Today, I would like to do a swing trading analysis using just Volume Profile and Price Action.

What got my attention this time was Gold. Its price has been rising and it hasn’t been this high for 7-8 years!

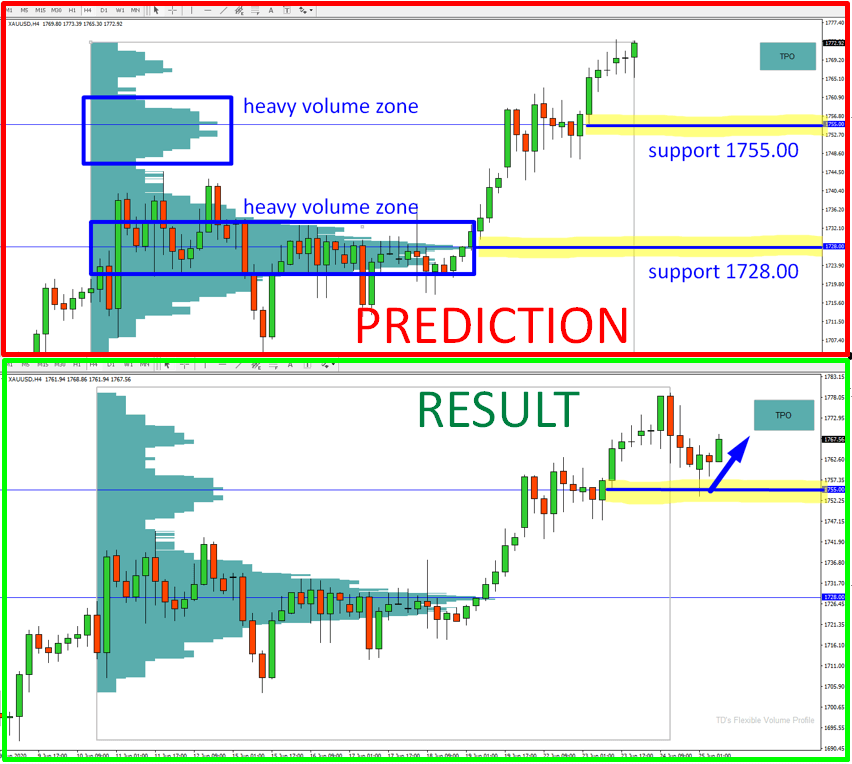

As the price is moving upwards there are zones where the Volume Profile shows heavy volumes. Those are most likely areas, where buyers were adding to their long positions. They are around 1755.00 and 1728.00.

Two factors which drive the price up from volume-based supports

Those heavy volume zones should work as Supports. Why? Because the buyers who were building up their positions in those zones won’t want the price to drop below those zones. That would mean their positions would be in red numbers!

So, when the price reaches those volume zones, then the buyers will want to defend those zones. They will start aggressive buying in order to drive the price upwards again.

There is also a second factor at play. When there is a pullback, then the sellers behind this pullback will want to quit their short trades before they reach the heavy volume zones. Holding to those positions could mean a potential fight with the buyers! They wouldn’t want that!

Sellers getting rid of short positions means they will need to buy (to get rid of shorts). This is the second factor which could help drive the price upwards from those two heavy volume zones.

So, the two factors to drive the price upwards from volume-based supports are:

First factor: buyers defending long positions.

Second factor: sellers getting rid of their short positions.

Both factors help the price turn upwards at the volume based support zones like these.

You can see the heavy volume zones on 4 Hour chart of Gold below:

Trade execution

What do we do now? Now we simply wait. When there is a pullback and the price makes it back to those zones, then they should work as supports. Then it could be a nice opportunity for a swing long trade from both of those supports.

Gold specifics

Gold is a bit specific trading instrument because it often works as a safe heaven instrument. This means that when there is some global uncertainty (economical crisis, coronavirus, war, disaster,…) then its price usually rises. On the other hand when it is over its price drops.

So, if there is some really important global news then you should watch Gold and trade it carefully. Especially when it is moving around its all-time highs like now.

I hope you guys liked today’s analysis. Let me know what you think in the comments!

-Dale

Do you want ME to help YOU with your trading?

EDIT

This is how it went the next day:

hi what volume profile indicators would you recommend for TradingView?

I would go for the fixed range profile. But still I don’t think it is nowhere near my Volume Profile indicators. Also you need to pay every month to use it. Mine is a lifetime license.

Interesting evaluation. So you wait for the price to drop to 1755 and then buy back?

yea, that’s the idea

At 1765,00 for me it possible a good Sell. What do you think?

I personally wouldn’t sell in an uptrend like this.

what would you recommend for the 1755 level as SL – around 1745 ? and TP 1765 ?

I would quit trade if candle closed below 1747. 1765 looks good now for a TP, but it is too soon to tell. It depends on the development. I would place it before heavy volume zone, which now is at 1766.

Level was tested. And nice reaction as you predicted. But the limit order didn’t activated because of wide spread. Thanks Dale

really spot on reaction, my pending order was triggert – thanks Dale

Hi Dale, can you please explain what you mean by the term “buyers defending long positions”. Because if buyers have already bought, how are they defending long positions at the high volume node. Thanks in advance

Hello, they bought and they don’t want the price to go against them, that would mean their positions would start losing. So those buyers start buying again aggressively (with Market Orders) and try to start buying reaction also from other market participants. This drives the price upwards again. Good question thanks!

Really impressed by you Dale, always simple but yet very spot on presentations/predictions, you make trading look so easy by your presentations, so much logic than many others do. Kudos!

Thank you!

Roger

Thanks so much Roger!