Hey Guys,

In September 2016 (exactly a year ago) I started publishing my trading levels in my Forex Factory Thread, on the Trader Dale Facebook Page, and after that on the www.trader-dale.com website. I have been collecting data since I started publishing those levels, and now I can show you the entire years worth of trade analysis.

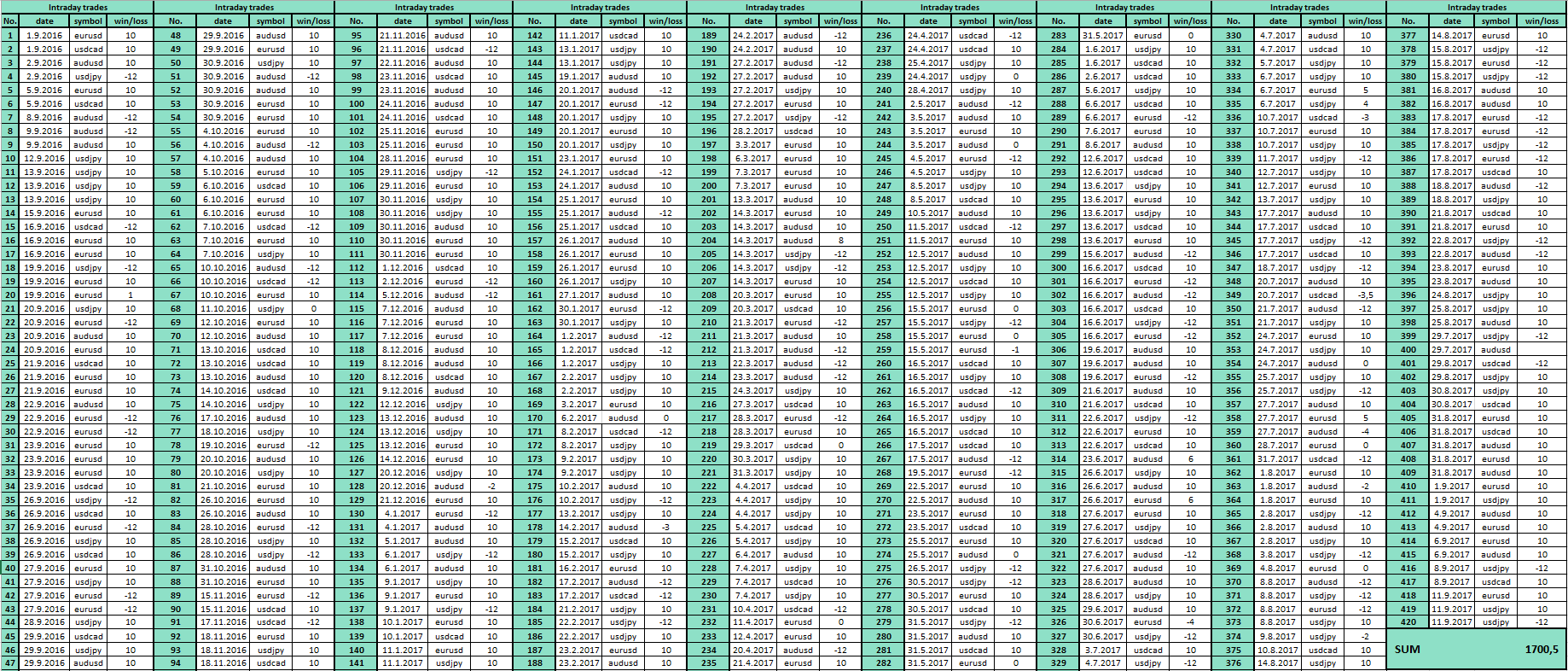

All the results are based on my trading levels that I first shared publicly, and since April 2017 I have continued publishing them daily in my Member’s Trading Forum. Position and trade management was done with the 10/12 method and “neutral” position management.

12 Month Trade Analysis Using Market Profile

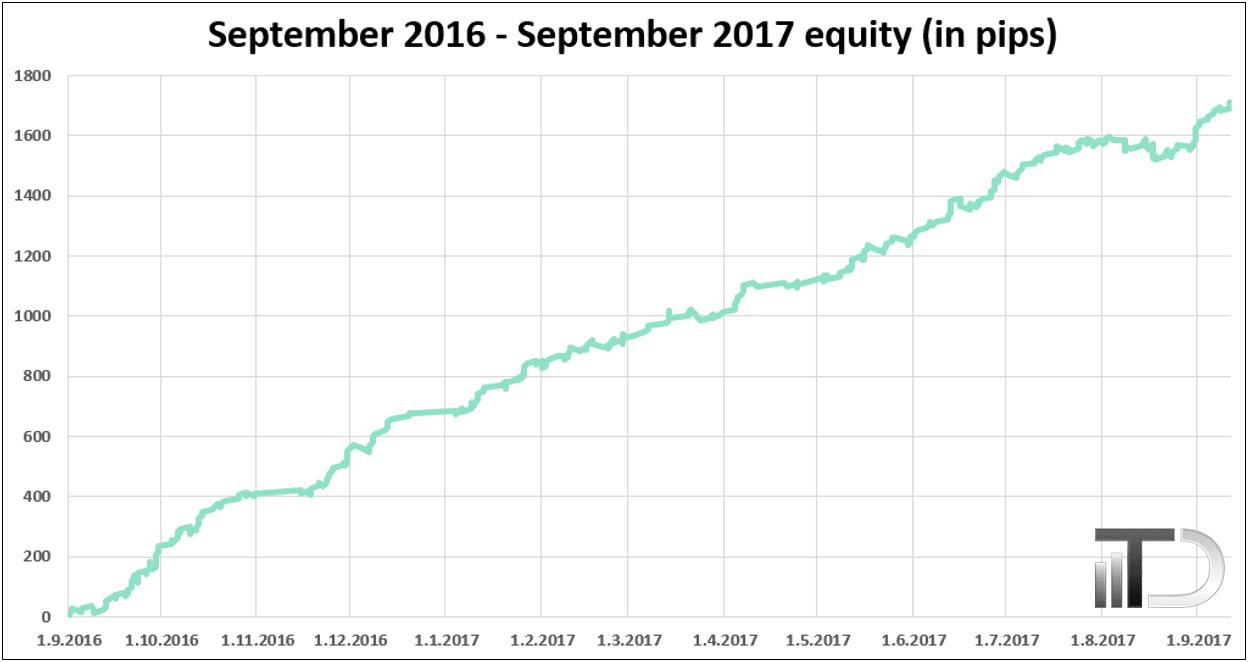

In the past 12 months, the total net pip count was +1700, nice and green pips! There were 420 intraday trades. 289 of them were winners, 100 losers and 30 ended up around break even. Those numbers come out to a win/loss ratio of slightly over 70% (calculated with RRR = 1)! These are the type of numbers I can live with, especially given how consistent it was throughout the year.

On average there were 34 trades every month (that makes around 1,7 trade per day) and the average monthly gain was +136 pips. Remember this is just for the 4 pairs I list levels for each day. MOST members go on to trade many more pairs, and thus profit potential, as well as potential risk, is increased.

If you started with $10,000 account and then risked $120 on every trade (1.2 % of your starting capital), you would end up with an account balance of $27,000 for the year. This is also without compounding gain at all! That means that you could cash your profits month after month without cumulating them in your trading account. And that is only with quite a conservative approach which is risking basically 1 lot per trade.

If you were adding to your positions accordingly and always risk 1.2 % of your current account balance (cumulative yields), you would end up with around +$48,179 profit, which would give a total balance of $58,179! Again, this is all based on only 4 pairs (most trade 6-8 on average) as well as a conservative risk per trade.

It’s also important to remember that this is only hypothetical, as there are no trading costs in this equation. It’s important to look at your overall trading costs as they can add up with a high trade volume strategy. That is why it’s so important to have a reputable forex broker, with tight spreads and instant execution. With all costs included (spread + commission) you should be able to average a cost of (or below) 1 pip per trade on the majors and a touch above for the less liquid pairs.

Here is the whole 1 year statistics with equity (in pips):

*CLICK TO ENLARGE*

I am really happy with the great start we had with this service! It has also been an awesome experience to see so many traders doing well. Actually, it was my “humble” dream when I started sharing this trading strategy in the first place.

Happy Trading!

-Dale

P.S. – If you have any questions about the service, trading strategy, or just general questions, just shoot me an email at contact@trader-dale.com

Hi Dale,

To clarify, This results is just your intraday trades and does not includes your swing trade?

Btw, whats the max drawdown in pips and %? thx

Hey,

correct. These are intraday only. Max DD was -76 pips. If you count the DD with pips it was around 5 %.

76pip, thats about 6 losers in a row?

Very nice ?

Btw, beside having this 1 year past result what makes you think or give you the confident that the method is profitable in the longer run and not just lucky for the year?

thanx mate,

there wasn’t 6 losers in a row, there were also some winners but it was overall a worse trading period with more losers than winners.

I have been trading with profile for some years now so I have absolute confidence in it. Also, the logic behind volume profile just can’t stop working because institutions will always be visible on the profile. Thats what I like about trading profile so much 🙂

Thanks alot for your generosity mate enabling so many traders to learn and earn at the same time!! 🙂

Haven’t seen someone do that this way. And the simplicity of your trading is truly brilliant!

Thank you so much mate!

1. Is it possible for one with a starting bank of $500 to trade your swing trade strategy without going down to micro lot?

2. I know you concentrate on four main pairs even though can go up to 15 or more. I’m curious-Is your EA able to select high probability levels or you pre-select levels for members and they can use the EA for Entries, Stop Loss and Take Profit?

3. How soon can one start making pips with your strategy? I mean for one who has been trading, would he have to train for some long period of time like say one month upwards or can he start trading immediately if he watches you in the members’ area and demo trade it comfortably? I mean some courses or membership training can be unnecessarily cumbersome and takes undue confusing time before one grabs anything while some make you to hit the ground running. Why? I’m tired of staying long on expensive courses that end up ruining one’s account. Yours and DTFL seems to make sense.

4.I had debated whether taking DTFL or going for your TD’s. Why? I wanted one that will be simpler and faster for me to hit the pips because I’ve spent three(3) unnecessary years of wastage of resources and time on courses that ended up teaching but are not practical enough. I’m sincerely confused on which of these two to go for. Dale, help me out.

5. Is there any copier service?

Hi Dale,

Nice statistics but I am a little confused. You use a 12/10 method in your actual trading but your statistics uses a RRR of 1:1.

Can you explain what you mean and how to reconcile a 12/10 with a RRR of 1:1?

Many thanks.

Do you have the results from your swing trading?

Hi Dale,

I am a beginner trader just starting out. Are there any tips that you can recommend me and point me to the right direction. Much Appreciated!

Hi Gary,

I think you can start with this webinar here: https://www.trader-dale.com/market-profile-webinar/