Trading With Volume Profile in a Price Rotation

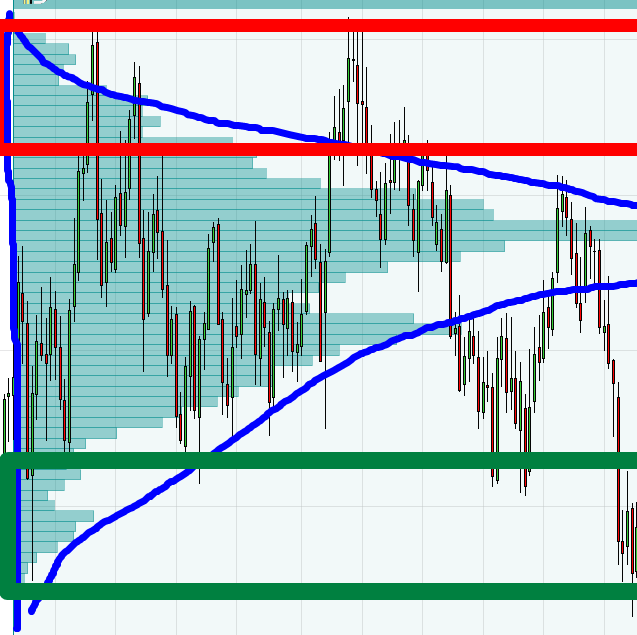

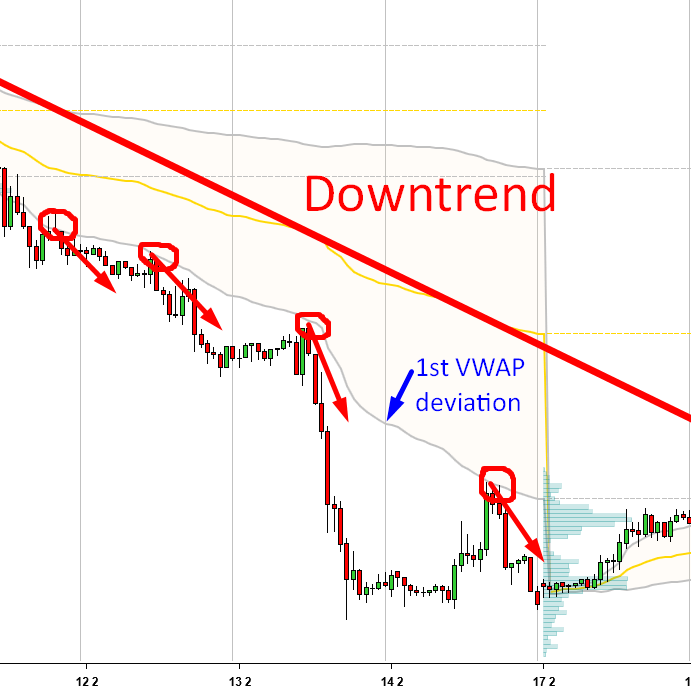

The most common Volume Profile histogram shape is the D-shape. It forms when the price is in a rotation. Learn how to trade in a rotation on a real trade example on USD/CHF.

Trading With Volume Profile in a Price Rotation Read More »