I had two trades today. It is a shame because I almost had four. All of them would be winners. Yes – would be if the price didn’t turn just the tiniest bit before reaching the levels. Those types of reactions that come a bit before the level is reached are typical for summer months when the volatility is lower. They also occur sometimes during the year. This time it is November. I don’t think there is any logical explanation and I don’t really think you can foresee that this will start to happen (except for summer, of course). My approach towards this is to trade as usual and wait until this period ends. It usually isn’t too long.

Let’s have a look at the trades I took and the reasoning behind them:

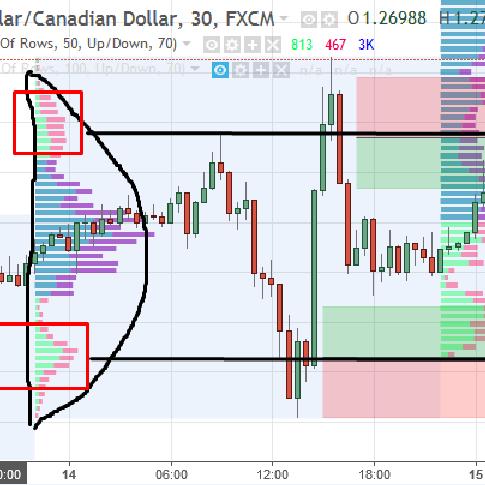

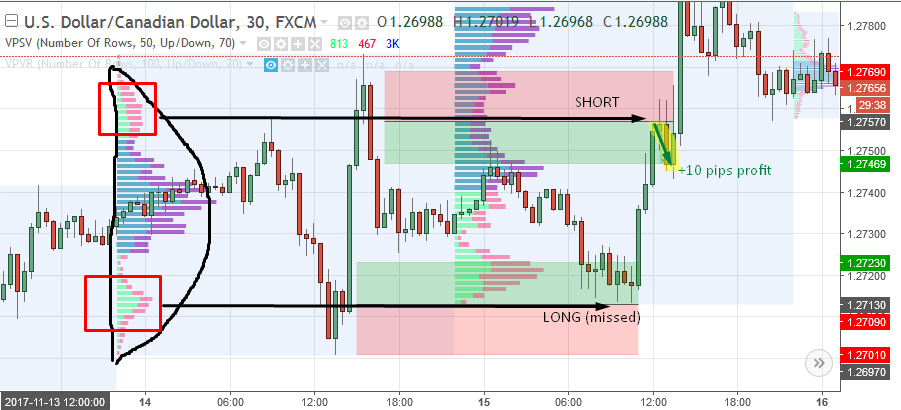

USD/CAD

There was a D-shaped profile which indicates a temporary balance between buyers and sellers. In a case like this, I am looking for short trades at the higher extreme of the profile and long trades at the lower extreme of the profile. Best places for trades like this are small volume clusters at the extremes. I market these in red rectangles. The first trade I wanted to take was a long from 1.2713. Unfortunately, it got missed and the market turned just a tiny bit before reaching the level. The second level was a short from 1.2757. There was a small 7 pip reaction a bit before the level at first but because USD/CAD is more volatile and I don’t really consider such small reaction a valid one, I entered the trade at the proper “touch” of the level. It proved a good decision and I was able to take a full profit few minutes before macro news. This was pretty fortunate because if my position wouldn’t hit profit target before the macro event, I would have to quit it before the release with only partial profit.

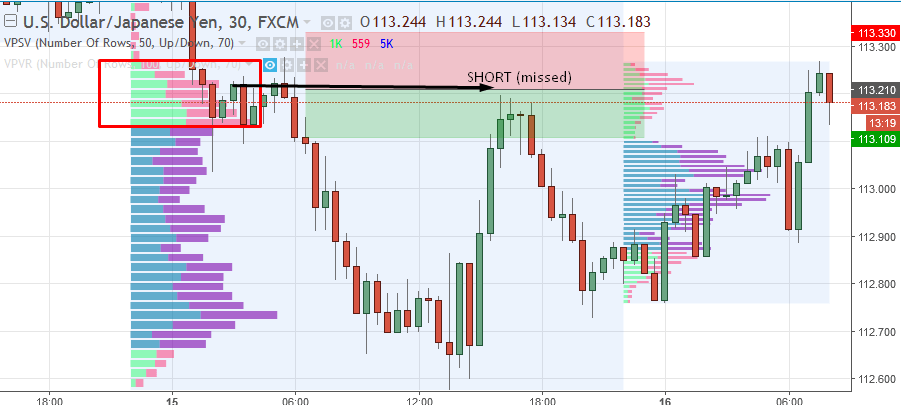

USD/JPY

My short trade from 113.21 was based on volume accumulation setup. I think it was a really nice place for a short trade but unfortunately, the price turned before the level was reached. It was a shame because the reaction was pretty strong.

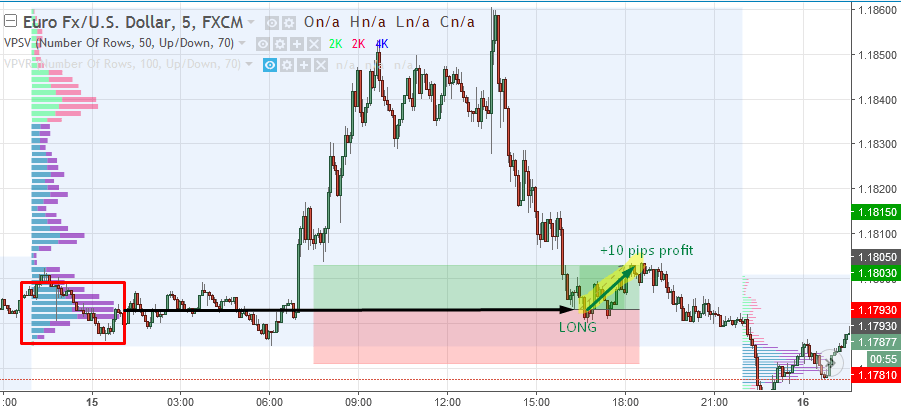

EUR/USD

A long from 1.1793 was also based on the volume accumulation setup. There was pretty strong accumulation during the asian and european session. From this area, there was strong and aggressive buying activity indicating that these volumes were volumes of strong buyers. I was waiting for a pullback to this area and went long from there later in the US session. The reaction wasn’t as strong as I expected but it was still enough for me to bank a +10 pip profit.

All in all, I ended up with +20 pips profit. It could have been +40 if the usd/jpy and the first usd/cad didn’t turn just a tiny bit before the actual level.

BONUS

Here is a Daily levels commentary video that I shot yesterday for members of my Pro Forex Course. In this video, I show you previous trades I took and detailed reasoning behind the new levels I was going to trade. There is also the USD/CAD level traded live.

So that’s it guys! I hope you found this trade recap and the video useful. If you would like to trade with me every day, you are very welcome to join me here: Dale’s Market Profile Course.

Happy trading

-Dale