All eyes on GOLD!

Why is that? Because Gold is at its all-time highs! This is really an important event happening right now.

Gold has attracted many people because of its recent rapid growth – investors and also people who have never invested before. I think this situation could be potentially very dangerous for both of those groups.

In this article, I would like to present some of the facts and also my opinions regarding Gold.

$2.000 – Psychological level

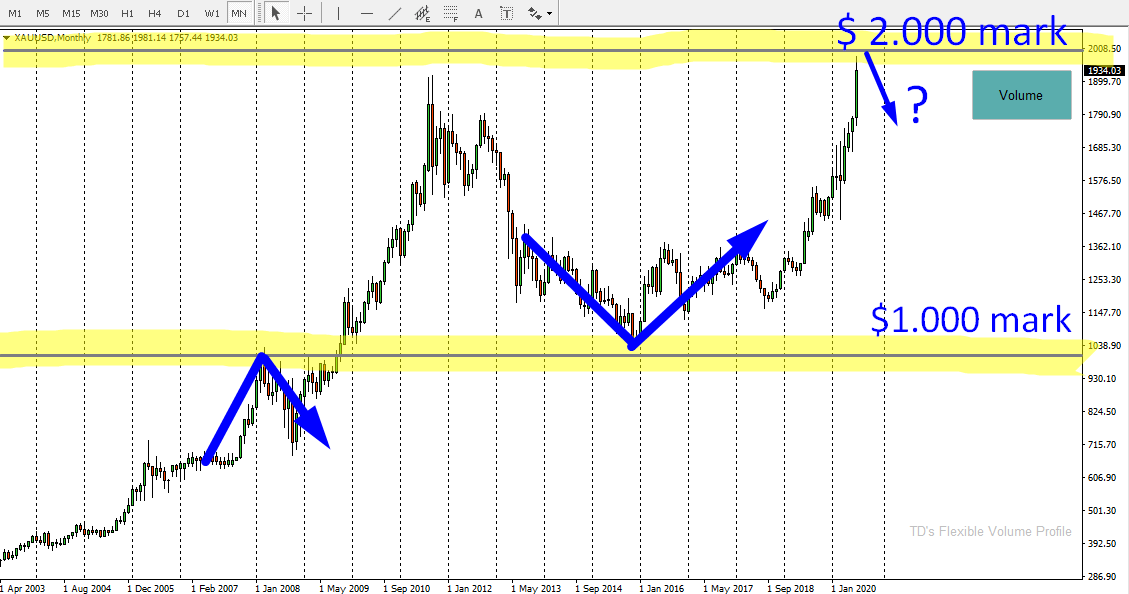

First, I would like to have a look at technical analysis and start with a simple Price Action.

In my opinion, Gold has entered a critical area now. It has almost hit the $2.000 mark. This could work as a strong resistance based on a psychological standpoint.

The last time when price was around a similar level was in 2008 and 2014 when the price reacted to $1.000 mark.

Check it out in the Monthly Gold chart below:

I am not saying that the price will reverse now because it is at $2.000, but you should be aware of the possibility that it could.

Attacking historical high

Now, as the price has breached the historical high, it is very important that the price manages to stay there.

The risk here is that even though the price has made the breakout, if the higher prices are not accepted as “fair value prices” then the price would break and fall sharply down.

In order for the price to rise, there is a need for buyers who are willing to buy for those high prices! Ask yourself this: “If I was a financial institution, would I buy at historical highs after a crazy fast uptrend? Isn’t that too expensive?”

My own answer would be: Hell yes, it is expansive!! I am not paying $2.000 for this!

If I really wanted to buy some Gold, then I would wait until:

a) Higher prices got accepted – which means that price started to rotate above the $2.000 mark.

Or preferably:

b) I would wait until the price dropped and I would buy cheaper.

This brings me to another point – How deep does the price need to drop in order to get me interested?

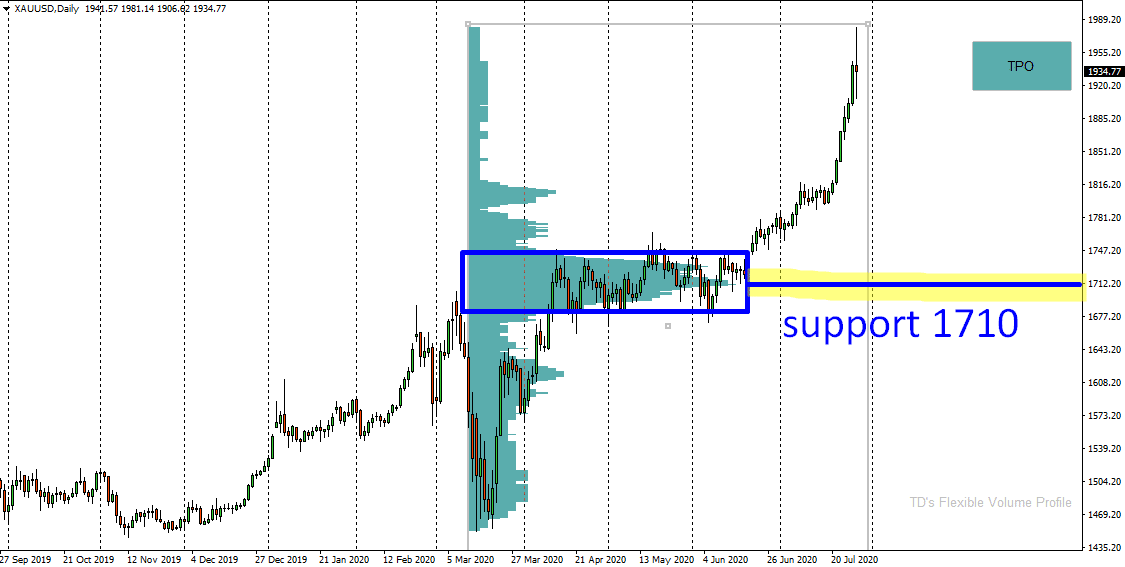

Strong support at 1710 – Volume Profile analysis

In my opinion, the best place to jump in a long trade is around 1710 mark.

Why is that?

If you use my Volume Profile indicator and look at how the volumes were distributed throughout the last couple of months, then you will see that a lot of trading positions got placed around the 1710 area.

What I think this means, is that in this area, buyers were entering their long positions slowly. The big institutions were getting ready for a big push.

When they have slowly and unnoticed accumulated their long positions, they started an aggressive buying activity. This activity snowballed, everybody started to join in the new buying, and the price started to rise sharply.

Now, if the price drops back into the 1710 zone again, those institutions will become active again. This zone is important for them, because they placed a lot of their volumes there!

This is why I expect they will try and drive the price upwards from there again. In my opinion, this is the place to buy cheap.

Below is a Gold chart on Daily time frame with Volume Profile:

How important is Gold actually?

Have you ever asked yourself how important Gold is? Why is it so precious, or why investors like to invest in it?

Let me ask you a question. What do you think would actually happen if somebody just stole all the Gold there is and just shot it into space?

The answer is pretty funny. You know what would happen? Almost nothing, really…

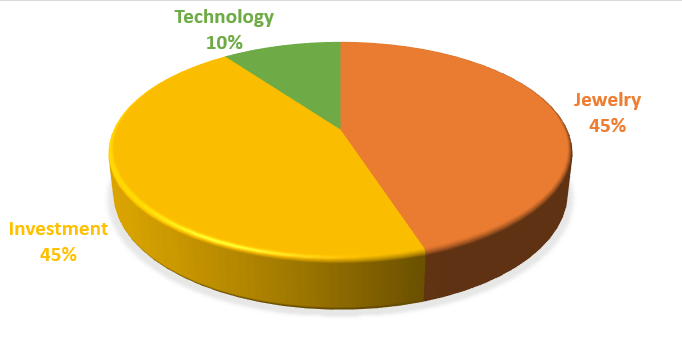

Here are the hard numbers to back this up. Below is a chart which shows usage of Gold worldwide:

As you can see, people are mostly buying Gold in the form of jewelry and also as an investment. Funny thing is, that majority of the investment gold is not actually gold in its physical form, but just a “paper Gold”! Are you getting where I am going with this?

Buy a golden brick, not a paper

To me, buying the “paper Gold” makes almost no sense. Gold is considered a safe heaven – a place where investors put their money to reduce risk.

If you want to reduce risk by buying Gold, then be my guest, but buy PHYSICAL gold! Buy a golden brick and hide it so nobody knows you have it and where you have it!

You don’t reduce risk by buying paper Gold! Paper Gold is not really backed by real Gold. There is not enough real physical Gold in the world to back up the paper Gold!

So, if you want to make a long-term investment, think twice about the form!

Why are Gold prices rising now?

The reason Gold is gaining now is because of the COVID-19 pandemic. The world is scared, economy is endangered and investors are seeking the safe heaven. They want to put their money into Gold to reduce their risk exposure. What also helps is the low interest rates and USD weakening.

All those factors drive the price of Gold up. BUT, it can’t rise forever! There will be a point where it will be so expensive nobody would consider it a good investment anymore.

Could it be now? In my opinion yes.

Does that mean that you should short Gold now? No, it does not.

The world could go crazy and people could drive the prices of Gold even higher – to a point where it becomes a bubble (which will burst afterwards).

Similarity with Bitcoin?

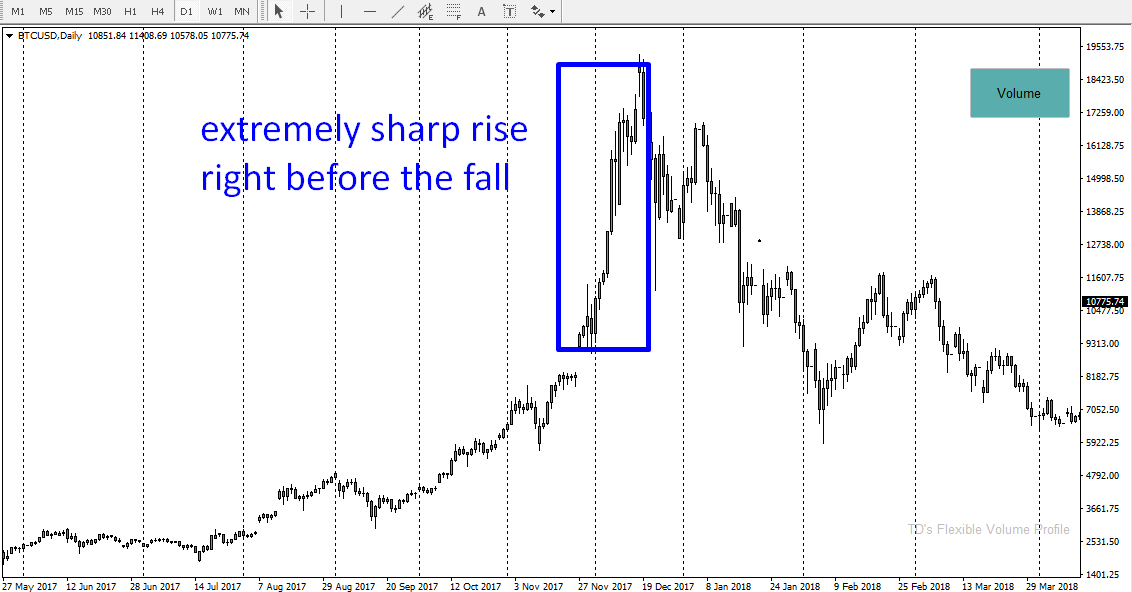

Remember when Bitcoin was close to the $20.000 mark? A scenario like this could actually happen to Gold too! Let me remind you, I hope this picture is not too painful for you to look at 🙂

Bitcoin, Daily time frame:

What do you guys think? Are you trading Gold? What is your opinion about the current price development? Let me know in the comments below!

Happy trading!

-Dale

you are definitely correct, it will fall down overnight like crude oil. I followed the dropping of oil in hours it reached -37 USD/BBL. I expect fall down of Gold price soon to set on a reasonable price level – as you said 1710.

Yes, it’s kind of crazy why people would place so much value on a nice coloured metal, which doesn’t really have much use other than jewellery and coins ( I know it’s used in electronics too, but it’s minimal), but especially in the paper value. Sometimes think the world is insane. But hey, if we can make money on that great, but personally, yes, I think it’s over valued and I think when the dollar index rises, it will fall.

I personally don’t think it can be compared to oil or similar commodities, oil is a completely different entity with different controlling factors, but always makes interesting reading and trading.

Thanks for the article Dale.

I agree with you. 2000$ is a strong Psychological level. I see it’s good to short now.

informative,,thanks