Did you know that many professional and institutional traders only focus on one or two currencies or another trading instruments? The reason they focus only on few instruments is to enable them to become really proficient at those pairs. A good analogy for why this is beneficial can be found by looking at the way lawyers practice law. As a lawyer, you can specialize in many fields, but the best lawyers only focus on one particular area. They have one field on which they concentrate all their time and effort, and this is what allows them to be the best in their chosen area of expertise.

Professional traders know all the necessary aspects of the market they trade. They know the average volatility, correlation to other instruments, the average impact of different macroeconomic news, as well as average volumes. They know if the market tends to move in spike or if it moves in a more subdued and calm manner. They also develop some sense of feeling for their core market. It’s something that is hard to put into words, but it is there.

Through the rest of this article, I’m going to break down the risk of trading too many pairs in greater detail, in addition to how you can choose the right currency pairs to trade.

Correlation & Excessive Risk Exposure

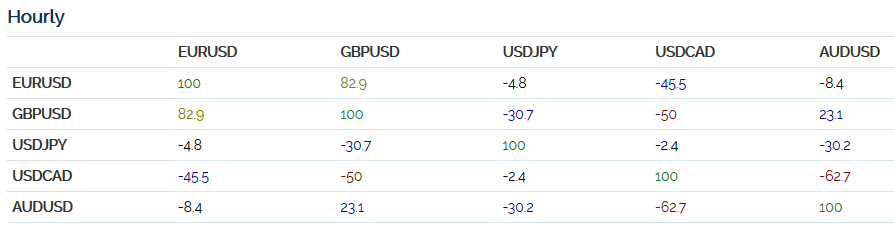

The more some instruments behave like each other, the more correlated they are. If two instruments have 100 % correlation, it means that they move the same way. If their correlation is -100%, then they move in exact opposites. These are the extremes of the scale, but in reality, the correlation numbers are somewhere in between. Here is a forex correlation table (from www.Mataf.net) with major FX pairs to give you an idea about the correlation numbers:

In this picture you can, for example, see that correlation between EUR/USD and USD/JPY is -4.8%. This is a really low correlation, and it means that those currency pairs move quite differently and independently to each other.

If you want to make your instrument list bigger, you need to accept the fact that there will be more and more instruments with pretty high correlation. Unfortunately, there isn’t a simple way to get rid of the correlation problem because the markets are connected. If there is for example event like US Presidential election, you can be sure that a lot of markets and instruments will be affected and the price movements will be very similar in many markets. I don’t see a problem with having an open position at that time (if it is part of your trading strategy, of course). Where I DO see a problem is when you trade too many instruments, and suddenly you are in too many HEAVILY correlated positions that all get triggered because of the Presidental election! This is called Excessive Risk Exposure, and it is a problem which you want to avoid.

It doesn’t have to be an extreme situation like that; sometimes there is something as simple as a USD rally. When this happens, all the pairs where one of the currency is USD move in unison. If you trade too many instruments with USD, you can find yourself in a pretty messy situation with, for example, 5 open trades all dependant on how the USD will move. Most likely all those 5 trades will end the same way, and that is just too much risk! If you were an institutional trader, you would probably get sacked for doing that.

So, my advice is this: don’t trade too many instruments/currencies with high correlation. If you do, make sure you have rules that prevent you from taking on too much risk. For example, don’t open more than two USD positions. This is an extremely simple trade management rule, but it’s massively powerful. You can also halve your positions if you see that you are going to enter a trade on two heavily correlated instruments. Remember that you need to feel comfortable with losses as this cannot be avoided from time to time. What we don’t want though, is a single macroeconomic news event to hit us for 3-4 losing trades at once because we forgot they were all heavily correlated.

Being overwhelmed

Another problem that comes with trading too many currency pairs or other trading instruments is that it’s just really complicated to handle all the trades. If you want to be successful in trading, then the execution of your strategy needs to be basically flawless. You need to focus and follow the rules of your trading strategy 100%. Everything needs to be perfect – analysis, entry, exit, position management, money management. Apart from that, you also need to know which macroeconomic news will impact the instrument/s you are trading and how large the impact will likely be. All that is doable if you focus on only a few trading instruments, but it is much harder when you trade 10+ of them on the intraday basis.

Choosing the Right Currency Pair

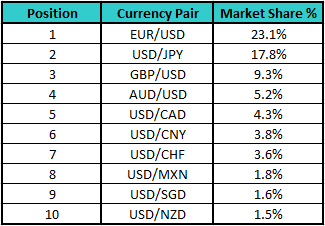

At first, you need to consider the costs of trading. These consist of spread, broker commission, and swap. Generally speaking, the bigger the Market Share percentage, the lower the trading costs. Here are the most liquid currency pairs (pairs with the biggest Market Share):

I also need to mention that the costs of trading can flucuate based on the instrument volatility. Generally speaking, the higher the volatility, the bigger the costs will be to trade instrument (spreads mostly). You also need to be aware of the various instruments volatility in your trading strategy. This will require you to adjust your SL and PT accordingly to the volatility of the asset you are trading. Also, the strategy itself should be consistent with that currency pairs volatility and behavior. Some pairs are good for fast, aggressive trading, while still others are better for slower and calmer trades.

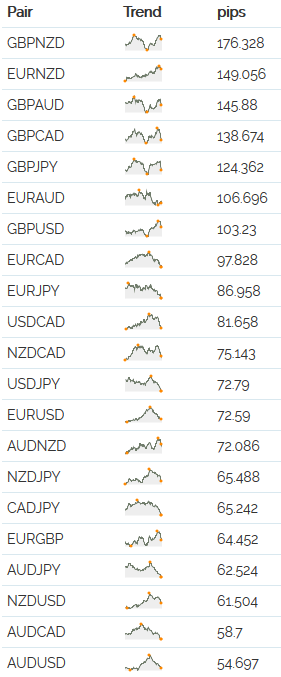

Here is a Daily Range table (average from the last 10 weeks) of various currency pairs to give you some overall picture of their average volatility.

In my trading, I prefer to avoid GBP pairs. If you look at the table, you can see that they are one of the most volatile. The GBP also tends to aggressively spike past major support and resistance zones, which doesn’t really suit my trading strategy as well as many of the others. For that reason, I usually avoid trading the British Pound.

Steps To Chose The Right Trading Instruments

Now that we have covered all the necessary stuff, let me give you a really simple, quick guide to choosing the best currency pairs for you to trade:

- Cut costs – Especially if you trade intraday, you really need to cut the cost of trading as much as possible. For that reason, I only trade the most liquid forex pairs (EUR/USD, AUD/USD, USD/JPY, USD/CAD) where my costs are as low as possible. Again there are others acceptable pairs, but these are my personal favorite. As a side note, trading costs are also heavily affected by the forex broker that you are using. If you’re not using a reputable forex broker with very tight spreads, then I would recommend a switch in broker as well.

- Test your strategy – at first, do some quick backtest to give you an idea how well your strategy works on different currency pairs. In my experience even quick and brief backtest can show you if you should focus more on testing the given instrument, or if you should move to another one. After that, you need some more thorough backtesting and more importantly live trading on a real account. I won’t get much deeper on the backtesting subject here, but I would strongly advise you to check out my article that deals with the 5 phases of backtesting new trading strategy.

- Chose only a few instruments – Make sure the pairs you select have low trading costs in addition to making sure they fit your strategy well. Don’t try to trade too many pairs and my recommendation would be to start with just one or two. Once you have the pairs, you’re going to trade you then need to get really familiar and comfortable with them. After someone is proficient in trading only a few select pairs, I have no problem with adding in additional pairs or markets. Just keep adding a few at a time until you reach the point where you have the desired amount of monthly trades.

Currency Characteristics

Every currency pair is unique and has its own characteristics. There isn’t a universal rule that would tell you which pair to trade and which to avoid. As I mentioned before, you need to go through them and see for yourself which ones fit you and your strategy best.

To give you some initial idea’s and to help you get started, I wrote out the characteristics of some pairs as I see them. I hope it can help you in choosing the right instruments for your own trading.

EUR/USD

- Excellent winning ratio with volume-based strategies. This pair is number one for me!

- The most liquid pair.

- The cheapest to trade.

- Average volatility.

- If something significant is happening in the markets, the EUR/USD will “tell” you.

AUD/USD

- Slow. Sometimes you really need to be patient, but on the other hand, you have plenty of time to think when managing your positions.

- Less volatile.

- Cheap to trade.

- Good and precise reactions to volume-based S/R zones.

- Positive swap.

- Commodity currency (depends on commodity prices and commodity-related news).

- China dependant – reacts to China-related news because Australia has a lot of business bonds with China.

USD/CAD

- More volatile.

- Not as cheap as other major FX pairs, but still good even for intraday trading.

- Good reactions to volume-based S/R zones but sometimes not so precise (sometimes shoots past levels and turns later).

- Dependant on oil-related news and oil prices.

- Sometimes higher correlation with AUD/USD because of the oil and other commodities (CAD is a commodity currency).

USD/JPY

- More volatile.

- Cheap to trade (mostly because of high liquidity).

- Very precise reactions to volume-based S/R (even though it is volatile).

- Capable of spikes and big crazy moves.

- Safe heaven currency (uncertainty in the markets -> people buy JPY).

GBP/USD

- Volatile

- Moderately cheap to trade.

- Hard to predict. Sometimes reacts sooner to volume-based S/R zones, sometimes too late, sometimes never.

- Usually quite “dead” during the Asian session.

- Good for catching trends (you need to be ready to quit fast though).

- Quick spike moves.

- Massive reactions to UK CPI news and BREXIT related news, not so much on GBP rate decision news (for now).

If I had to choose two of these major pairs to trade with my Volume Profile trading strategy, I would choose EUR/USD and USD/JPY. The reason I would select those two is that they are both cheap to trade, have good reactions to my volume based S/R levels, and there is a very low correlation between these two pairs. Additionally, I can also use the same pip size for my take profit and stop loss which makes trade execution much easier.

This is just the way I personally see it. In the end, I think that it is best for you to do your own research and make your own opinion on what currencies are the best to trade. I will be happy if this article helps you find someplace to start from and if it gives you an idea what things to consider when looking for the ideal set of instruments to trade.

Happy trading!

-Dale

P.S – If you would like to trade with me every day, then I would highly recommend checking out our Advanced Volume Profile Course & Members Forum.

Really useful article

Thanks Dale .

Thank you

The information presented in this article is very useful for me!

Thanks Dale!

Great article! Thanks for connecting the dots when and how to trade FOREX.

Great article, very informative. Thank you

This article is absolutely great and helpful as a beginner it makes me realized each currency pair characteristics,

Thanks Dale

USDJPY it is, thanks Dale 🙂

Thanks Dale, Very informative information and more clarity for trading…

nice keep going

Thanks Dale, great information. Made me re-evaluate what I do.

excellent article with practical tips, thank you