In my yesterday’s post, I wrote about the BIG picture on USD/CHF and I did a Weekly time frame analysis. If you missed it then you can check it out here:

Today, I would like ho have a closer look at a lower time frame and show you some strong intraday trading resistances there.

How to trade in a trend

In the last couple of days, the USD/CHF has been moving downwards in a really strong sell-off. It fell around 450 pips just in few days!

When there is a development like this I look for areas where I can enter a short trade.

Those of you who follow me know, that in situations like this I always look for pullbacks. This means that I want to see the price to make a correction. When it does, then I jump into a short trade.

There are specific places where I want to jump in the trade. It is the Volume Cluster areas = places with significant volumes created.

Whenever there is a trend I use my Flexible Volume Profile in that trend area and I look for significant Volume Clusters.

When the price makes a pullback to them, then I enter my trade. Such a trade is always in the direction of the trend (so when there is a downtrend I enter a short)

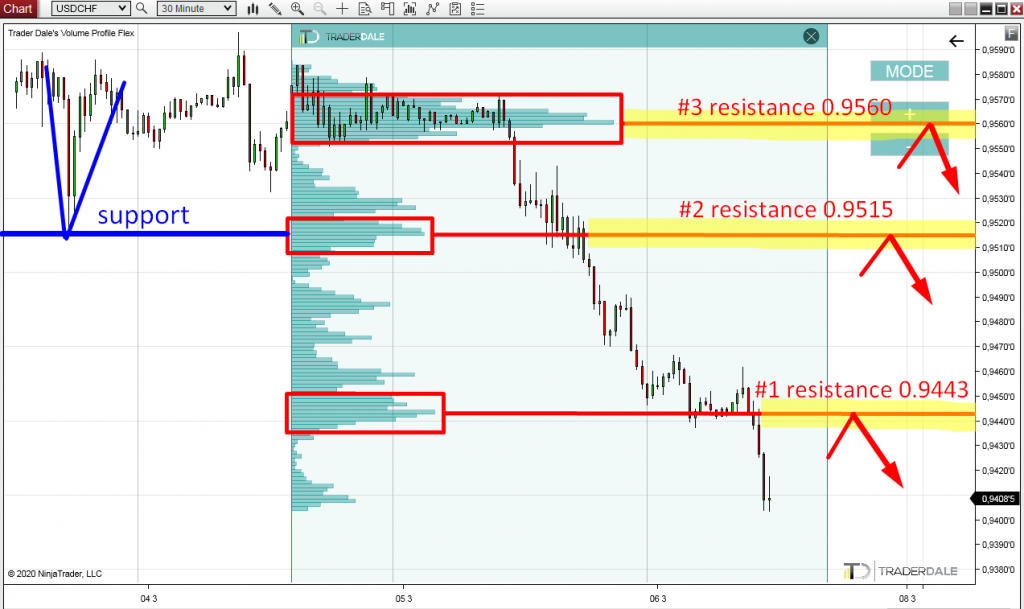

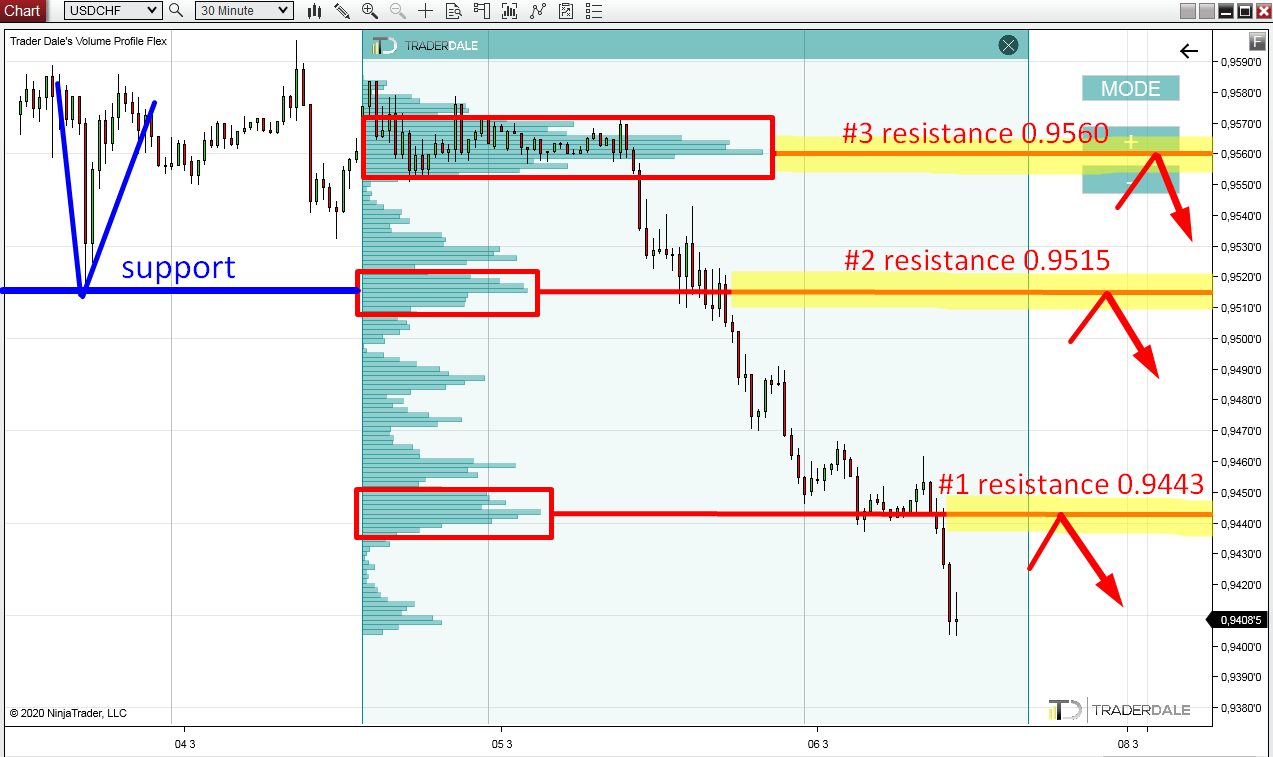

Let’s now have a look at the USD/CHF, 30 Minute time frame.

I printed the Flexible Volume Profile over the recent downtrend area. This revealed three strong Volume Clusters.

#1 Resistance (0.9443)

The first Volume Cluster is around 0.9443 and it has been formed earlier today. There was a little rotation in today’s Asian session. Then the European session started and there was a new sell-off. I think that sellers were adding to their selling positions in the Asian session (at the place where the Volume Cluster is).

When the price makes it back to this area I think those sellers will become active again and they will try and push the price from this area downwards again.

Do you want ME to help YOU with your trading?

#2 Resistance (0.9515)

The second resistance is based on a significant Volume Cluster created around 0.9515. The logic behind this one is more or less the same as in the previous one. There were sellers adding to their selling positions there and I expect them to defend their positions in the future.

What I like about this resistance is that it worked as a support in the past. I marked this in the picture with the blue color. The price bounced of this level nicely and aggressively (this is how I know it was a strong support). When the price made it through this support, it then became a resistance (0.9515). A cool thing is that this is the same spot as the one where the Volume Cluster is. I really like confluences like these!

#3 Resistance (0.9560)

This is where the recent sell-off started. As you can see there was quite a long rotation where heavy volumes got traded. In my opinion, this is the place where the sellers who initiated the recent sell-off placed most of their positions.

When the price makes a pullback into this area again I think that those sellers will become active and they will try and defend their selling positions. They will do this by aggressive selling activity which would push the price downwards again.

Macro news

There is a significant macroeconomic news coming up later today. It is the Non-Farm Employment Change and Unemployment Rate. Both these strongly affect the US Dollar. This means they will also affect the USD/CHF.

Anything can happen during the release of such news and I would not advise you to take any intraday trades no matter how strong and appealing they appear. A safer approach is not to trade few minutes before the news release and then start trading only after the post news volatility has calmed down.

Recommended Forex Broker

I hope you guys liked today’s market analysis article. Let me know what you think in the comments below!

Have a GREAT weekend.

-Dale