Have you ever heard the term “Black Swan” phenomenon?

In short, it is when something which NOBODY expected happens.

In my 12+ years trading career, I have witnessed just two such situations.

The first was the crazy jump in the value of the Swiss Franc in 2015. This was seconds after the Swiss central bank announced they are abandoning the cap of CHF against EUR. This was one of the craziest days in my trading career.

The second Black Swan nobody expected is happening RIGHT NOW! Here is what is going on:

How it started

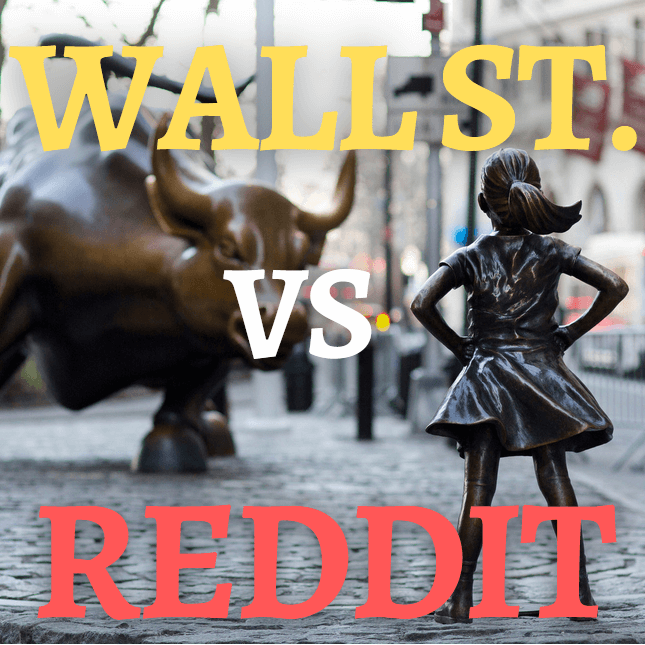

Huge hedge funds started to Short stocks of a company called “GameStop” driving the price downwards.

GameStop is a US company with headquarters in Texas. They sell computer and console games, electronics,…

They haven’t been doing too good because the COVID-19 situation. People simply don’t go out to buy games anymore. They do it online now…

Now, a thing NOBODY expected happened!

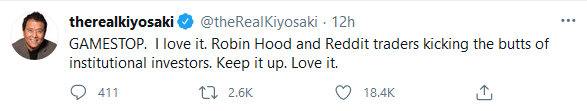

Regular guys from Reddit forum (discussion group called “wallstreetbets“) started to post about buying the stock and kicking the ass of the hedge funds who were shorting it!

The thing is, that this group has millions of members! Posts about buying GameStop became viral and the forum went crazy with it!

Those guys who never traded nor invested in their lives actually started to buy the GameStop stock and they managed to move the price upwards!

Additionally, the Stop Loss orders of people who were short GameStop got triggered and the price soared upwards again (the reason is that when you close your Short you need to enter Market Long order).

Then it grew BIG!

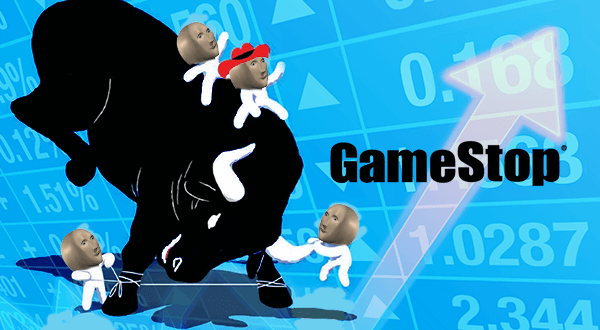

After this, more and more people from this and other forums started to join the party and the whole thing went out of control!

The price shot upwards from $5 to $400!!!

Keep in mind that this was just regular guys from forum who did this:

A very similar scenario also started to occur with some other stocks (AMC, Bed Bath & Beyond,…).

Now comes the best part!

Hedge Funds Bankrupt

Hedge funds who were shorting those stocks started to report enormous losses! They even started to bankrupt!

Never in my life I saw anything like this! Hedge funds getting their assess kicked by regular guys who never invested before!

Hedge Funds Strike Back!

Now the sad part.

Hedge fund managers started a massive lobby and they are doing everything they can to stop this!

Now, some of the platforms people used to trade those stocks implemented restrictions. They restricted trading GameStop stocks!

Do you guys see how crazy this is?

Here are the biggest names that restricted trading the stock: Robinhood, Interactive Brokers, Charles Schwab and TD Ameritrade.

What was the official statement they gave on this?

Try not to laugh, okay? Here we go:

“We need to protect inexperienced traders from big potential losses”.

What I have to say to this is: If they want to protect them, then they should lower the leverage they offer. Not cut them out from trading!

Restrictions & Lawsuits

Actually, there are already lawsuits being filled against those restrictions, as they are clearly against the law. The reason is that restricting people from trading GameStop is MARKET MANIPULATION! THAT IS ILLEGAL!

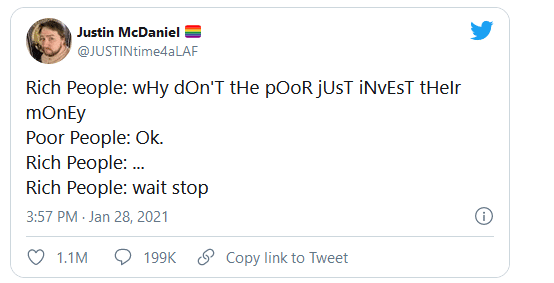

Those of you who follow me know that markets are manipulated every day. Big institutions like the Hedge funds manipulate them. Everybody knows, but it is not as plainly visible as when people on Reddit forum are chatting about it.

Tables Turned

Now, just once the tables turned and the market got manipulated by regular guys instead of the institutions. And what happens? Hedge fund managers start to kick around, cry and do whatever their power allows them to prevent this.

I say let them burn.

If you and me don’t control your risk in trading and get burned, then we take our losses. That’s it – we accept that we have made a mistake and we move on.

Why should a hedge fund be treated differently? If they short GameStop, AMC, or other stocks big time and they lose, so what? They were stupid to get such exposure.

Let them carry the consequences of their actions – like we do.

Forums Closed

Another interesting thing is that some of the forums are being closed! Official statements go like this: “discussion thread closed because continuing to allow hateful and discriminatory content”.

What a bull***t!

This is clearly big guys pulling the strings, doing what they can to control the damage.

I am absolutely amazed by what is going on and I really wonder what is coming next!

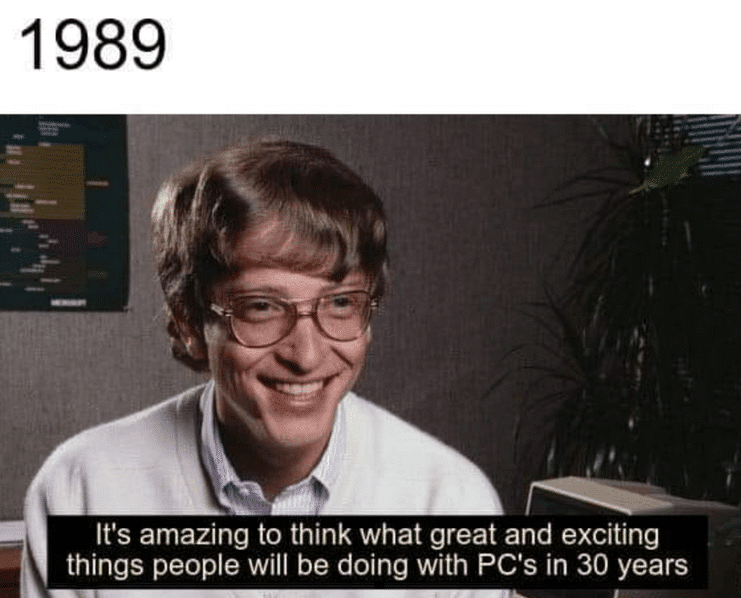

Here’s The Fun

And since this show is all about the internet community, here are the funny posts the forums are now full of:

This article was written for you to see how crazy things can go. I am in no way telling you to join the riots :).

It should also be an eye-opener for those who still think that markets aren’t manipulated.

This also nicely shows how all the standard trading indicators are useless. Do you think those guys from Reddit who drive the price upwards are interested in EMA, Bollinger Bands, RSI, MACD,…?

Hell no! They have no clue what they are doing! They are just manipulating the price and that’s it!

You may ask – well what about Volume Profile, isn’t it the same?

No it isn’t, because Volume Profile shows real trades of real people. That’s a crucial difference.

So in the end, let me say this – don’t join the riots, this is not trading and those guys from Reddit can fall as easily as they rose.

They don’t control their risk, they just go blindly in, shooting memes and comments to encourage themselves.

The way to go is to manage risk and to have a good strategy with a solid edge – like for example Volume Profile strategies.

Let me know what you think about this show!

I am really interested what you guys think about this! Are you joining the riots? Did you notice this crazy situation? What is your opinion? Let me know in the comments below!

I wonder how this is going to end and also what will happen after the weekend!

Happy trading

-Dale

Do you want ME to help YOU with your trading?

Join one of my Volume Profile Educational courses and get my private trading levels, 15 hours of video content, my custom made Volume Profile indicators, and more!

Click Here

100% agree with Dale’s point of view

Wow! Very educative and comic. Maybe we are starting to see a market power shift back to the people – more like real democratic trading starting to take shape. Thanks to the internet. But like you rightly said, it’s a black swan. Not the norm. But the question is, are we going to be seeing this kind black swan more often? Or not? My take is that it won’t be the norm. For one reason: the 80/20 golden principle – 80% of output will be controlled by 20% input. Meaning, there will always be the big guys even if it’s no longer the Hedge Funds (e.g about 20% of the Reddit users own about 80% of the Gamestop stock bought by Reddit users). Anyways, it’s fun seeing the big guys getting some beating in the ass. Thanks again for the great article!

Hi Tim, I don’t think we will see more of this. If something, then I would say there will be less. I think when this passes over everybody will be more careful so it does not happen again. Maybe there will be some new regulations/limitations for us retail traders (to protect us :))))

Wow, Awesome great write up, love the cartoon captions etc LOL. I’ve following this online and on Bloomberg.

Great show to watch 🙂

Somewhere between The Boston Tea Party and ‘The Wave’ phenonema at sports arenas. God Bless.

What an article Dale,

I’m sitting right here laughing my ass out! You know why ? I think it fair enough for Wall Street to bleed ? even if for a week. the name of the game is called had( enough)

This guys been manipulating the market from time immemorial and it ok for ordinary people to bear the brunt week in week out. This shows the kind of society we live in today.

Yea exactly. I also can’t help but watch and laugh 🙂 Those hedge fund guys deserve it so much 🙂

Howzit Dale,

this is a very cool explanation, but please explain to your friends and followers …… do not get sell the stock ,,, if you want to go short——— buy puts, so you either make money, if it goes down or you lose what you put in…….

Thats Really Important …..

Cause if they sell they could lose their pants ,,,,if the stock rocketed………it’s done it already and might do it again,,,,and sorry don’t have the magic ball, depends on the people…..

Yea, my message is more – watch, learn, laugh if you want but don’t go into this at all. This is not really trading. I personally don’t have an idea how this will end.

Trader Dale……it is back to basic….volume and price

Yea, if anything can give us any clue here then it is Volume & Price. But there are too many other factors – most of all the regulation. And there is no way to predict what will happen there.

Dale great explanation 🙂 thanks,

maybe you could also tell all your members, followers and friends not to try and short these stocks, because if you cannot cover you will lose everything and more !!!! So best they just do buys it is safer 🙂

Have a nice weekend

cheers Billy

Well, in this place I think buying is as risky as selling. This is just a too crazy an environment to trade in.

As of Friday, hedge funds shorting GME were losing a total of 19B altogether. I don’t this will make a dent in Wallstreet. But the Robinhood millenneals who purchased GME using credit cards and college loan will bleed when the stock price returns to its fair value of around $13.

Well, the truth is the hedge funds are not the biggest beasts out there (capital wise, not risk vise :).

I wonder how these guys will continue fighting. The fact is, in a couple of months/ years I don’t think these stocks can remain where they are now. They are absolutely out of value.

On the other hand, there are also so many other companies out of value, and they still remain there 🙂

I will never enter my trade in such a volatile market. As for the brokers, I hope that the law will be applied towards their restrictions of traders activities. And for sure, this is not a good PR for atracting new clients.

GREAT STUFF! Thanks for pointing out the illegal nature of brokerages shutting down trading of select stocks in preferential treatment of the Wall Street Dons. Very well put!

I’ve seen the documentary on Netflix about Gamestop. What shocks me is the role of Citadel and Robinhood in this tragic comedy, I can’t understand how there were no legal consequences. The CEO from Citadel saying to the judge “we haven’t called Robinhood”, and some weeks after they got caught lying. I remember also TD Ameritrade and the other big brokers restricting trading on GME. It’s just criminal.