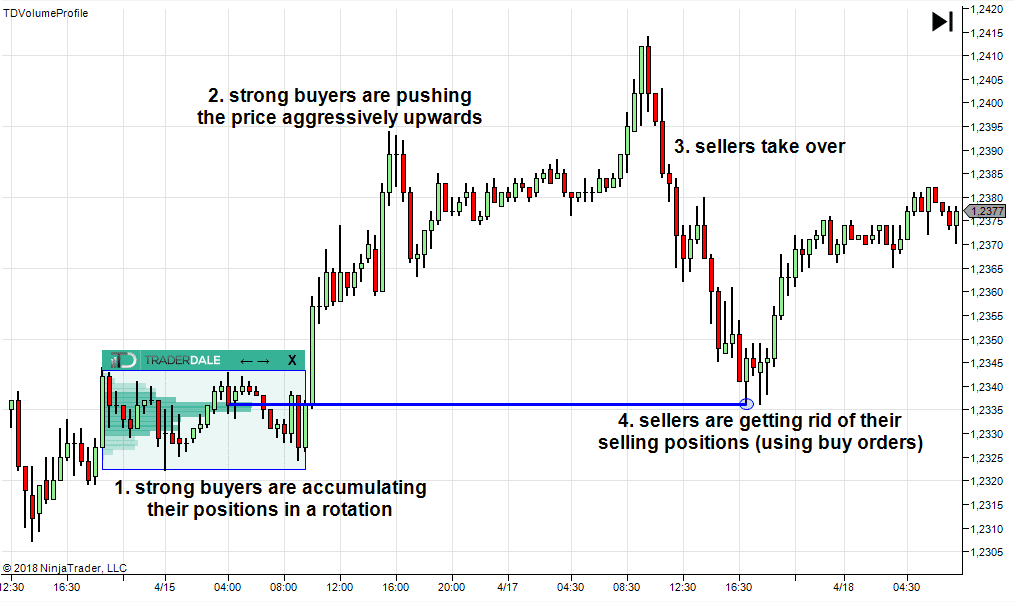

Reason #1: Strong buyers/sellers who were accumulating their positions are likely to defend their positions and their interests. So, when the price returns to the volume accumulation area, strong buyers/sellers start to defend their positions aggressively. This means that strong buyers start aggressively buying to drive the price upwards again and defend the previous level from which they accumulated their longs. Strong sellers defend their short positions by aggressively selling which moves the price lower again. Here is a picture to demonstrate this (long trade scenario):

Reason #2: Nobody wants to risk a fight with strong and aggressive buyers/sellers.

Let me demonstrate this on an example: First, strong buyers accumulated their positions in a sideways rotation. Then they pushed the price aggressively upwards (this is the long scenario of Setup #1). After that, the buyers stopped pushing the price upwards for a while and sellers took over. They were pushing the price lower and lower, but when they approached the strong rotation where the aggressive buyers had accumulated their massive positions, the sellers stopped their selling activity and closed their positions. Why? Because they didn’t want to risk a fight with strong and aggressive buyers.

When somebody who is in a short position wants to quit their position, he buys. So when those sellers start to buy to get rid of their selling positions, they drive the price upwards.

Let me make this more clear with a picture:

It is the combination of the two factors I showed you, that drives the price away from the support/resistance zones.

Do you want ME to help YOU with your trading?

Volume Profile Setup #2: Trend Setup

This is also one of my favorite Volume Profile Setups. Learn to trade it in four simple steps:

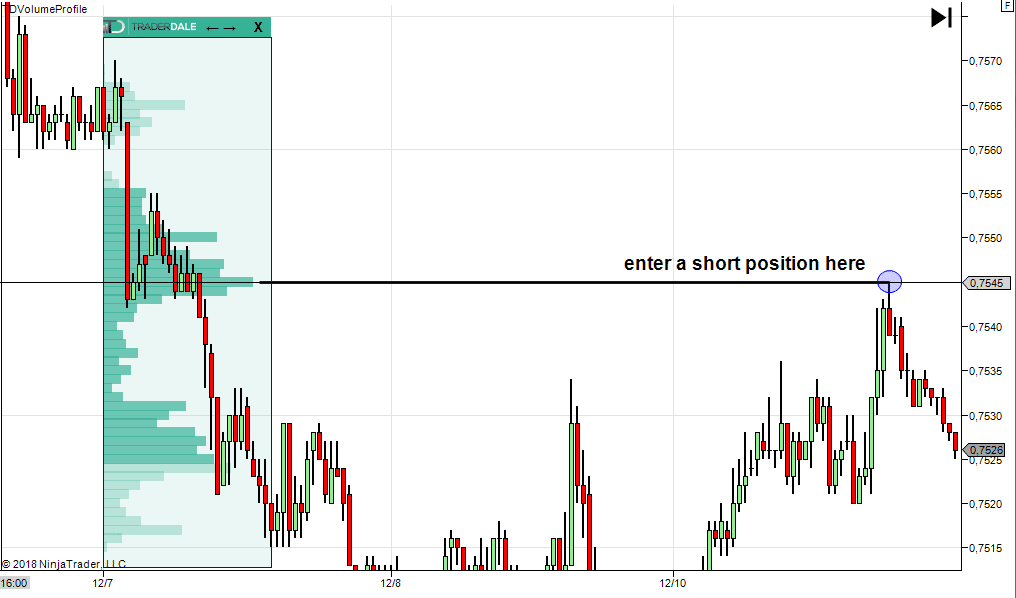

1. Trade this setup when there is a strong trend. So, the first step is to find a strong trend. If there is an uptrend, then you will be looking to trade long with the trend. If it is a downtrend, then you will be trading short.

2. When you have found a trend (in this case a downtrend), use Volume Profile in this trend to see how the volume was distributed throughout the move.

3. Look for significant volume clusters that were created within the trend. In this picture, there is one significant volume cluster in the middle of the downtrend. Draw a line from the place where the volume cluster was the widest. This will be your resistance area.

4. Wait until the price hits this level. Go short when it does. As with the previous example, there is no need to wait for any sort of confirmation.

The logic behind the Setup #2

The logic behind this setups is, that sellers were pushing price downwards and they were adding to their positions in the places where we see the volume cluster mid-trend. When the price hits the volume clusters again, those sellers will likely become active again and begin to defend their short position. This, in turn, will push the price down from these volume clusters again.

The same two factors I mentioned in the Setup #1 apply here as well.

Recommended Forex Broker

More Volume Profile Setups

If you would like to learn more of my trading setups, see more examples, learn more about trading with Volume Profile and trade with me every day then you may want to check my Volume Profile education packages here:

Dale’s Volume Profile Training

Happy trading!

-Dale

Continue reading to part 3 here:

Beginners Guide to Volume Profile Part 3: Where to get Volume Profile & Setup Guide

There is no central exchange and I have heard that these forex brokers rip you off due to the fact that they are supplying you the chart and price data, as well as running the stops on their own brokerage to whipsaw your account. Here in the USA they will not allow you to hedge. I don’t trust them.

I am comparing forex to futures counterparts every day and they are REALLY close. If you have a solid broker you won’t have such a problem… But sure they are a lot of scammer brokers too! Be careful who you choose to trade with.

What’s your take on Oanda?

The problem with trading forex is that you are trading against your own broker and not the Forex Market or other Brokers. Either you have to lose or your broker. It is exactly like gambling in a Casino. You are gambling against the House. And as you know, the House at the end of the day always wins! But this does not mean you can not win. Occasionally you will win and then you keep trading till you lose it unless you walk away with your win.

No sorry that’s completely wrong – if you trade Forex with good money management and stay strict to your Risk to Reward Ratio along with staying consistent to your strategy you can effectively have a win rate of 30% and still be profitable.

Saying you keep trading until you lose all your money is a gambling mentality and this is why so many fail to be successful in this market because they have no idea how to manage themselves as a disciplined trader.

hello, when you go long short or long ( like in your example here) , do you use a trailing stop, go for a scalp to lock-in profit, use a more complex multi target OCO Bracket or just nurse the trade manually?

What are your suggestions? Thank you.

Hi Dale…your work is very interesting and makes sense ….these areas seam to be areas of great importance and of great significance if known in advance…well done and continue with your work in the markets much appreciated

Thank you very much, Tim. I am glad you like what I do!

Trader Dale-

Question #1: I only swing trade long with TOS/Ameritrade Zack’s #1 or #2 stocks with a $200 risk limit <$200/(Entry Pr – S/L) and a 15% Target. Can you show me how VP Setups have backtested? and would VPA help me (show me different entry or S/L points) or simply confirm what I'm already doing?

Question #2: My usual long setup is POH back to price support levels (e.g. horizontal, Moving Average), How do Volume Profile support levels differ? Don't price clusters "basing" generally coincide with volume accumulation (VPA)?

Thanks

Hello Marty, I am sorry I don’t have a quick method to tell you how my swings would work in such conditions. they have around 65-70% win rate in the long run.

Yea price clusters do coincide with volume accumulation, but volume Profile makes it way easier to read and way more precise.

Hello this is a very silly question though..please don’t found and me,but generously reach out coz some of us a Beginners here with very little knowledge about fx and ofcourse pretty good Volume Profile.. I must say, Volume Profile based strategy out numbered so many so-called complicated standard indicators including historical candle sticks patterns..This are all old testament stuffs..I am so happy and thankful to You.Mr Dale..Thought I am a fx student beginner, I get something from your publications..

I am ready to purchase your Volume Profile right away and get it up on my mt4 from demo account..kindly reach me through my mail as address for step by step guide..