Here are two trades that I took today. Both on the AUD/USD, and both against a strong trend. Still, me and members of my Market Profile Course managed to pull a nice profit from these setups!

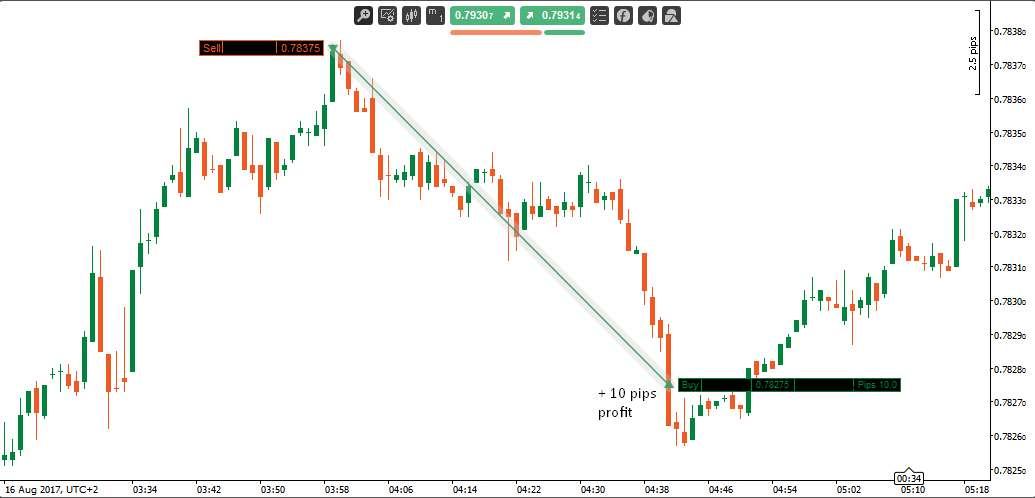

AUD/USD 0.7837 SHORT

This level was hit during the Asian session which I trade using simple limit orders. If I were at the computer, I would discard this level because it was already tested an hour before the actual (2nd) test.

However, I was not at the computer, I was sleeping, and I woke up with a nice +10 pip profit 🙂 That’s what I call a good start to the day!

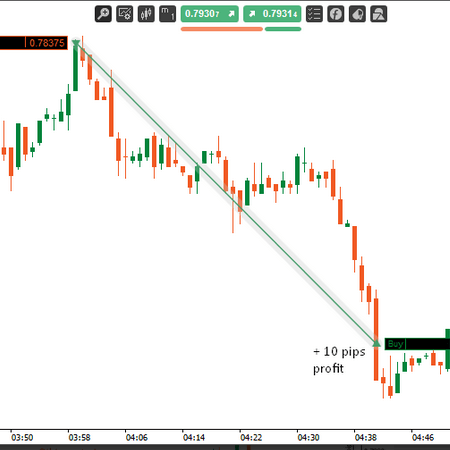

Here is a screenshot from my cTrader platform (1-minute chart):

AUD/USD 0.7888 SHORT

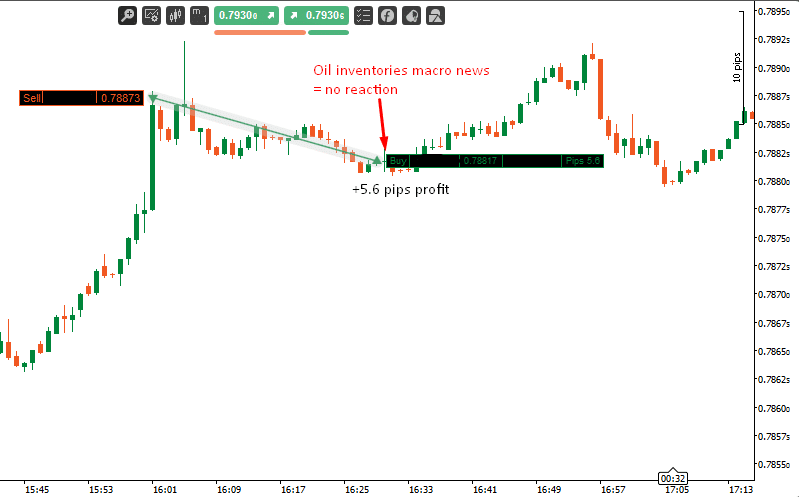

This trade was a bit unique. My Aussie short was around +5.6 pips in profit, but we were approaching Oil Inventories (market ‘Red’ in ForexFactory). Even though this particular news isn’t that significant, I chose the more conservative approach and closed the position before the news release.

Here is the 1-minute chart from my trading platform:

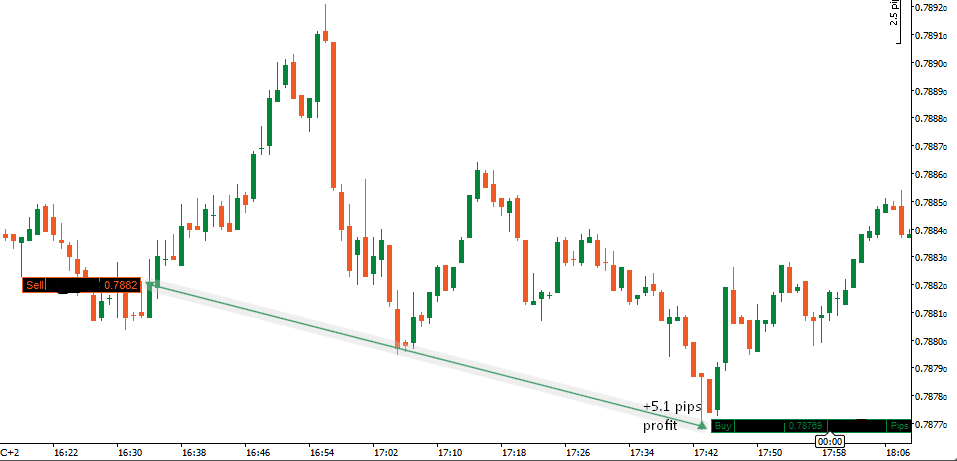

There was no reaction to the news, so I re-entered the trade. I managed to take another +5.1 pips profit, totaling in +10.7 pips profit. Cool!

Here is the 1-minute chart from my trading platform:

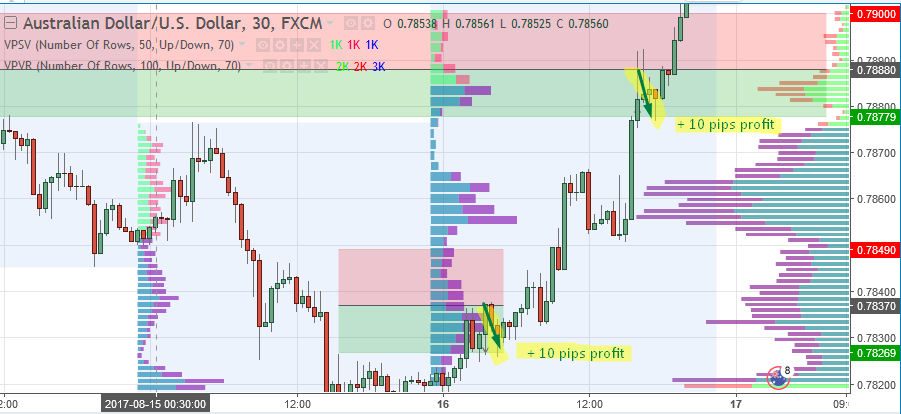

Here is the whole day on a 30-minute chart along with the Market Profile indicator from Trading View (my charting platform):

Trade Summary

Today’s results = +20.7 pips profit

Today was a very good example of why I go only for 10 pip profit targets. The reason is, even if I go against a strong daily trend, levels I trade are usually strong enough to make at least 10 pip counter reaction before the trend resumes. This is, however, a trade-off and at the end of the day comes down to preference.

Happy trading!

-Dale

PS. If you would like to trade with me every day, you are very welcome to join me here: Dale’s Pro Forex Course