Do you want ME to help YOU with your trading?

Video Transcript:

Hello everyone! It’s Dale

here with a new weekly trading ideas video. Just a quick note before we

begin—if you’re thinking about getting one of my trading courses or indicators,

now might be the right time. I’m currently running a special Halloween

sale on my website, Trader-Dale.com.

The sale will be ending very soon, in just a few days. If you go to the Trading

Courses and Tools section, it will take you to the sale page. As you can see,

the sale ends at the end of the month. It includes my best educational and

indicator packs: the Volume Profile Pack, focusing on Volume Profile trading;

the Order Flow Pack, teaching you everything about day trading with Order Flow;

and the VWAP Pack, which focuses on both day trading and swing trading with

VWAP. Apart from the courses, these packs also include my custom-made

indicators. If you scroll down, you’ll find a really special deal—until the end

of the month, you can get all three packs together for a massively discounted

price of $597. That’s Volume Profile, Order Flow, and VWAP packs combined!

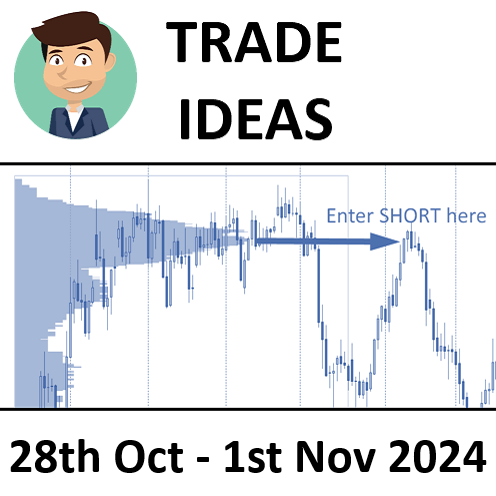

Now, let’s switch over to

the charts and talk about the new trading ideas and key levels. This is the GBP/USD

chart on the NinjaTrader 8 platform, with my custom-made Volume Profile and

VWAP indicators. It’s a 30-minute timeframe, and I want to highlight two strong

resistance levels—one at 1.3050 and the other at 1.3190. The

resistance at 1.3050 is based on a sharp rejection of higher prices,

where significant volumes were traded. It forms a volume cluster where sellers

began to push the price downward. This area is important because sellers are

likely to defend it. If there’s a pullback to this level, there’s a good chance

sellers will push the price down again. Additionally, there’s a Fair Value Gap

(highlighted in red) starting at this level, aligning perfectly with the heavy

volume zone. This is one of the Smart Money concepts I like to combine with

Volume Profile.

The resistance at 1.3190

is also key. If we move the Volume Profile over this trend area, we can see

high volumes here. This suggests sellers were adding to their short positions,

continuing the aggressive selling. This level aligns with a previous support

level that turned into resistance. We also see a Fair

Value Gap here, confirming the strength of this resistance. These three

elements—Volume Profile, Fair Value Gap, and price action setup—combine to make

it a solid trading opportunity. Now, we just need to wait for the price to

reach this level.

Next, let’s move on to AUD/JPY.

Here’s a 30-minute chart. Something interesting here is an opening gap that

hasn’t been closed yet. Markets often like to close gaps and retest the volumes

below them. Using the Volume Profile, we can see significant volumes below the

gap. It’s likely the market will move downward to close the gap and react to

this volume cluster, which is at 100.61. This is where I’ve placed the

level. We’ll need to wait for the price to close the gap and react to the

volume zone.

In previous trades on this

pair, I took a long position from a heavy volume zone, followed by a strong trend.

Another opportunity came from a pullback to a similar volume zone, where I took

a short trade. These levels have already been tested, so I won’t trade them

again, but the current gap level is still valid and worth waiting for.

Finally, let’s look at AUD/CHF

on a 30-minute chart. I have two short levels marked, though one of the

original three was missed. The price turned slightly before reaching this

level, so I won’t be trading it anymore. However, the higher short level

remains valid. This level aligns with a weekly point of control, showing where

the most volume traded in the previous week. This second short level is based

on heavy volumes formed during a rejection of higher prices. It aligns with

another Fair Value Gap and suggests that sellers are active here. I expect

sellers to defend this level if the price pulls back. By merging two weekly

Volume Profiles, we see that this two-week point of control aligns perfectly

with the heavy selling. This makes it a high-probability level for a short trade.

I’ll be waiting for the price to reach this level and expect a reaction from

the sellers.

Before wrapping up, I’d like

to announce the winner of the previous contest! The prize was my custom-made

Volume Profile and VWAP indicators for the TradingView platform.

Congratulations to the winner—your name is displayed on the screen! For this

week, I’m running another contest. To participate, just leave a comment below

this video on YouTube. I’ll randomly select a winner next week to receive the

same set of custom indicators.

Thank you for watching the

video! I look forward to seeing you next time. Until then—happy trading!