Video Transcript:

Hello

everyone, it’s Dale here. Today, I’d like to talk about advanced take-profit

placement. Let’s start with a little quiz to see where you’re at.

Alright,

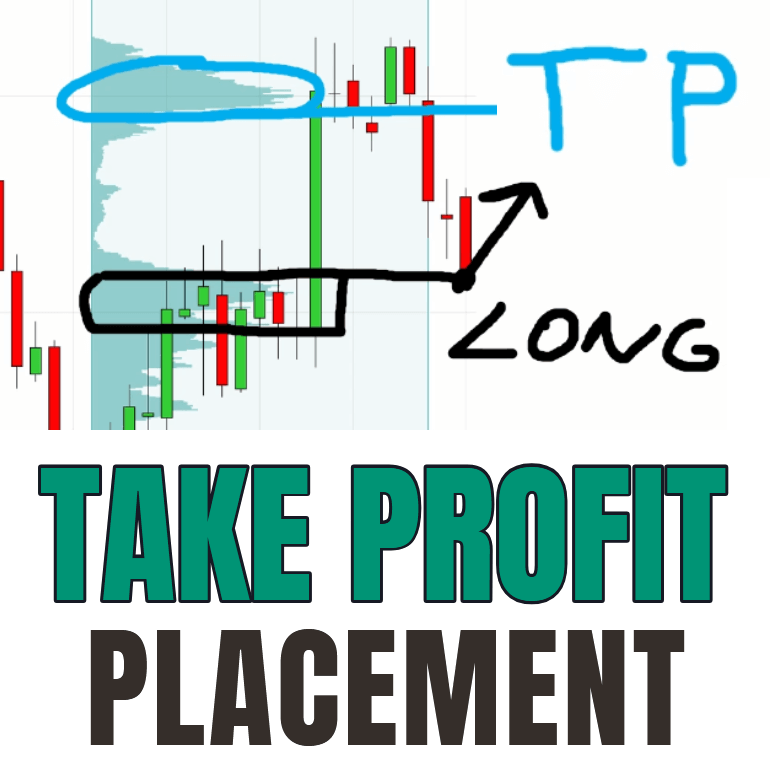

so if you look at this picture here, this is a picture of a swing trade I took

recently, and I have a little question for you. This was the trade entry based

on those heavy volumes here, and this was the long trade entry, right? So I

went long from there. Now, my question is: where should the take-profit for

this trade be?

Look

at the Volume Profile, look at the price action, and tell me what the ideal

take-profit for this trade should be. If you’ve been following me for some

time, then you know that I like to place my take-profit before a strong

barrier. And because I trade with Volume Profile, that strong barrier is, in

most cases, a heavy volume zone. That’s the barrier. In this case, we have a

strong barrier right here—this is a heavy volume zone, and this is the

beginning of that heavy volume zone. So, in this case, the take-profit was

right here.

Let

me show you how the trade played out. See? The price hit that barrier, I was

able to take profit here, and then the price turned and went downwards. The

reason is that the price hit that barrier. Price likes to react to those heavy

volume zones, to those barriers. That’s why you want to exit your trade before

the price actually hits that barrier and potentially reacts to it.

So

this is how I do things, but sometimes it’s a little more complicated, and this

is actually what I want to focus on in this video. Sometimes, a heavy volume

zone like this just isn’t there. Sometimes, it’s very hard to find a place to

take profit. In this case, it was simple—it was easy. The heavy volume zone was

easy to spot. But sometimes, it’s not so easy to spot, and this was exactly the

case in a trade on EUR/USD that I took recently.

In

our live trading room, I was talking about this trade and about how you can

determine where to place take-profit in cases like that. So, let me show you a

snippet from the live trading room and demonstrate how to place the take-profit

in those cases where it is not as clear as in the previous example.

Here

comes the video—I hope you find it useful.

Alright,

so this was a short trade based on this volume cluster and the gap in here.

This was the short, and I just wanted to talk about the take-profit placement

on this one because you guys have been asking me about it, and I think this is

a perfect example of good take-profit placement.

As

you can see, the level worked nicely—nice reaction. But where should the

take-profit be? That’s the question.

It’s

very clearly visible on the one-minute chart here. So, this is the one-minute

chart of EUR/USD. This was the level, and this was the reaction to the level.

Let me draw the profile here. You always want to use the profile to look into

the area where the price was heading toward the level, right? So, you want to

look into this area and search for the first barrier standing in the way. That

should be the take-profit.

If

you look here, this was a significant volume cluster standing in the way. The

price was going downwards, and this was the significant volume cluster blocking

it. There was also a beautiful confluence because if I draw a line here, you

can see that the price reacted here and very sharply in this area. So, it was a

resistance. When the price broke past it, it turned into support.

This

is actually my favorite setup—volume cluster plus resistance turning into

support. My favorite setup tells me that the price should go up from here. Now,

I wasn’t trading this long, but at least I was able to exit the trade here

before the price turned upwards.

So

this was the take-profit because of this barrier—a very strong barrier standing

in the way of that trade.

This

is exactly what you want to do—you want to look for the first barrier. You can

also do this on the one-minute chart if it’s not clear on the 30-minute chart.

Now,

back to the 30-minute chart—it wasn’t as clear, right? These are the two

rejections. That’s the resistance turning into support, and this was the volume

cluster. It is visible, but not as clear as on the one-minute time frame. On

the one-minute chart, you can clearly see the volumes, the rejections, and the

strong level.

I

don’t always use the one-minute chart for this. The risk ratio was positive. My

stop was… let me go back to the 30-minute chart. My stop was around 10 pips. I

had the stop somewhere here. I thought, “Okay, I need to let the trade

breathe a bit,” so I placed a wider stop.

The

take-profit was placed accordingly, so the risk-reward ratio was almost 2:1 for

this trade.

What

I wanted to tell you is that I don’t always switch to the one-minute time frame

when deciding on take-profit. I only do that when I need to find a place to

exit the trade and I’m not completely sure when looking at the 30-minute time

frame. Most of the time—maybe 70% to 80%—you don’t need to switch time frames

to find a good barrier to exit your trade.

In

this case, it wasn’t as easy to find, so that’s why I checked the one-minute

chart. When I saw this setup, I thought, “Okay, this is clear. This is the

volume cluster. This is resistance turning into support. The take-profit needs

to be here.”

You

don’t always need to use a one-minute chart—maybe a five-minute chart will work

too. Let me check.

Yeah,

this is the five-minute chart. You would find it on the five-minute chart as

well. On the five-minute chart, this is the volume cluster. This is where the

resistance was, and this was the take-profit. So, it’s visible on the

five-minute chart as well.

Alright,

so that’s how I determine take-profit. You always want to look for some

barriers, and you always want a risk-reward ratio greater than 1.

Now,

just a quick summary before I wrap up the video:

1. The

first important rule is that you want to trade with at least a risk-reward

ratio of 1. You don’t want to risk more than you can potentially gain on the

trade. So, the risk-reward ratio should always be greater than 1.

2. The

second rule is to exit your trade before a barrier. If you can’t find a barrier

on the original time frame you’re trading on, then you can switch to a lower

time frame.

For

example, in this trade, I was originally trading on the 30-minute time frame,

which is my favorite for intraday trading. But if I can’t find an ideal

take-profit placement, I switch to a five-minute or even a one-minute time

frame to find the perfect exit.

That’s

how I do it. That’s what works best for me.

If

you’d like to join me and trade live with me and other prop firm traders every

day, I recommend visiting my website. This is it—Trader-Dale.com. If you click the

button labeled “FTA”

it will take you to a page where you can watch a video where I explain

everything in more detail.

If

you’re interested, you can book a one-on-one call, and we’ll walk you through

the service so you can decide whether or not it’s right for you.

Alright,

that’s it for today. Thanks for watching, and I’ll see you next time. Until

then, happy trading!