Video Transcript:

Hello

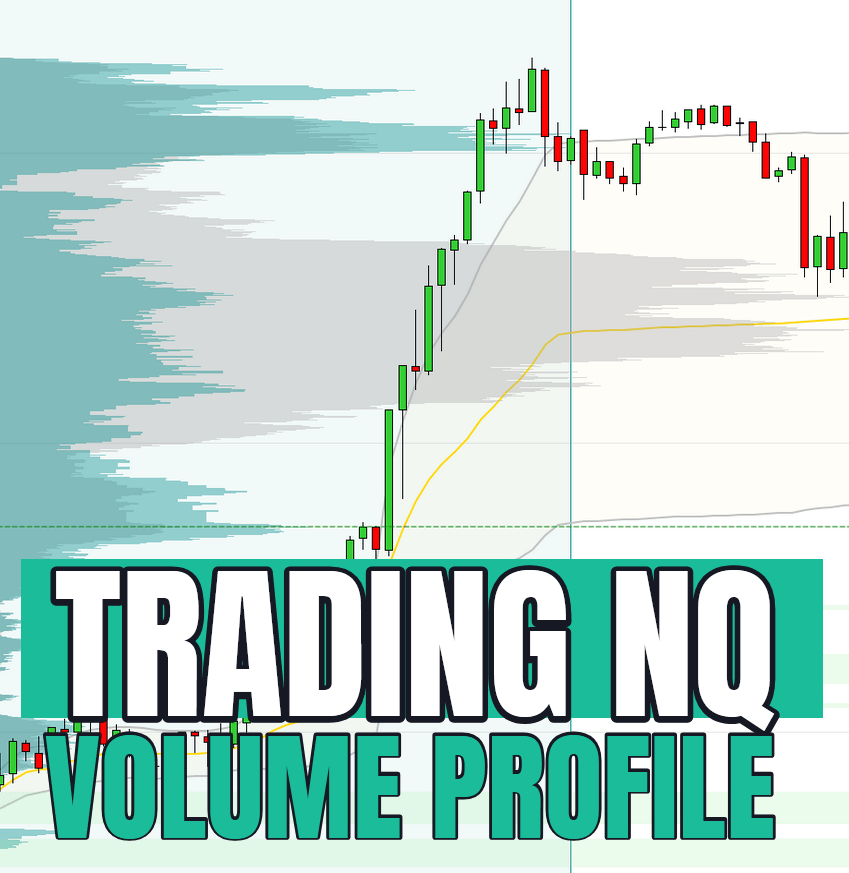

everyone, it’s Dale here. In this video, I want to show you a trade I recently

took on the NQ. This trade nicely demonstrates my Volume Profile trading

strategy, which you can easily replicate yourself. Let me explain what this was

all about.

The

first thing I look at when analyzing charts is whether there’s a rotation, like

here, or a trend, like here. Based on that, I decide how to trade. In this

case, there was an uptrend, so I focused on the uptrend zone using a Volume

Profile. I wanted to see how the volumes were distributed within this uptrend

zone. Specifically, I look for significant volume clusters, like this one,

because in a trend, such clusters indicate areas where buyers were active and

took long positions. In this case, it was right here, due to the heavy volume

cluster.

This

tells me that this is an important area for the buyers and that, in the future,

these buyers are likely to defend this zone. This is the Volume Profile setup I

use during trends: I identify volume clusters within the trend, wait for a

pullback, and trade from that level. However, I often combine this with

additional setups, typically price action setups.

Let

me show you two price action setups that align with this Volume Profile setup

and reinforce this level. First, notice the strong rejection very close to our

level. This indicates that the zone worked as resistance in the past because

the price reacted strongly here. When the price broke through this resistance,

it turned into support. This newly formed support aligns perfectly with the

volume cluster, confirming the level.

The

second price action setup is a fair

value gap. If you’re familiar with Smart Money Concepts, you’ll recognize

this as one of its key elements. My software identifies fair value gaps, and

although the gap in this case has already been tested, it was initially here.

For a long trade scenario, I like to trade from the start of the fair value

gap, which is this level. As you can see, this level coincides perfectly with

the area I identified, and the price reacted very well to it.

While

these setups are helpful, the volume cluster remains the most important factor

for me. For all my trades, I first need to see significant volumes. If volumes

are present, I then look for additional setups to confirm the trade. It’s rare

for me to trade based on just one setup; I usually rely on multiple setups

aligning at a single level or zone to support my decision.

This

was the trade I took using this strategy, and as you can see, the reaction was

excellent. While this analysis is hindsight, I wanted to show you the thought

process behind the trade and how you can apply this method to your trading.

It’s a straightforward strategy—you just need a Volume Profile indicator to

identify heavy volume zones.

As

mentioned, this analysis was done in hindsight, but I had actually published

this level for members of my trading course the day before. I provide my

trading levels daily in advance for all members to use and trade. If you’re

interested in joining, I’m currently running a special Christmas sale. Let me

briefly explain.

If

you visit my website, Trader-Dale.com,

and go to the “Trading

Course and Tools” section, you’ll find the special page with the Christmas sale. Here, you

can get my most popular trading and indicator packs at a discounted price.

These include the Volume Profile Pack for Volume Profile trading, the Order

Flow Pack for day trading with Order Flow, and a brand-new Smart Money Pack

focused on Smart Money trading. This last course is unique and taught by a

professional trader managing a $2 million prop firm account. He’ll teach you

his exact strategy step by step so you can replicate it.

We

don’t usually offer this course, but it’s available during the Christmas sale

until the end of the year. You can get all three packs together for a

discounted price of $597. If you’re interested, visit the page and take

advantage of this offer before it expires.

Thanks

for watching the video! I hope you found it helpful, and I’ll see you next

time. Until then, happy trading!