Markets are generally known to be overreacting. I saw this happen so many times and the last time I saw this was just yesterday.

Market open like this hasn’t happened for quite a long time. There were market gaps everywhere and volatility got really high.

Why did the market open this way? Funny thing is that nobody really knows. Sure, there is the coronavirus outbreak but nothing really unexpected happened during the weekend so why the gap and crazy volatility?

There was also the big news concerning the oil. I was talking about this in my yesterday’s video here:

Weekly Trading Ideas 9.3.2020 (Oil Special)

However, the oil news is not really the kind of news to cause such panic.

So, in my opinion markets are overreacting and I think it will all get back to normal again.

The market open on Monday created many nice gaps. There is still a lot of them which have not been filled yet.

As I showed you in one of my previous articles – gaps tend to get filled. If there is a significant Volume Cluster created before a gap then it usually works as a strong support/resistance.

More about the basics of this strategy here:

Let me now show you some of the current gaps and do a small comment on each one of them.

EUR/JPY gap

Forex pairs which include the JPY were hit the hardest, created the biggest gaps and had the biggest volatility increase.

Even though the EUR/JPY made a 280 pip downwards move in one day it recovered quickly and just today it closed the opening gap.

As you can see in the picture below, there was a significant Volume Cluster created before the gap. The price reacted to it nicely and made a selling reaction. This is exactly how the “market open gap” setup is supposed to look like.

Do you want ME to help YOU with your trading?

USD/CHF gap

Another gap occurred on a less volatile forex pair – the USD/CHF. the gap was around 50 pips wide and it got closed today.

In here the price closed the gap but did not made it to the heaviest volume peak which I marked in the picture below.

This left the resistance “tested”. In a case like this I don’t want to trade shorts from such resistance anymore because I consider it spent (even though the price did not really hit it). The reason is that the price turned very close to it and made a significant reaction.

It is a shame as it would have been a nice short trade.

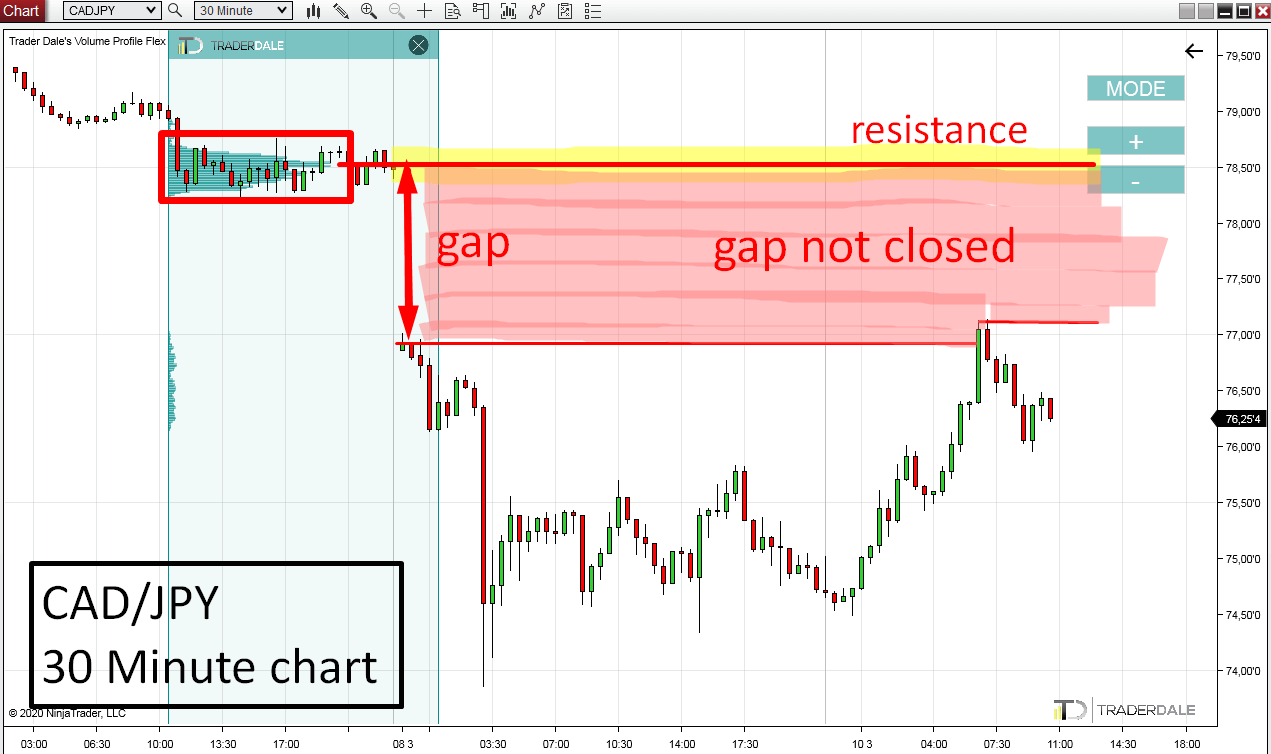

CAD/JPY gap

Now this is a different story! There was a 160 pip opening gap on the CAD/JPY! The price haven’t even get close to closing it. The volatility is pretty big here. This means the gap could get filled shortly. I would not be surprised if it got filled today or tomorrow.

It does not matter too much when it will get closed though. The thing which I find interesting here is the heavy Volume Cluster which got created before the gap (Volume Cluster with the heaviest volumes at 78.51).

According to the gap trading strategy this Volume Cluster should work as a strong resistance and when the price closes the gap and hits it, then it should react to it and go downwards again.

Recommended Forex Broker

AUD/JPY gap

AUD/JPY made a 100 pip gap and then went into a crazy selloff. It made a 500 pip downwards movement.

Now this crazy movement has been negated and the buyers are pushing the price upwards again.

Still, the price has not gone into the opening gap area yet . This means that the setup we are looking for is still viable to trade.

There is a nice Volume Cluster with volume peak at 69.84. When the gap gets closed and price hits this area then it should work as a strong resistance.

Adjusting to a bigger volatility

When the volatility rises to such extent like now then it is necessary to adjust to such market conditions. If you were used to trading with 10 pip Stop Loss then now when the volatility rose you should widen your SL (and TP).

In most of the cases I like to stick to my fixed Stop Loss and Take Profit pip values but when volatility changes as drastically as now then I adjust it. At least for a few days until all gets back to normal again.

I hope you guys liked this article. Let me know what you think in the comments below! And remember to trade carefully especially in conditions like these.

Happy trading!

-Dale

Great ! thanks