Hello guys,

today’s analysis will be a bit different since I won’t be talking about day trading, but about long-term position trading.

Maybe you remember a video called: How To Use Volume Profile For Long-term Investing. In this video, I showed you how you can analyze long-term trading opportunities on stock indices.

Today, I am going to follow up and comment on another stock index – the German DAX.

DAX – Waiting For A Pullback

DAX is at its absolute highs right now. It has never been so high as it is now. As you probably know I don’t really advise to go Long when the market is at its highs. In fact, I am quite against this. What I prefer is to wait for a pullback and then jump in the Long trade.

The only question is: “pullback to where?“

A rule of thumb is simply to the closest significant volume area.

You can identify such area with my Volume Profile indicator.

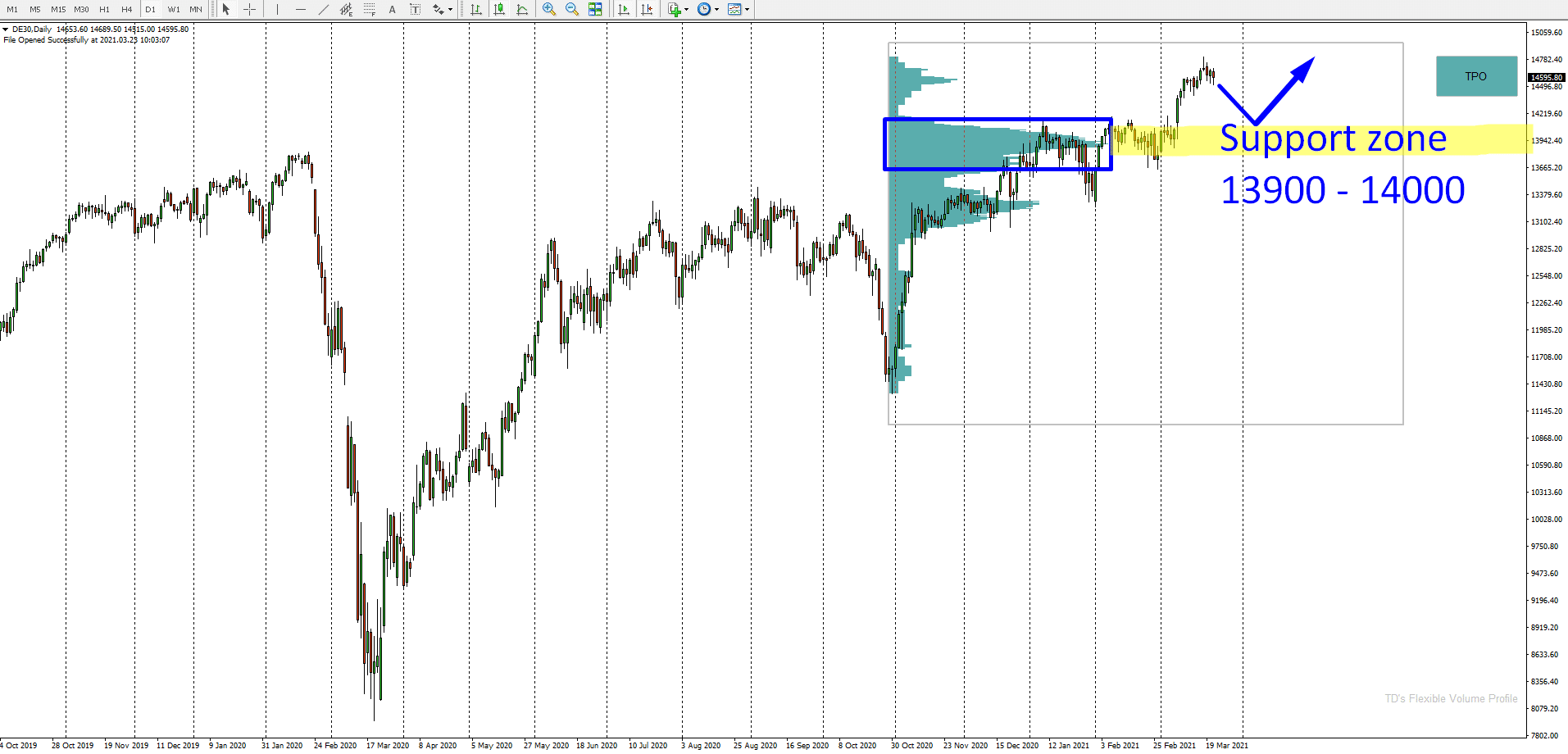

DE30 (DAX CFD), Daily chart:

As you can see, there was a massive volume zone around 14.000. From this zone a strong buying activity started. This indicates that strong Buyers were building up their Long positions there – in that rotation around 14.000. Then they pushed the price aggressively even higher.

When there is a pullback into this zone at some point in the future, then it should work as a Support. Strong Buyers who placed their Longs there should defend this zone. It is important for them.

This is why I think this could be a nice opportunity to jump in a Long (if there is the pullback, of course….). If DAX shoots through the roof without any pullback, then no point in chasing it…

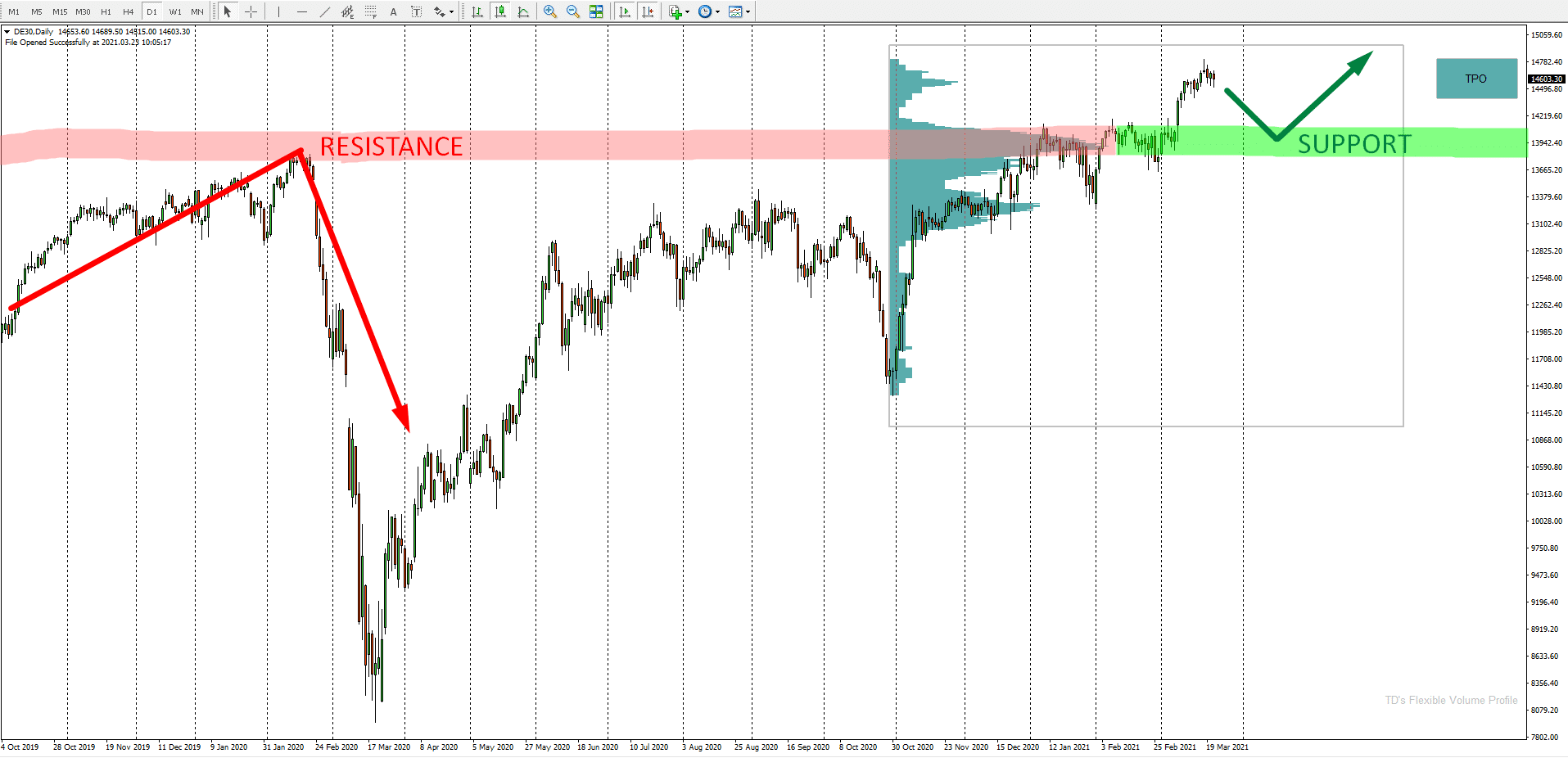

Resistance Became A Support

There is one more thing I like about this Support zone around 13900-14000. It is that this Support was a Resistance in the past.

If you look at the chart below, you can see how strongly the price rejected this 13900-14000 area in the past. This means that it was a strong Resistance.

Now, when the price shot past the Resistance and created a new all-time high, this Resistance became a Support.

This is a simple Price Action setup which I not only use for Day trading or swing trading, but also for long-term position trading.

You can learn more about this setup here:

All Time High – Prediction From November 2020

One more thing I would like to point you to is an article which I wrote a couple of months back – in November 2020.

In this article, I was also talking about DAX and about strength of Buyers vs. Sellers. The main message of the article was that Sellers were very weak on DAX and that I expected this index to shoot upwards and create new absolute highs.

You can check the prediction here:

DAX: New All-time High Coming Soon

I hope you guys liked the analysis. Let me know what you think in the comments below!

Happy trading!

-Dale

I don’t seem to be able to load charts for Indexes (or crypto for that matter) with my free MY FXCM feed – forex is OK though. Any idea why that would be?

Using NT8

Hi Peter, obviously FXCM doesn’t provide datafeed for indices or crypto. It does provide it only for Forex as far as I know. For indices, we use CQG/Continuum futures data.

Ah I’m guessing it’s because the free (demo) feed is limited to FX.

Lol, didn’t see your reply Dale – thanks! Don’t think I’ll be paying for anything like that for a while. Hopefully if/when I get proficient using your methods I’ll invest further into other useful resources like that.

Sure, no need to rush!

Buongiorno, sapete se esiste la versione in italiano del libro Volume Profile? Grazie

Ciao, non ho la versione italiana del mio libro, scusa! Se desideri comunque provare a utilizzarlo con l’aiuto di Google Traduttore, contattami al mio indirizzo email: contact@trader-dale.com così posso inviarti il libro in PDF (non è necessario pagare nulla)