This week in the trading room, David walks you through a textbook gold trade that delivered a 5-to-1 risk-reward payoff.

📈 It’s the kind of trade that shows exactly how to combine higher-timeframe setups with smart money confirmation and time your entries with precision.

📌 In this video, you’ll learn:

✅ How to spot and execute a trade from a 1H Fair Value Gap

✅ The role of inverse FVGs and SMT divergence

✅ Why David avoided a tempting candle and waited for better confirmation

✅ The exact trade breakdown from 1H > 5min > 1min

🎥 Watch it here:

www.trader-dale.com/smart-money-gold-trade-from-1h-to-1min-full-breakdown-from-live-trading-room-...

If you've ever wondered how the pros time their trades down to the minute — this is it.

P.S. Want to trade like a pro and finally get funded? Our 🎓 Funded Trader Academy gives you direct access to our team of experienced prop traders, personal mentorship, and a proven road map to secure funding.

Click the link below to see how it works:

👉 trader-dale.com/funded-trader-academy

... See MoreSee Less

7 days ago

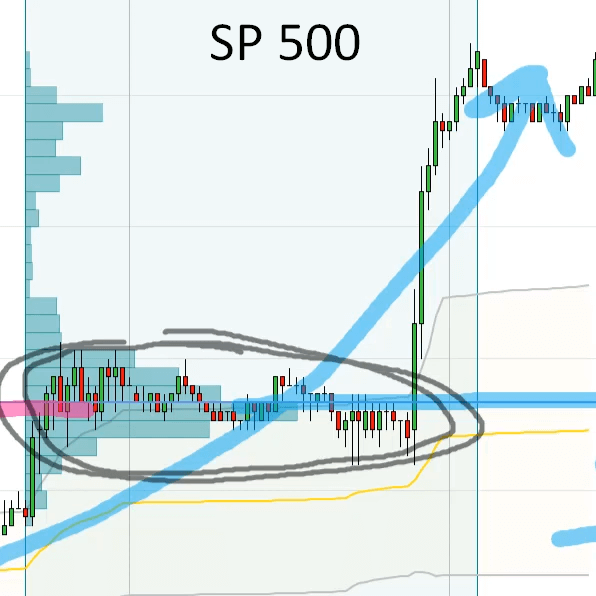

Check out my latest market commentary, where I will show you the strongest Volume Profile trading levels to trade this week!

Enjoy!

www.trader-dale.com/top-volume-profile-levels-to-trade-this-week-on-eur-usd-gbp-usd-usd-jpy/

Weekly forex market analysis and trade ideas for the week starting 23rd June 2025. Pairs covered this week include EUR/USD, GBP/USD & USD/JPY

P.S. Ready to trade with the same powerful tools I use? Discover my top educational & indicator packs here:

www.trader-dale.com/volume-profile-forex-trading-course/

Want to trade LIVE with me and my team of prop-firm-funded traders?

Claim your free consultation call now: www.trader-dale.com/funded-trader-academy

... See MoreSee Less

1 week ago