There has been a pretty significant sell-off on Gold since April 2018. The sellers are clearly strong and they are pushing the price lower and lower. In such cases, I look for significant volume areas to enter my trade. I enter it in the direction of the trend.

ENTRY POINT

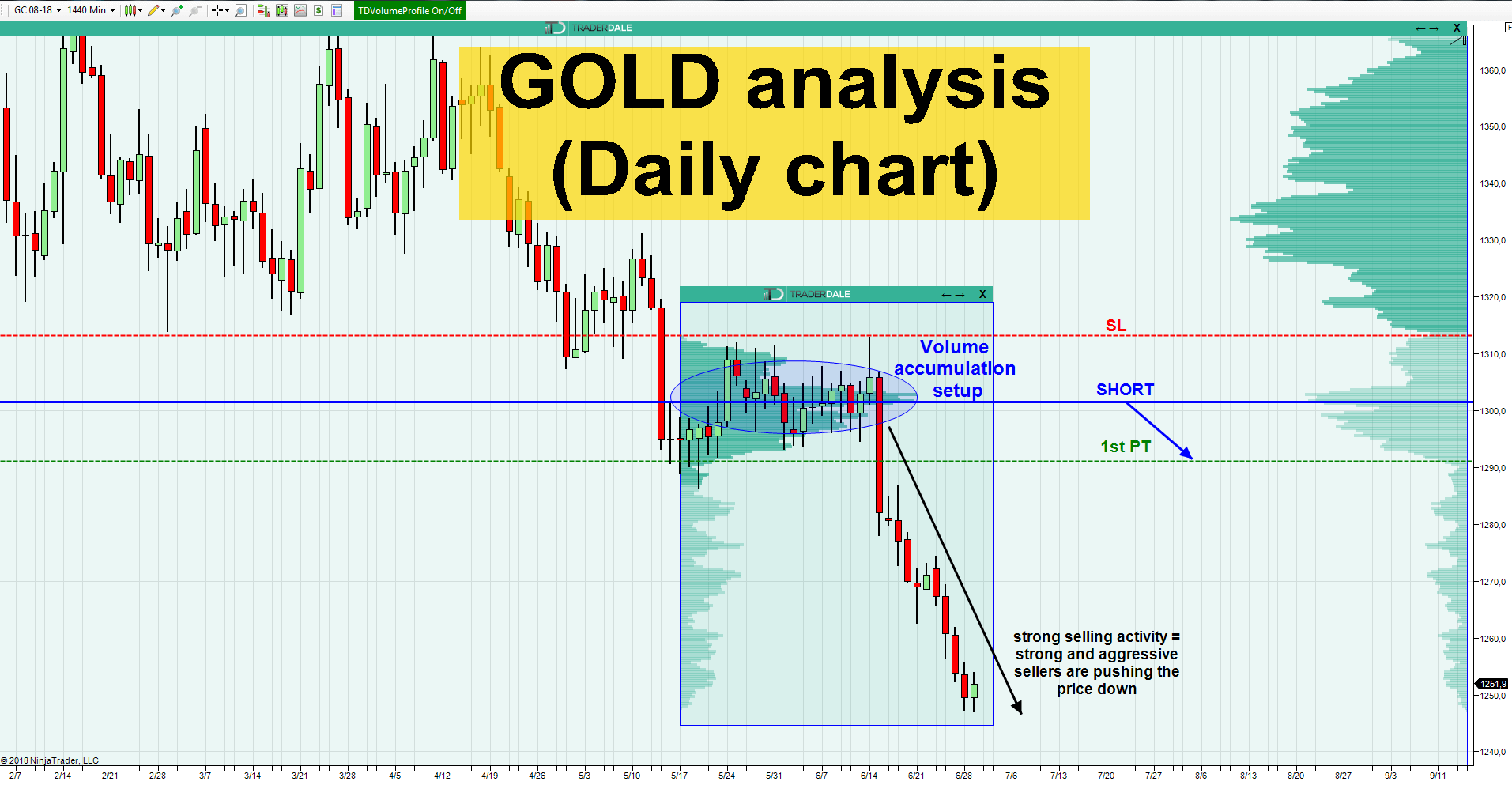

Below, is a Daily chart of Gold (futures). There is a sideways rotation (blue circle) from which renewed selling activity started. In a situation like this, I use my Flexible Volume Profile to see where the volumes were the heaviest. In this case, it is around 1301.5. Because there was a strong selling activity after the rotation, I presume that the heavy volumes accumulated before the renewed selloff were volumes of strong sellers. Those sellers were accumulating their selling positions there and afterward started aggressive selling initiation activity to push the price lower. As you can see from the Volume Profile – the heaviest volumes were around 1301.5 which means that most of the selling positions were placed there.

When the price comes back to this heavy volume area then I think that the strong sellers who were accumulating their positions around 1301.5 will start to defend their positions and they will start an aggressive selling activity to push the price lower again. For this reason, I will enter my short trade there.

STOP-LOSS

My Stop-loss will be at 1313. The reason for that is that 1313 is a place where the volume-based resistance zone ends. If you look at the Volume Profile you will see that there were basically no volumes there. Places like these are generally good places for a SL.

I won’t be quitting my trade if the price hits the SL level though. I will use the Alternative SL method and I will close the trade only if a Daily candle CLOSES past the 1313 SL level. This way I can avoid short squeeze moves, SL hunting, and false breakouts.

PROFIT TARGET

I like to trade with Risk Reward Ratio close to 1:1 so my first Profit Target will be somewhere around the 1290 area. This could vary a bit since now I don’t know yet how exactly the price will move when it is making a pullback to my level. Ideally, my PT should be above some heavy volume area (which would work as a support – therefore it would be risky to try and hold my trade past it).

If you like to trade with a positive RRR then you can also use a second Profit Target, which could be for example in 1278 area. this would be RRR 1:2. Right now it is impossible to tell how the price will develop from now on and how exactly it will reach the short level. Only when it does reach it we will be able to tell the best places for both Profit Targets.

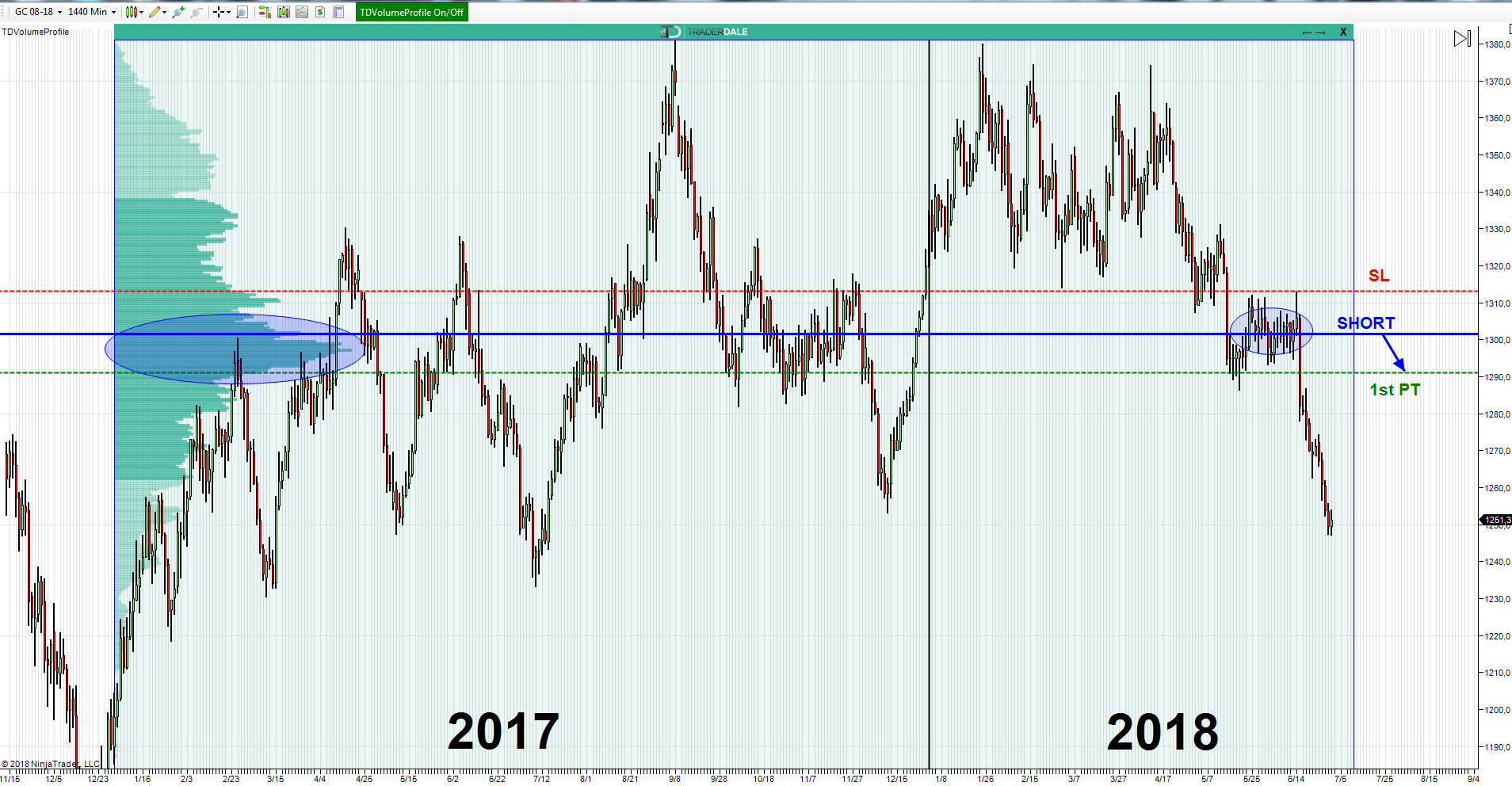

There is also another nice confirmation of the 1301.5 short level. In the picture below there is a Daily chart of Gold futures starting from 2017. What I really like is that the Point Of Control (POC*) is almost exactly at our level. This is pretty solid confirmation of the level because it indicates that it is very significant for the institutions even from the very long-term point of view.

*POC is a place where the heaviest volumes got accumulated.

I usually look for such confluences in my trading. Not only with swing trades but also with my intraday trades or when I plan my long-term investments.

I hope you found this analysis helpful. If you have any questions or comments please feel free to ask.

Happy trading,

-Dale

P.S – If you would like my Daily and Swing Levels so that you can start ‘Earning While You Learn,’ then check out our Advanced Volume Profile Training Course and Members Forum for more information – Click Here to Start Learning Now