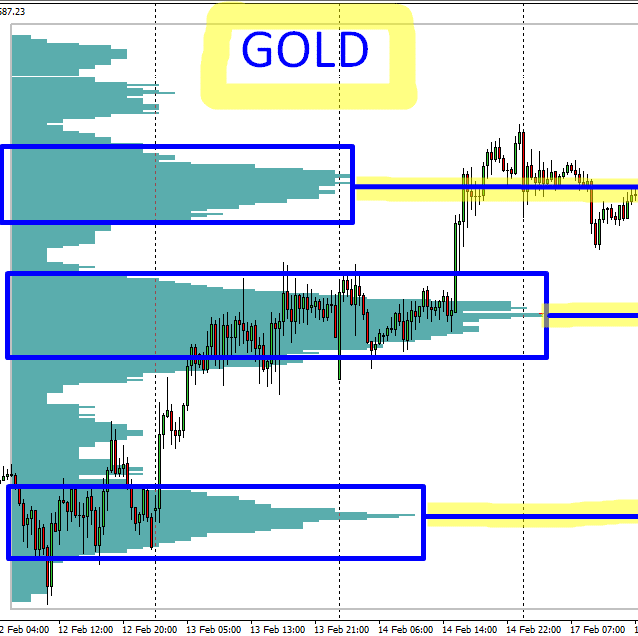

Will there be a Sell-Off on Gold?

Gold is at its all time highs now. Will the rise in Gold prices continue or will the uptrend break and Gold will fall? Check out my Technical and Fundamental analysis on Gold!

Will there be a Sell-Off on Gold? Read More »