Hello dear traders,

as you all know, my trading education is mostly based on the Volume Profile. It is a tool that shows us where the biggest volumes in the market got traded. In other words, it shows us at which prices most of the trading orders entered the market.

The BIG volumes we are looking for aren’t made by traders like us, often called the ”retail traders”. Those volumes are made by big financial institutions.

Our retail traders’ job is tracking the institutional volumes. That’s the best we can do and that’s our EDGE!

Since I already showed you how to track them (for example in my book, which you can download here for free), let’s explain it all from the fundamental point of view for a better overall understanding.

In this article, I will talk about what exactly financial institutions are and what their role in the market movement is.

Do you want ME to help YOU with your trading?

The Background

Roles of financial institutions

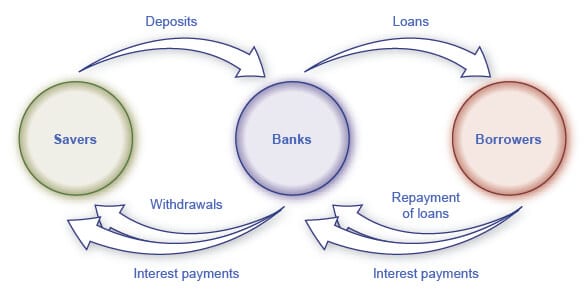

Financial institutions are mainly used to move the capital from people who are rather interested in savings than investing to those willing to invest in new businesses, but aren’t able to fund those projects by themselves.

People who are not willing to take risks on their own, who have no entrepreneurial spirit and have no ideas nor capacity to start their own business, are rather investing money in the banks and are satisfied with an interest they will get from the banks. On the other hand, people with business ideas, innovative spirit, and will to take greater risk, are taking money from the banks to finance their business projects.

Entrepreneurs are paying interest on the borrowed money to the banks. They are only able to get those loans because of the “Savers” who save their money to the bank.

Without capital allocation the financial institutions provide,the economy wouldn’t work at its full potential. The economic growth would just be too slow.

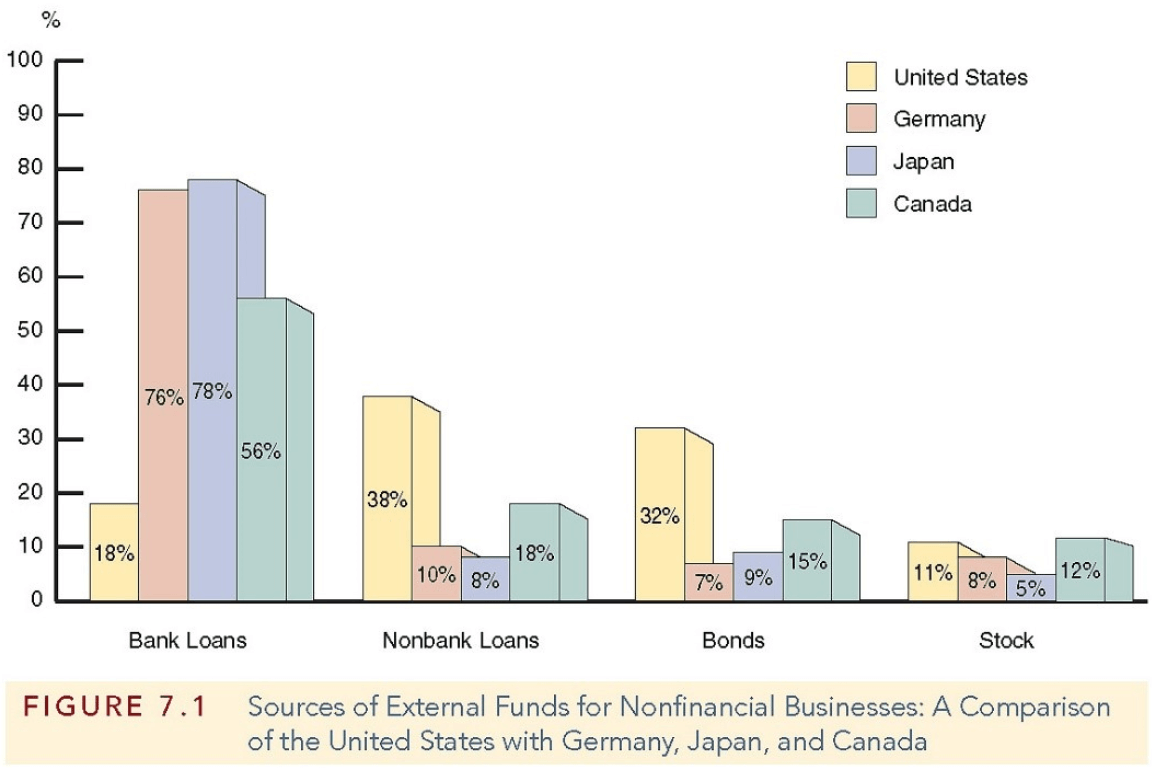

In the picture above, you can see what financial instruments each country uses to finance their businesses in the United States, Germany, Japan, and Canada.

Except for the US, most of the financing is coming through bank loans. While in the US it is coming from non-bank loans or through bonds.

Types of financial institutions

There are 9 major types of financial institutions. They provide different types of services like mortgages, investments, insurance, …

- Central Banks

- Retail and Commercial Banks

- Internet Banks

- Credit Unions

- Savings and Loan Associations

- Investment Banks and Companies

- Brokerage Firms

- Insurance Companies

- Mortgage Companies

Financial Institutions on the Stock Market

A lot of big businesses go public on the stock market. A stock is a small fraction, a percentage of a business. Their prices are determined on the stock market.

Let’s say you own a big business and are running low on funds. By going public on the stock market you make it available for investors or financial institutions to buy a part of your company (stock). This way you gain capital for your business. That is the main reason why companies go public on the stock market.

The price of the stock (or any trading instrument) on the market depends on the law of supply and demand and on aggressivity of the big players who are able to move the price.

If the big guys start to buy aggressively (with Market orders) then it moves the price upwards.

Examples

Simplified example: A pension fund wants to buy 1.000 stocks of APPL. The current price is 115,75 (USD). Sellers are willing to sell only 400 contracts for this price. But there are more sellers willing to sell for a higher price 115.76. If the buyer is aggressive and uses a Market order to buy 1.000 contracts, then he first buys 400 contracts for 115,75 and then AUTOMATICALLY 600 contracts for 115,76.

This is how the price is driven upwards.

Institutions, due to their high capital power are able to influence the market – to manipulate the price movements. They are able to buy a high number of stocks (or any other trading instrument) which increases the demand, or sell a high number of stocks which increases the supply.

For instance, a bank decides to invest in Tesla stock. They buy a large amount aggressively which influences its price and makes it go up. Everyone at the stock market is able to see that Tesla stocks are being bought heavily and that the prices are skyrocketing.

When this bank sees that the current prices were driven too high, they can decide to sell to get their profits (if speculation like this is their strategy – which it does not need to be btw…).

Big trading institutions are able to influence the market so much that they are able to create trends. This is only possible because they have capital to create a strong buying or selling pressure.

Financial Institutions on the Forex Market

Forex Market is a market where people buy or sell currencies. Thanks to the internet, buyers & sellers are able to buy and sell currencies at any time. This market is available to everyone, the biggest players again, are the banks. They trade a high percentage of currencies on the market every day.

Commercial financial institutions

Trade on Forex for their own profits and for profits of their clients.

Thanks to their high capital power, they are able to buy or sell enough volume of a currency to make a change in its price.

Central banks

Their main goals are most often:

1. Maintain the currency stability (strength) of their own currency.

2. Minimize the volatility of the economic cycles. This means helping economy when it is doing bad (recession) and slowing it down when it is expanding too rapidly.

3. Maintain their inflation goals. They for example intervene to get the inflation to +3%. BTW. The inflation stability is the main goal of the Bank of England. That’s why this currency always react so much to macro news about inflation in UK.

How those banks intervene to reach their goals? The usual tool for that is the interest rate (a percentage rate for which they lend money to corporate banks)

That way, Central banks are making some currencies more or less attractive to investors. This makes the central banks really powerful players who can start or change trends in the market.

No wonder that the strongest macro news is when a central bank releases an interest rate related statement.

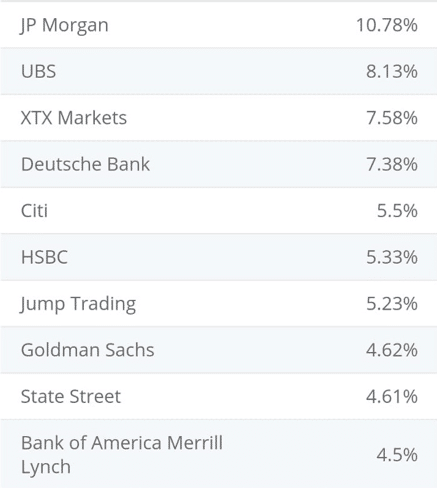

This table shows the market share of trading institutions based on how much volume they trade on average each day.

The most important thing to notice is that these 10 financial institutions make 63% of the total volumes traded!

When 10 institutions make 63% of the whole market share, then it is very important to follow their footsteps in our trading! It is essential to know what these big guys are up to.

Getting our ˝bread crumbs˝ left behind them

In order to get these ˝bread crumbs˝ left behind them, we have to track their trading activity. That’s why I favor volume-based trading over any other strategy. It’s because of the fact that if we know how to read the volume properly, we can predict what is going to happen next – what the big guys will do next.

To read volume and to predict actions of the big guys I developed my own Volume Profile indicator. That indicator is something I’m considering necessary for successful prediction of market moves.

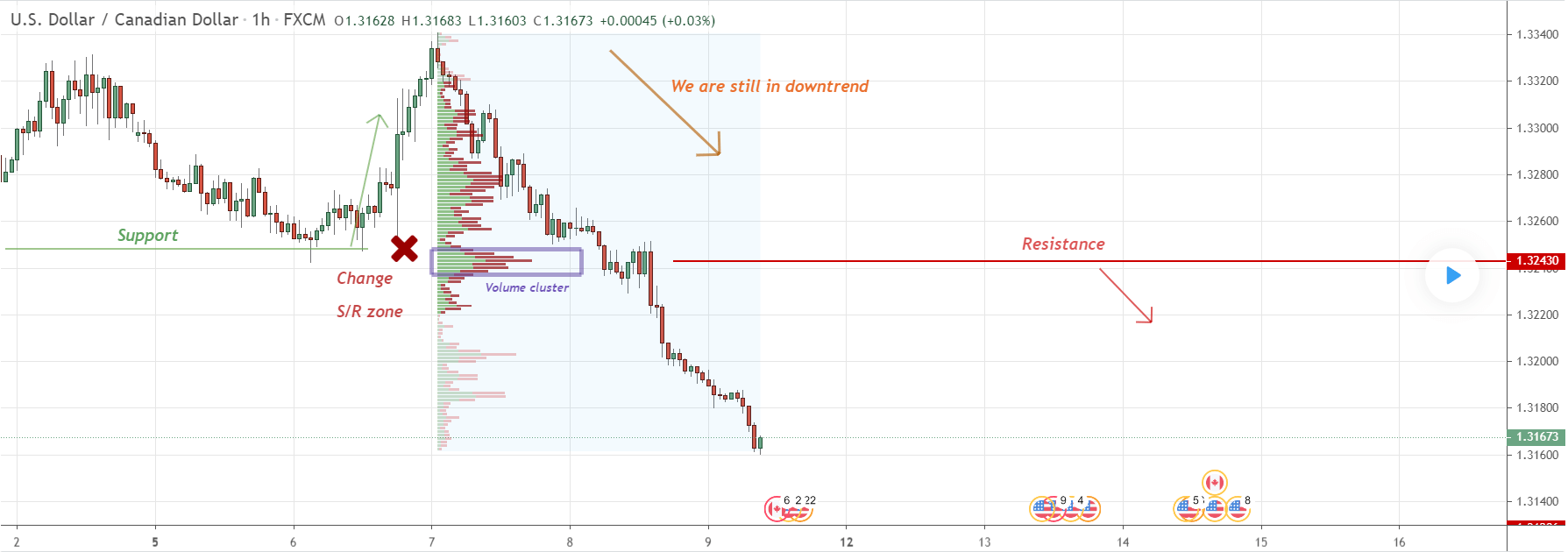

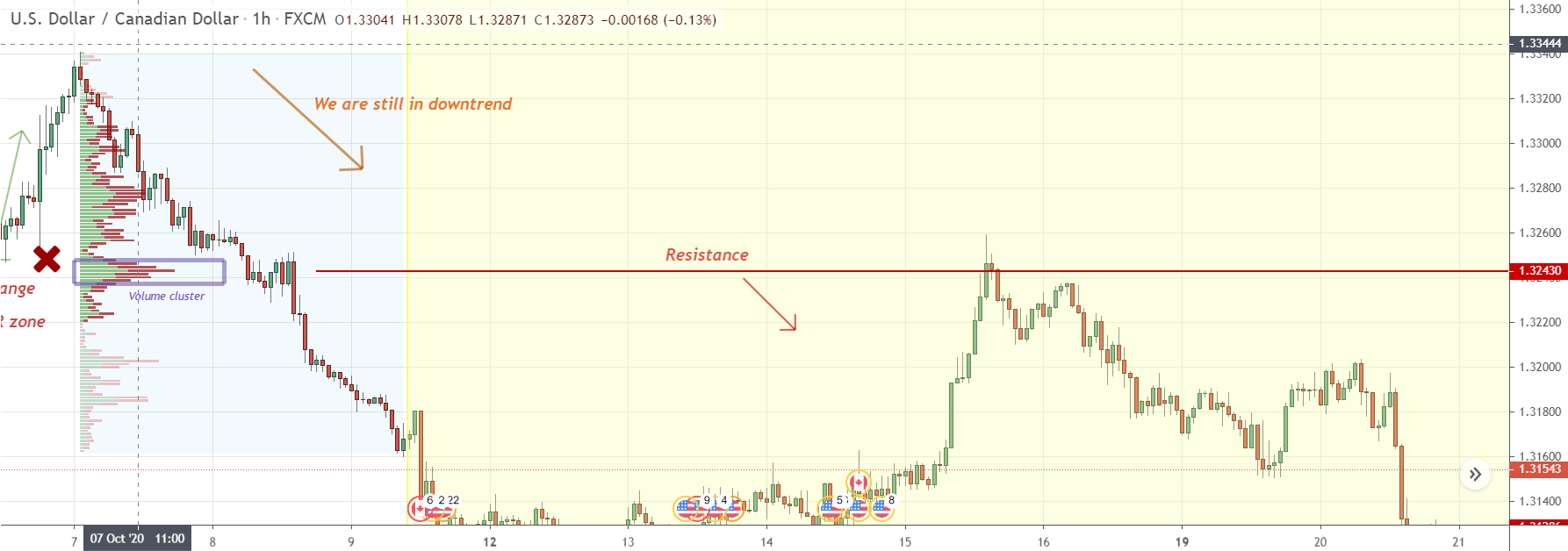

In the example below, you can see how I used Volume Profile to predict market movement on USD/CAD recently.

PREDICTION:

RESULT:

If you would like to learn how to follow the big trading institutions using volume Profile, you can enroll in one of my trading courses:

https://www.trader-dale.com/volume-profile-forex-trading-course/

I hope you guys liked this article and learned something new. Share your thoughts in the comments section with me. I am looking forward to reading them!

Cheers,

-Dale

Educative read as usual. I’m simply blown away by your display of knowledge about the fx market. But can I ask a question. So far I must say your trading strategy is 90% if not 100%. All the posted trade levels that I took reacted to the poc as expected. But the BIG challenge is in knowing “WHERE” the POC will react. Like 4 reacted precisely to the POC and went on to hit TP. One reacted too late and hit SL as the SL is not wide enough. And the remaining had an early test of the POC. My question, how do I find balance in all these to stay profitable? And how can I know the best sl and tp value to trade with? I feel like my brain will explode ??. Thanks

Out of 10 trades

Hi Tim,

I am glad you like my approach and that it works for you! What I like to use is Volume-based SL and TP. This could help with the tight SL being hit. I wrote about this in my book, which you can download on my site for free.

Thanks for the reply. Very helpful.

Always glad to help buddy!

Hello Dale,

What is your win rate on trades that you place? Do you have a 60% win rate or better?

Hi Robert, I have around 66% winrate in the long run. It’s even better on swings. 🙂

Does your volume profile indicators work with Indian Market like Nifty nd Bank Nifty, if yes plz show some trades.