In today’s breakdown, our Head Trader Vivek walks you through a textbook Reclaimed Inversion Long setup that unfolded in real time.

First, price aggressively swept the Asia low—a classic liquidity grab.

Then it reclaimed a key inversion zone and printed a bullish order block, giving a clean long entry.

Even in a choppy, uncertain market, Vivek showed how sticking to the model—waiting for opposing liquidity to be taken, looking for engineered targets like equal highs, and confirming bullish intent—can still produce a high-probability, risk-controlled trade.

🎯 Target? The equal highs.

📊 Result? Trade worked perfectly.

🎥 Watch the full recap and learn how to spot this setup in your own trading!

www.trader-dale.com/reclaimed-inversion-order-block-setup-that-hit-target-live-trade-breakdown-9t...

P.S. Want to trade like a pro and finally get funded? Our 🎓 Funded Trader Academy gives you direct access to our team of experienced prop traders, personal mentorship, and a proven road map to secure funding.

Click the link below to see how it works:

👉 trader-dale.com/funded-trader-academy

... See MoreSee Less

6 days ago

Check out my latest market commentary, where I will show you the strongest Volume Profile trading levels to trade this week!

Enjoy!

www.trader-dale.com/top-volume-profile-levels-to-trade-this-week-on-gbp-usd-usd-jpy-aud-usd/

Weekly forex market analysis and trade ideas for the week starting 7th July 2025. Pairs covered this week include GBP/USD, USD/JPY & AUD/USD

P.S. In honor of Independence Day, I’m offering a special 55% discount on my best trading tools and education.

If you’ve been waiting for the perfect moment to level up your trading game — now’s the time!

Here is what you can get:

🎯Volume Profile Pack

15+ Hour video course

Daily/Swing trading signals

Volume Profile indicators

VWAP indicator

FREE Tech call & Indicator setup

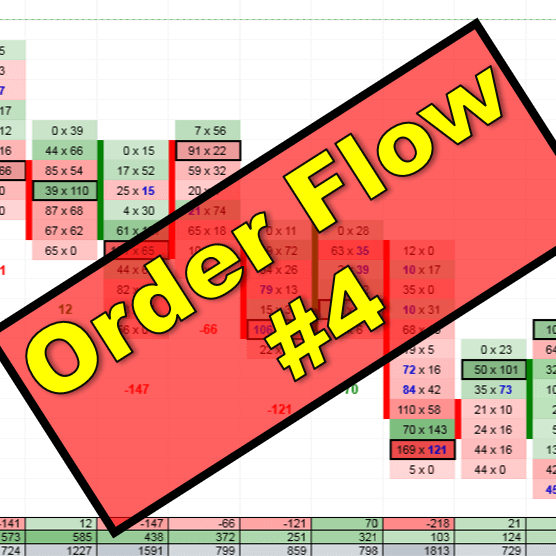

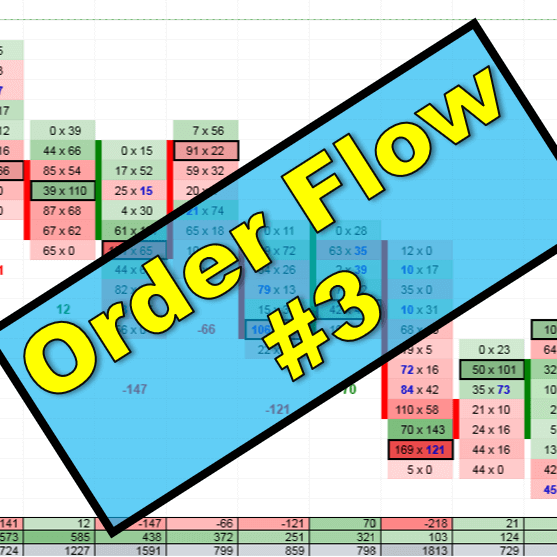

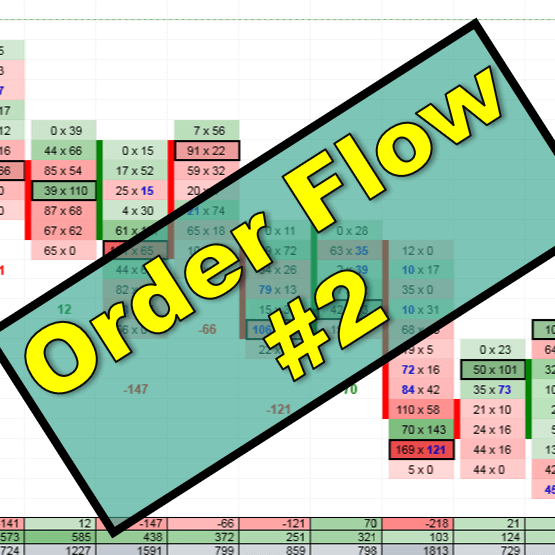

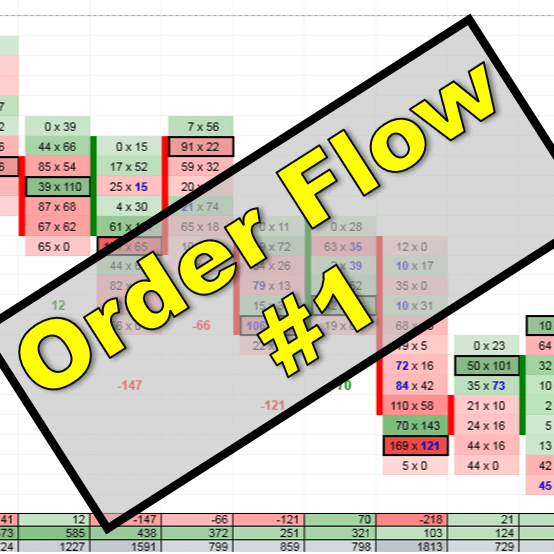

👑Order Flow Pack:

12+ Hour video course

Order Flow software

Volume Profile software

FREE Tech call & Indicator setup

🚀VWAP Pack

9+ Hour video course

VWAP software

Volume Profile software

FREE Tech call & Indicator setup

💡Smart Money Pack

6+ Hour video course

Smart Money Software

12+ Hours of Live Trading Videos

FREE Tech call & Indicator setup

Get all four packs together and get -55% discount

Get it here:

www.trader-dale.com/volume-profile-forex-trading-course/

... See MoreSee Less

1 week ago