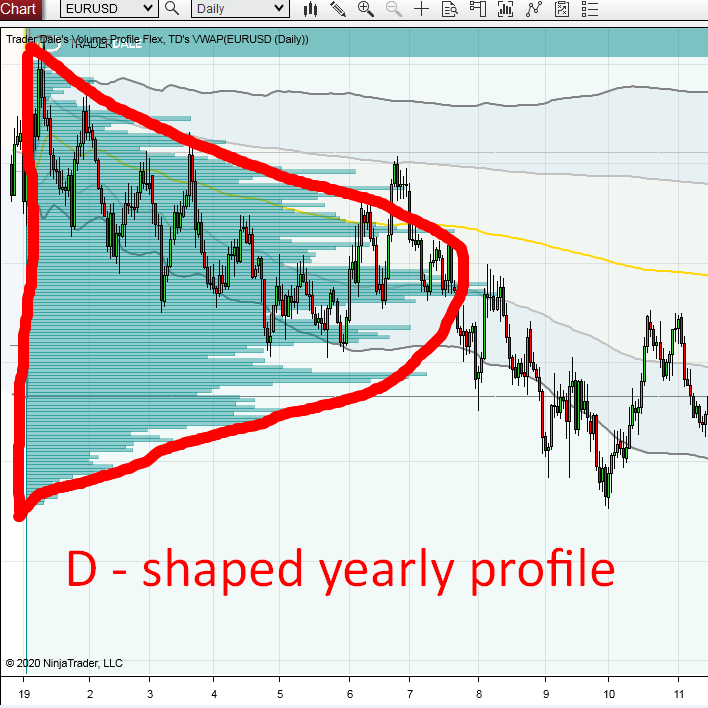

The Last Support Before EUR/USD Hits Its 3 Year Low

EUR/USD is heading towards its 3 year low. There is only one support standing in its way before it collapses. Learn more about this support and what to expect in the next couple of days.

The Last Support Before EUR/USD Hits Its 3 Year Low Read More »