Hello my friends!

Hopefully you read my previous article Price Action – aggression and you can now identify aggresive trading activity just by watching plain charts. In this article I would like to tell you how to identify big players (big financial institutions, banks, funds,…) who do such aggresive activity to move the markets.

Both you and I are just small fish in the ocean. The only thing that could make us profitable is try to think like the big players, predict what their intention is and trade with them. Fortunatelly for us there is a way to identify what these big guys are doing. You can guess what it is. Little hint: it isn’t any indicator like SMA, EMA, RSI, Bollinger Bands, MACD, CCI etc.

The one thing that is specific for them is that they need to allocate huge amounts of volumes. If you or me want to enter a position, we easily buy or sell for example 1 or 10 lots. They need to allocate much more and when they do they become visible! We are able to see those volumes they are allocating by using Market Profile (more on that later) or simple price action.

Here is how to identify big institutions using price action:

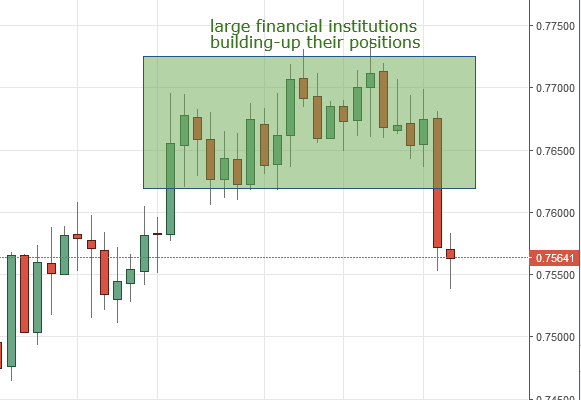

Big players need time to discreetly enter their positions. They may be entering their position for example for a week because the volume of this position is just too big and they want to be discreet and not to alarm anybody. There is a very nice example of big institutions building up their positions on AUD/USD. This time it took a whole month for them to enter their positions! Here is a daily chart of it:

If there is a long time rotation like this, you can be almost sure that big institutions are building up their positions.

What do they do after build their positions? You can see it in the picture – they become very aggressive and they move the price. They are making money now!

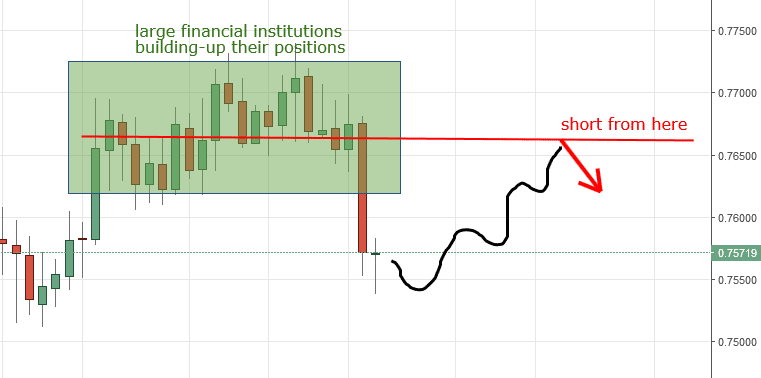

And what about us? We also want some piece of the cheese, right? We have now identified 1. place where the big players entered their positions, 2. place where the strong aggressive activity begun. The best place for us to enter a trade would be the place where the big guys became aggressive. The place where they will defend their accumulated positions. It could take some time before the price reaches this area again but when it does the big guys will be there defending their positions.

Here is the place for us to enter a short trade:

If you follow this simple idea you should be able to identify activity of big players/institutions yourselves just by using simple price action!

Apart from price action you can also identify big institutions with a very clever tool called Market Profile. I personally use combination of both. I will tell you more about Market Profile in my next article!

Dale