In today’s analysis, I will have a closer look at CHF/JPY.

What caught my eye, at first sight, was yesterday’s price development.

First, there was a tight rotation, in which heavy volumes were accumulated. At that point, it was not really possible to tell who was getting ready for the big action – whether buyers or sellers.

Then a sell-off started. At that point, it was clear that it was the sellers who were getting into their short positions in the rotation.

Activity of sellers

They were building up their short positions unnoticed in the rotation and then they started aggressive selling activity using Market orders. With action like this, they wanted (and succeeded) to start a downtrend and use the “snowball effect” to also get other people to start selling aggressively. This helped to push the price even more downwards.

So, how to work with that information? We know that there were sellers around 114.06 and that they pushed the price down.

I am not a huge fan of jumping into a downtrend when it appears, because it could just be a false breakout or there could be a sharp reversal. I prefer to make sure the trend is “valid”.

Then I like to wait for the price to come back into the area where the trend started. Then I trade from the place where heavy volumes were created before the trend.

CHF/JPY, 30 Minute chart:

Do you want ME to help YOU with your trading?

The logic behind my approach

The logic behind this approach is that the Volume Profile revealed a place where the sellers placed lot of their positions and therefore they are likely to defend this area in the future again. It is an important zone for them.

When they defend this area at some point in the future then they will do so by selling again and trying to push the price downwards again.

That’s what I want to trade.

VWAP confluence

What I always look for are confluences. The level I found is based on Volume Profile and Price Action, but I always look for something extra, that would confirm my trading idea.

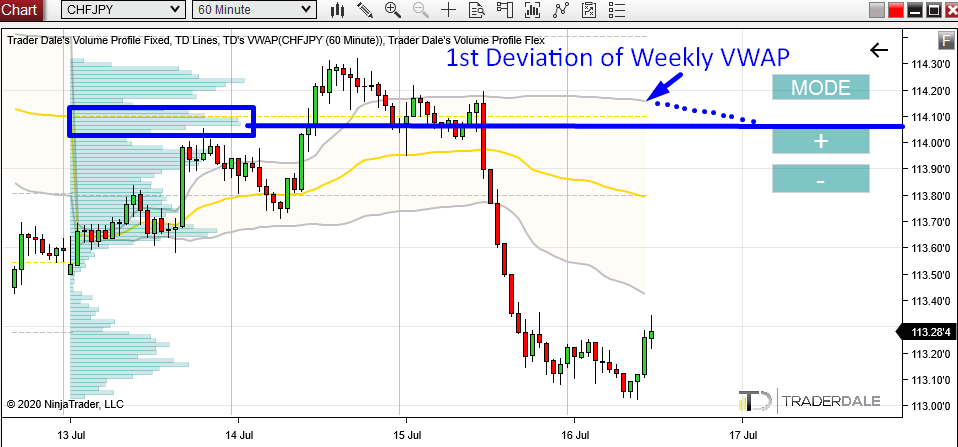

In this case it is the 1st Deviation of Weekly VWAP.

Generally speaking, the 1st Deviation works as a strong support/resistance.

Currently, the 1st Deviation is a bit above our 114.06 level, but it is still developing. The way i see it, is that it is quite possible that it will slowly decline and when the price reaches the 114.06 zone, the 1st Deviation will be there (or somewhere close).

This would be another nice confirmation of the level.

You can see what I mean in the picture below.

CHF/JPY, 60 Minute chart with Weekly VWAP:

Macroeconomic news

Today is a pretty important day because there are some high impact macroeconomic news coming up later today.

It is the Main Refinancing Rate and Monetary Policy Statement, and then maybe even more important the ECB Press Conference.

The CHF/JPY is not “directly” affected by this news. But because the CHF is very closely linked to EUR (which will be directly affected by this news) the news will also have a strong impact on CHF/JPY.

So, be careful around the time when the news come up. It could cause a heavy volatility and it would be very risky to trade during that.

I hope you guys liked today’s commentary, let me know what you think in the comments below!

Happy trading,

-Dale

ChfJpy