Hello guys!

June – the second month of my Pro Forex Trading Course has just ended and I would like to tell you how my trading went.

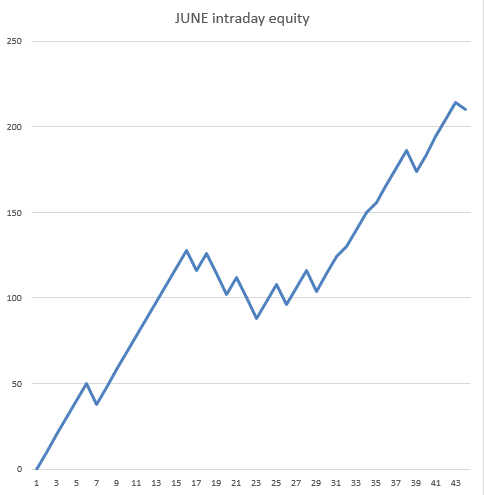

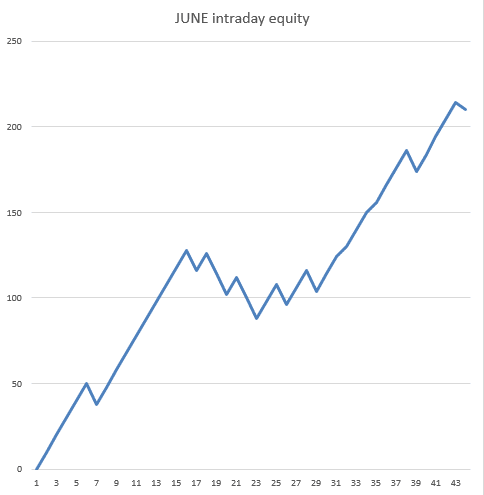

INTRADAY TRADES

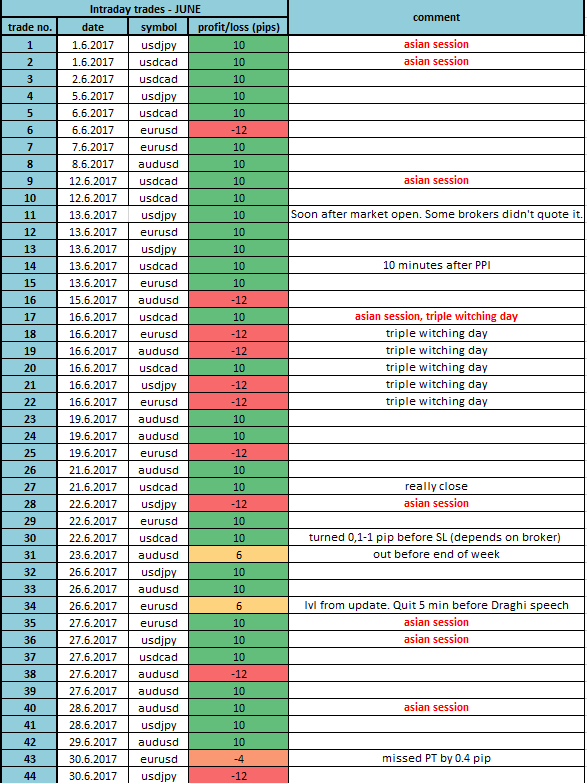

Using my standard 10/12 method (with Neutral SL management approach) there were 44 intraday trades. 33 of those were winners and 11 were losers. If you calculate this for RRR = 1, this makes 72,2 % winning ratio!

All in all this makes + 198 pips profit just with intraday trades! This is almost $2000 with 1 lot trades.

There are two things I would like to point out:

- Triple witching day – this day occurs 4 times a year. Lot of different Options expire this day and for this reason there is usually a lot of market manipulation all across the markets. If you are a daytrader it is usually best to take a day off because trading in such an environment could be quite dangerous. I didn’t take a day off and I took a proper beating. This was one of the worst days I had recently. I had 4 losers and 2 winners (one winner was during asian session and second one was a really close one). I won’t be trading the next Triple witching day – that’s for sure. One thing I would like to point out there – some of members of my course also took a beating there – some probably worse beating than me and were considering making some changes in their trading strategy. I gave them this advice: “Don’t change your strategy just because of a losing series. Also – don’t lower your trading volumes now.” Few days after there was a winning series of 9 consecutive trades 🙂 Those who didn’t change their approach and didn’t lower their volumes had their money back really soon and on top of that some very nice profits!

- Asian sessions – these continue to be really easily tradable and highly profitable trading sessions. I personally trade asian session with simple limit orders with 10 pip PT and 12 pip SL. That’s it. No position management at all. Just set-and-forget limit orders. With this simple approach I had 7 winners and just 1 losing trade in June’s asian sessions. This is over 85 % winning ratio (calculated to RRR=1)! How cool is that!

To wrap the intraday trades up – June was a really good and highly profitable month with nice and long winning streaks. There were only few tough days around the Triple witching day and as you see on the equity, those got covered pretty quickly.

Here are all the intraday trades:

You can see some of the trades with a brief commentary here: RECENT TRADES

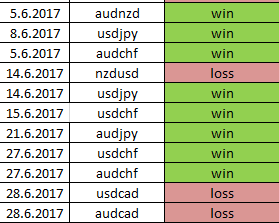

SWING TRADES

There were 11 swing trades in June: 8 winners and 3 losers.

You can see all the trades here:

There were two cases that were quite important to have like me to have such results:

- There was unexpected but extremely significant news concerning Canadian rate policy on 12th of June. I warned about this on my forum so those who read it and cancelled their CAD trades avoided 2 swing trade losses and 1 win.

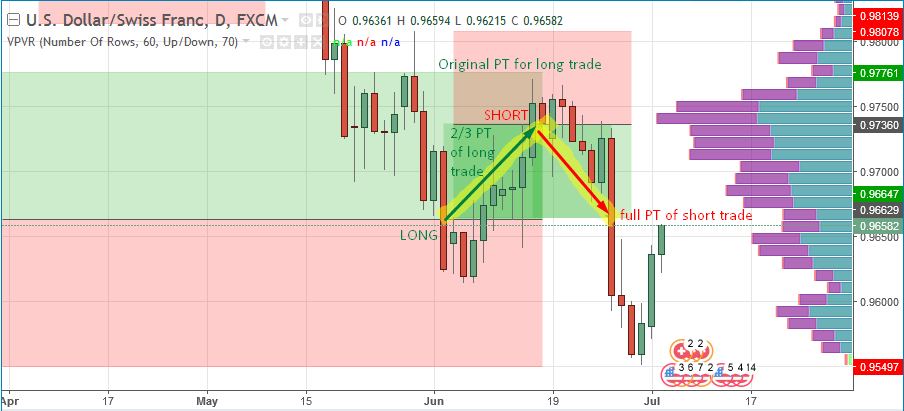

- There were two USD/CHF swing trades that were in a small part in a contradiction. There was a long trade running and before reaching it’s PT (in about 2/3 of it’s PT) there was a signal for a short trade. It was crucial to exit the long trade a bit sooner – at the place with a contradictory short level and go immediately short. I mentioned this in my swing trade video in advance. Here is a screenshot of this situation:

Summary

June was really successful and profitable month for me and also for members of my course. There were quite a lot trading opportunities both on intraday and swing trades. The winning ratio was pretty high. Lets see if we can keep that up in the next Summer months!

Happy trading

-Dale

PS. If you would like to become a member of my Pro Forex Course and trade with us every day, you are very welcome to join us HERE