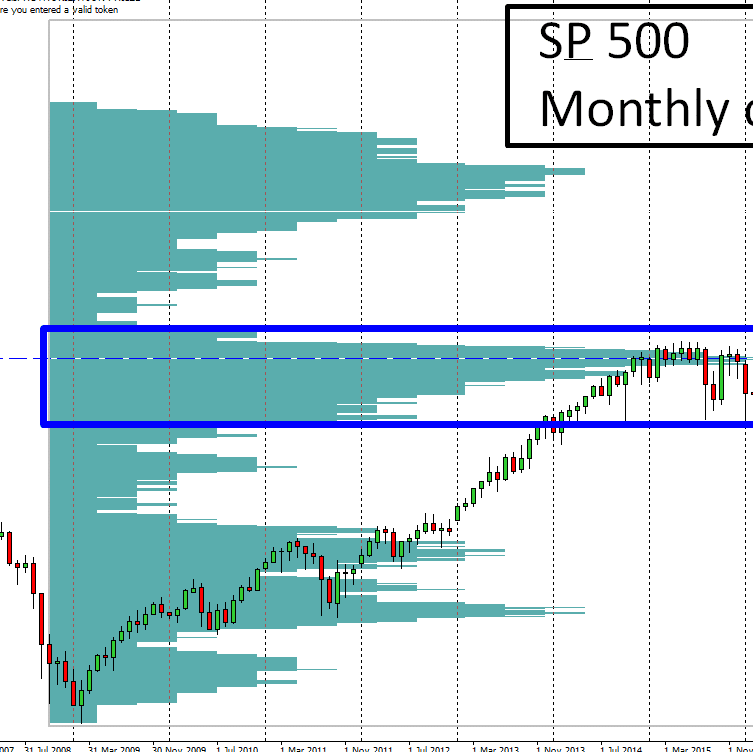

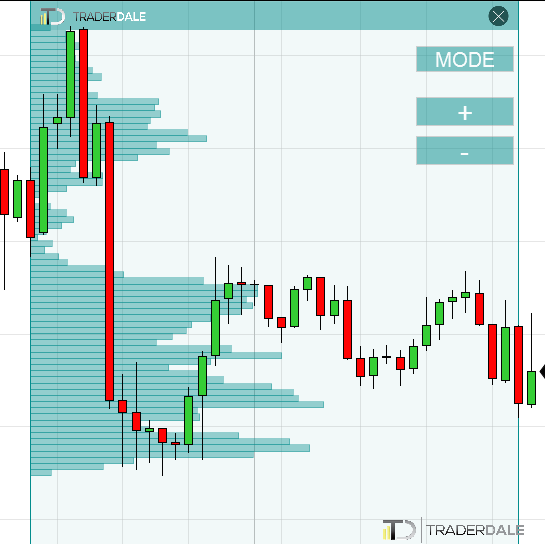

S&P 500 Volume Profile Analysis

The S&P 500 dropped again today. The reason is the new corona virus precaution which stops all travel from Europe to the US. S&P 500 is getting “discounted” more and more every day. Learn how to find the best places to buy the S&P 500 cheap!

S&P 500 Volume Profile Analysis Read More »