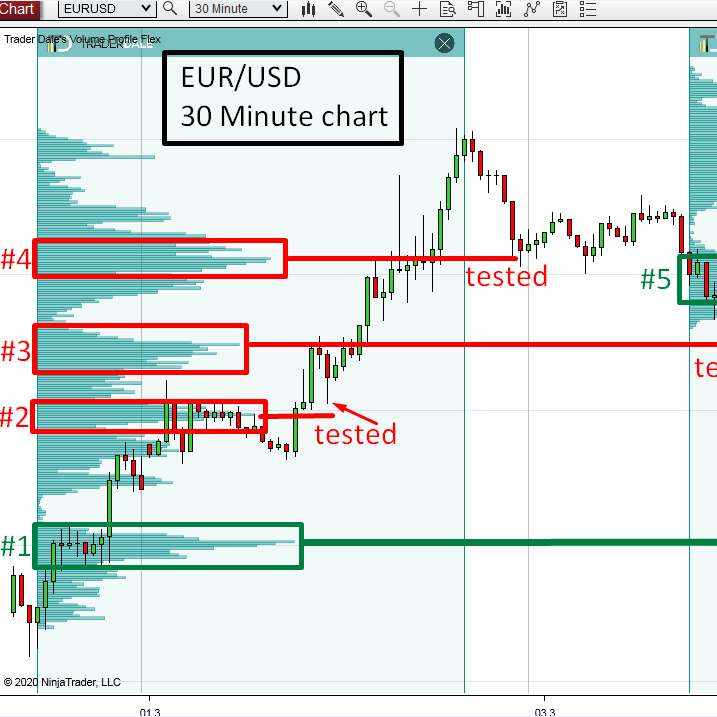

EUR/USD: All Significant Supports EXPLAINED

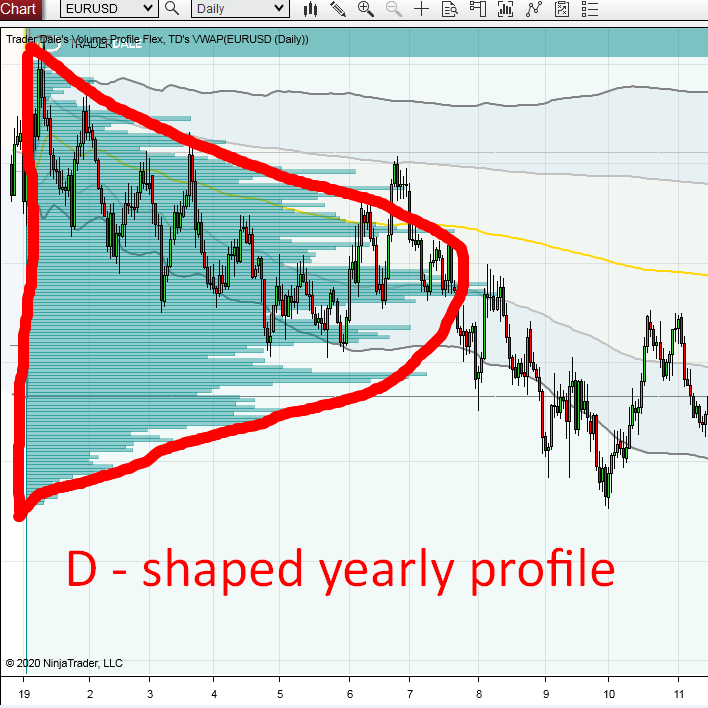

The EUR/USD is in a strong uptrend. The Volume Profile shows several supports the EUR/USD can react to if there is a pullback. This article examines all those supports one by one.

EUR/USD: All Significant Supports EXPLAINED Read More »