We are now experiencing something that has NEVER HAPPENED BEFORE. The prices of Oil are falling into negative numbers and the energy market is panicking.

Is this an opportunity of a lifetime or a mad gamble?

Here are some facts that may help you make your mind about that.

FACT #1: What caused this?

There are two factors that caused the crazy price drop.

The first factor is Russia and Arabia who simply flooded the market by their excess supply of Oil. Under normal circumstances, this would be bad, but what really made this a catastrophe is the timing which came along with the current COVID-19 pandemic.

The demand for Oil has plummeted because most of the world is now in a lockdown, and the economy is massively slowed down.

Simply put: Too much oil and nobody wants it.

FACT #2: Oil storages are nearly full

If there was a place where to put all the excessive and cheap oil, then it wouldn’t be such a huge problem. But unfortunately, the biggest Oil storages (both private and non-private) are almost full.

There are some storage containers still empty (mostly those under maintenance) but there are not many of them and even if they got filled it would not help too much.

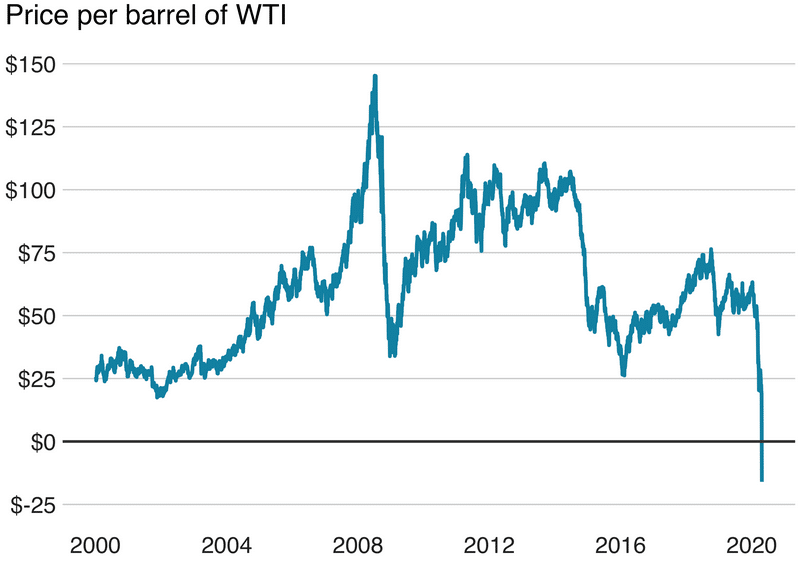

FACT #3: Oil prices CAN be negative

When there is no place to store the oil, then the only option is to pay somebody to take it (unless you want it delivered into your backyard). This is a crazy thing, but it happens right now! Oil with March delivery went into a crazy sell-off and it ended up in negative numbers!

I personally thought I would never see such a thing, but here we are and this is happening right now!

FACT #4: Negative Oil prices were mostly caused by futures rollover

This plunge of Oil price was most likely caused by the futures contracts rollover. Everybody wanted to get rid of their Oil before the rollover and this caused the free fall and the negative prices.

If there was not a rollover I don’t think we would see Oil prices in negative numbers

FACT #5: Cuts in Oil production

An agreement has been made that the OPEC will cut the production of Oil. This should help the Oil prices to recover.

The production will be cut by nearly 10 million barrels/day. This is the biggest single cut in history.

This cut will take place from 1st May 2020 and it will be active until the end of June 2020.

FACT #6: The 10 mil. cut is not enough

The cut in Oil production was agreed upon in order to help the Oil companies and save them from bankruptcy.

Even though this cut is huge, it needs to be bigger in order to save most of the Oil companies. It would need to be around 20-30 mil cut instead of “just” a 10 million cut.

FACT #7: Oil companies will bankrupt

It is said that around 40% of the Oil and Natural Gas companies will go bankrupt within a year if the price does not rise at least above $30/barrel.

Or if they won’t get saved or bought by somebody else.

FACT #8: Big Oil companies will be taking over the small ones

Right now, it seems inevitable that some Oil companies will go bankrupt. The first ones to go are the ones with big debts.

What can be expected is that the biggest companies in the industry (like Chevron or Exxon) will want to take this opportunity and buy their smaller competitors cheap.

This way they will grow even bigger and they will get rid of their competition. They only need to have the cash to do the acquisition.

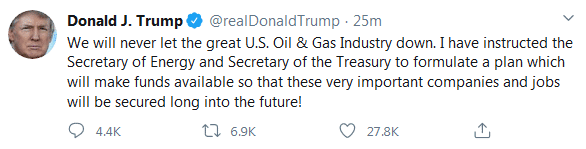

FACT #9: Donald Trump is trying to save the Energy sector

Those are the steps the US president took to rise the Oil prices and to help the energy sector (or at least the main steps which I noted):

1. He managed to make the deal to cut the Oil production by 9.7 mil barrels/day.

2. He publicly announced that the US will be filling up their Oil reserves. He announced this twice (I think) and neither announcement helped the Oil to recover.

3. He said he would work on a plan to save the US Energy sector (companies). He announced this just a few moments ago so let’s wait and see what this plan will be.

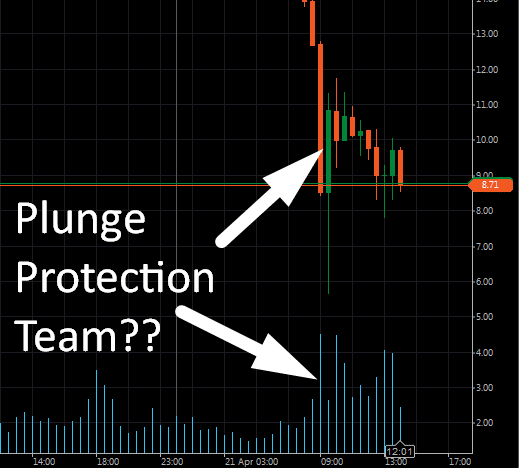

?FACT #10: Plunge Protection Team in play?

This is not really a fact but my own hypothesis. I think the Plunge Protection Team is in play.

What do they do? They simply wait until the market is under some crazy pressure and panic, and then they start to pump money into it to save it from a total collapse.

I think this happened today (April 21st 2020) when the Oil was in a free fall. Then the price froze for about 5-10 minutes and then the price shot upwards from $5.69 to $11. That’s 100% gain in just a few minutes! Crazy right?

I think it is pretty likely that it was the Plunge Protection Team joining the game here.

Do you want ME to help YOU with your trading?

Join one of my Volume Profile Educational courses and get my private trading levels, 15 hours of video content, my custom made Volume Profile indicators, and more!

Click Here

UPDATES

I will update this article if some new important facts about the Oil show up. If you have any (or if you have any corrections to my facts) please shoot me an email and I will update the article.

Stay safe and happy trading,

-Dale

That’s crazy, do you think that it’ll go down more?

when do you expect it to go up?

My very careful guess is that it could turn now. We have already seen the big boom and panic. Now OPEC will start the cuts and everybody seems to do something to help…But this does not mean the oil could not stay super cheap for the next year…Maybe it just bottomed out and now we will see a rotation, not an uptrend. There is still no demand and this is not going to change overnight.

Privatize the gain, socialize the loss.

oh yea, thats how it all works.

Thanks for the article…quite comprehensive and spot on..

Thank you!

Does dark pool trading reduce the power of using volume profile? If 60% or more trades by the big money do this, how can you see it? If they can hide this way how can volume profile help us? There are lots of people wanting to teach this…….. what makes your any better?

Interesting point about dark pool 🙂

There are most likely not 60% in dark pools. More likely 20-30% worldwide. Also, dark pool price needs to correspond to the real market prices, if it did not there would be a place for an arbitrage. Markets nowadays get rid of those pretty effectively.

If other people want to teach this then they can do so. I am just running a website about stuff I like and about stuff I have been doing full time more than half of my life.

Nice comment Ken very true, the public have the power in their pockets yet we let them take it by being compliant, who’s to blame, we put them there,,,,

Dale i agree the US gov will support the OIL industry “JOBs” but this won’t address the oil GLUT, any time soon,

the oil barons have shit in their nest due to greed, now there will be major takeovers happening which we will pay for in the long run, less competition,

Exactly. Helping Oil companies won’t help Oil. You know when I read the news I took it as a bad sign – because they are focusing on curing symptoms but not the problem with this. If they want to help those guys they need to cut way more. But I think this is not within Trump’s power so he now focuses on what he CAN do – help Oil companies. I guess we will see some more money printed 🙂

Thanks

Your broker would mostly close your position because the won’t be able to process a physical delivery. I understand you meant the May contract?