Hello guys,

trading it not just about taking winners. Losing trades are also part of the business and there is no point denying it. In my trading career, I took hundreds of losers (maybe even thousands) and I feel no shame in that.

Today, I would like to talk about a recent losing trade which I had on USD/JPY.

Let me first talk about the logic behind this trade – the reason why I took it.

The logic behind the trade

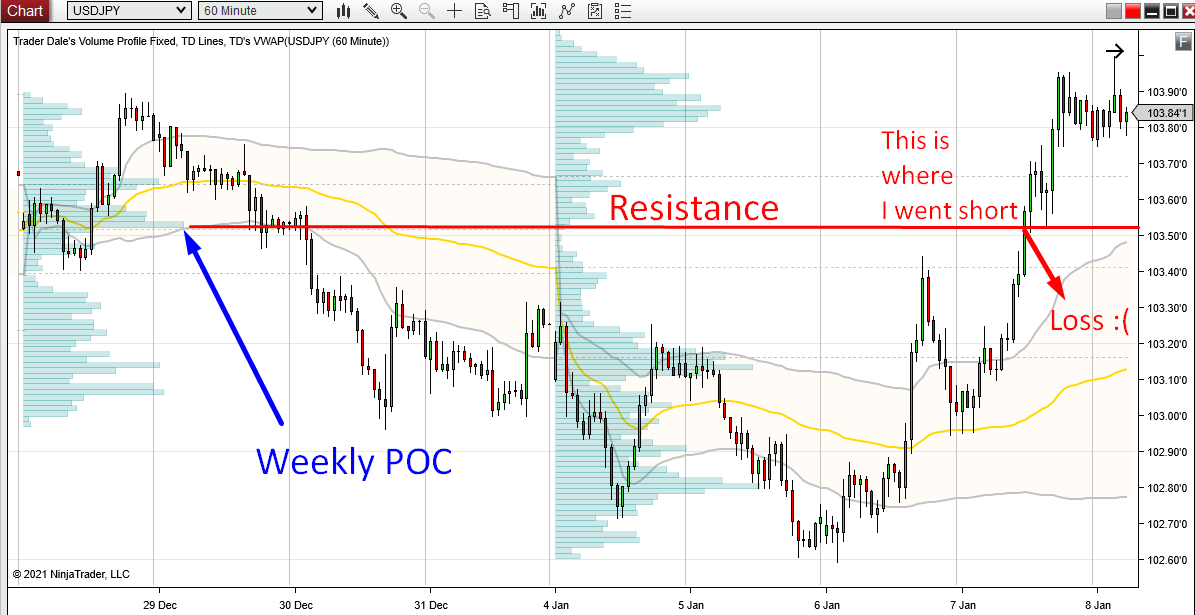

In the last week of 2020, there was a zone where heavy volumes got traded. It was at 103.53.

This was the Point Of Control (POC) of the whole week – this means the heaviest volumes throughout that week got traded there.

From this place, the price went sharply downwards which indicated that there were strong sellers present and that they entered most of their Short positions at that POC (103.53).

The idea behind my trade was to wait until the price reaches this Weekly POC again and enter a Short trade. I expected the sellers that entered their Shorts at the POC would defend this area and to push the price downwards from there again (this setup is called the “Volume Accumulation Setup“.

That didn’t happen tough…

How the trade went?

I went Short fro 103.53, but there was no selling reaction whatsoever and the price just shot past the level. I took a loss there.

USD/JPY chart, 60 Minute time frame:

Do you want ME to help YOU with your trading?

After that it was time for me to shoot a Daily video for members of my trading course. In that video I talked about this losing trade and I said that if there was a pullback to the same level (103.53) it would be a nice place to open a Long position.

Why I said that?

Reversal Trade

There were two reasons why I wanted to take a Long from there.

The 1st reason was that there was a very strong, volume-based trading level (Weekly POC) breached. This is quite unusual, because such a strong level as Weekly POC should trigger a reaction!

The 2nd reason was that the price just shot through the Weekly POC without ANY sort of reaction. This is important, because it indicates that the Buyers were so strong and aggressive, that the Sellers didn’t stand a chance.

You usually discover the strength too late (after you had taken a Stop Loss) – like in this case, but you can still emerge a winner from this, if you switch sides and join the winning party.

The best way to do it is to wait for a pullback to the same level you entered your previous trade. Don’t chase the market. Wait for it to come to you.

Then enter a new trade, but this time in the opposite direction.

In this case, the first trade was a Short which failed, and the second trade was a Long (from the same level) after a pullback, which was a winner.

The same USD/JPY chart, 60 Minute time frame:

I call this a “Reversal Trade“. Those work best if a very strong level based on a Volume Profile setup fails, and when there is no reaction to it whatsoever. Those are two main conditions to remember.

You can learn more about Reversal Trades in this video:

I hope you guys found this helpful. Let me know what you think in the comments below.

Happy trading!

-Dale

Dale

That is what you call experience!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

You let it look so easy!

Excellent Dale, Thank you for taking the time to explain this. I’ve read about it in the VP book and watched in the videos but it always helps to be reminded of the importance of this reversal trade setup.

Really helpful advice. Thanks so much

Good to see this. Finding and managing trades is only one part of the story managing and exiting are every bit as important, arguably more so. Nearly all of your content (albeit good content) talks about ‘setups’ so refreshing to see this.