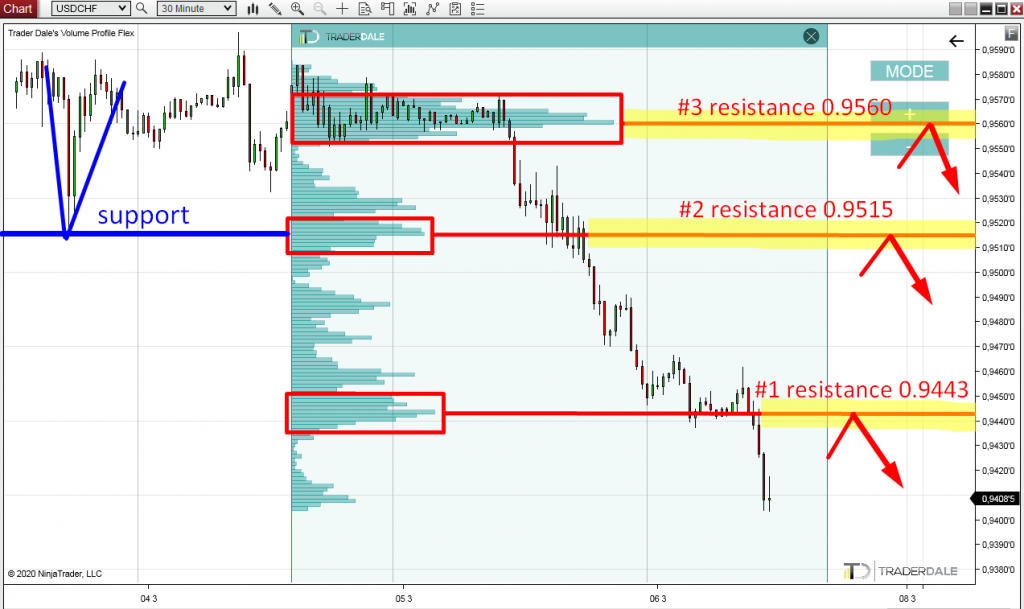

Trading The Trend On USD/CHF

There is a strong sell-off on the USD/CHF. In a situation like this it is ideal to wait for pullbacks and then go short. Learn how to use Volume Profile to identify best places to enter a short trade.

Trading The Trend On USD/CHF Read More »