Hello Guys,

My friend and a great trader Ziggy wrote an amazing article in the member’s section, and he was kind enough to agree to publish his work here for you. This article deals with a slightly more advanced technique of securing your position, by moving your SL with dynamic trade management. This type of trade management adapts more efficiently to the behavior of the market.

Ziggy, as always, he uses his meticulously accurate data that he has been putting together since September 2016. His research is based on the intraday levels I have been publishing for members every day. Still, you don’t need to apply his position management rules only for my trading levels. You can also use this approach for your own levels. I am sure you will find this article most interesting and helpful.

-Dale

Trading with Dynamic Stops – by Ziggy

Some time ago I put together a spreadsheet which entailed moving stops after a trade had moved in our favor and satisfied certain criteria. This has since become known as Ziggys Alternative Trade Management. As I mentioned at the time, I do not trade that way, but it was an approach which reduced risk on most trades.

I have been back through the charts and for my own benefit put together something very similar. It is not a strict rules-based approach, but one of using what you can see on the chart to move the stop loss to a location that reduces risk while still giving the opportunity to profit. It will always entail positioning the stop at a reaction point once the trade has been entered. I will say right up front that this will reduce the win/loss ratio, and some will find it frustrating to be stopped out of a trade only to then see it turn and reach a profit target. The benefit is that you protect your position sooner which can increase the actual reward to risk ratios of closed trades.

I will give a few examples below, of how I have moved the stop loss. Some are obvious while others are not as much.

Entering Positions – Initial Trade Management

I always use a 5-minute chart to make these decisions. In my case, I will always open a trade with a 20 pip stop and then look to move it when price action gives me a reason to do so which we will detail throughout this article

I will not take tested levels. For this analysis, I used what I could see on the chart to determine whether or not the level was already tested. If the price got to within 2-3 pips and ran the opposite direction by 10 or more pips, then I considered it tested. If it got to within 5 pips and then moved away 20, then I also viewed that as a tested level. If it got reasonably close and pulled away 50-100 pips, it’s also considered tested. Finally, if it gets pretty close on several occasions but doesn’t touch – that is also tested as there is a high probability that when it does touch, it will blast right thru.

In my opinion, ‘tested levels’ cannot be defined by hard rules! Learn to select the correct levels requires you to consider the context of the chart at the time.

IMPORTANT: Over the last year, I can confirm that trading tested levels (in an effort to further simplify an already simple strategy) IS PROFITABLE. With that being said, they are not as productive as untested levels. Therefore, when you are first starting out, you may consider not worry about whether a level has been tested or not. After you are profitable with that, you can then move forward with learning to determine whether or not a level has been tested.

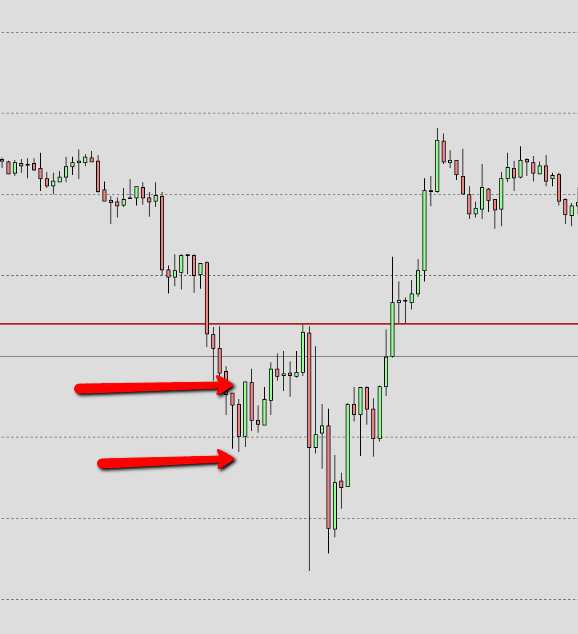

Trade Examples – How to Move Your Stop Loss

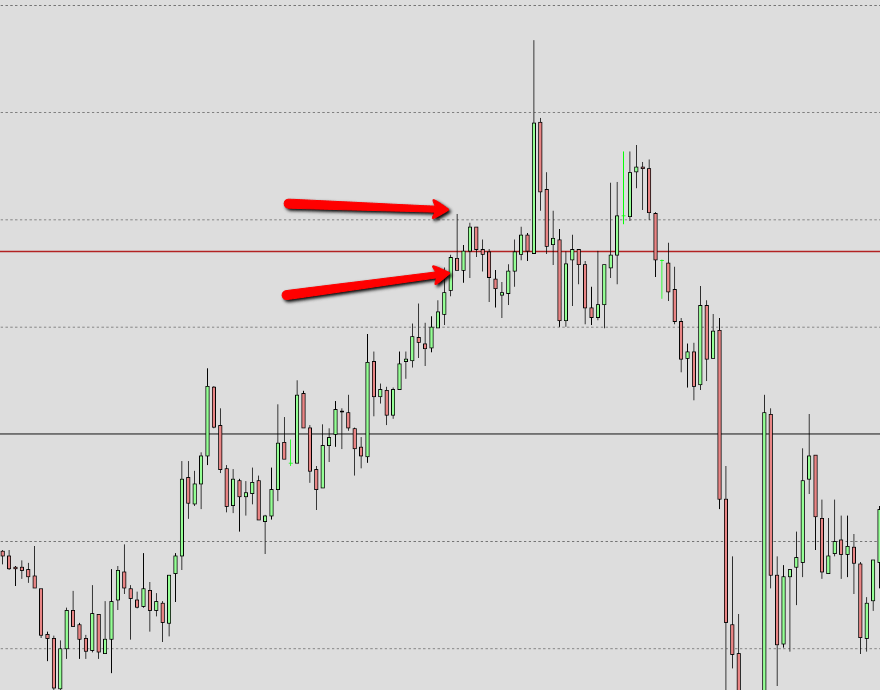

- The first example is a short trade from August 17th, 2017 on the USD/JPY. As soon as that pin bar closed, I moved my stop above it and took a smaller loss than I otherwise would have.

- The second example is a EUR/USD short setup, taken on August 17th, 2017. Once the 2nd pin bar closed, this confirmed that at least temporarily, there was some selling pressure. I then moved my stop loss, and ended up with a full take profit trade.

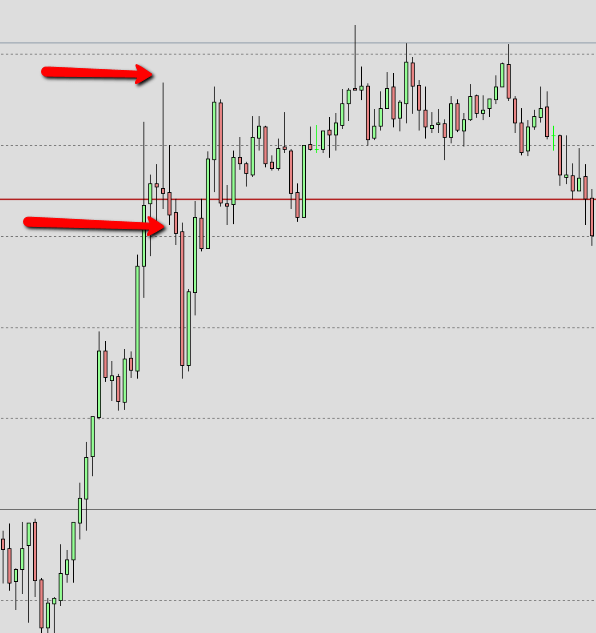

- In this EUR/USD long setup from August 17th, 2017 we have a less obvious trigger to move stops, as the bullish bars never actually broke out above the candle that triggered the trade. There was obvious selling pressure though, and so I moved my stop to protect myself from taking a full loss.

IMPORTANT: If there is not a relatively quick response to the level, then it has to be questioned whether or not Smart Money is still protecting this level. When you hover around the entry point, it is always a good signal to move the stop below/above the high/low since taking the entry.

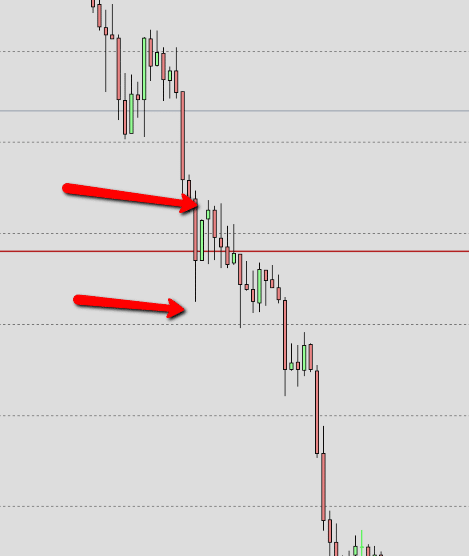

- In this example, I would have moved my stop as soon as the engulfing bullish bar closed, even though the trade was never in profit. In this case, I was pretty close to taking a full loss anyway – but it shows the principle of how I have chosen to reduce risk by stop moves.

When I open the trade with a 20 pip stop, I feel I am giving it room to breathe. Giving it a little extra room also enables enough time to see a reaction to the level to tighten up my stop loss.

After taking the time to trawl through each of the last 11 months worth of trades, I have decided that is the trade management style I will be using moving forward. To be clear I believe all approaches are profitable, but my focus is on capital preservation. I feel I have confirmed to myself that this approach will give me the best all-around performance, given my risk aversion.

I will also attach my spreadsheet to this posting so that anyone who is interested can carry out some “what if” calculations for themselves. Also, be sure to look at past examples where I have moved my stop, and hopefully will be able to see why I have done so.

Trade Log – Spreadsheet Download: Dynamic SL spreadsheet

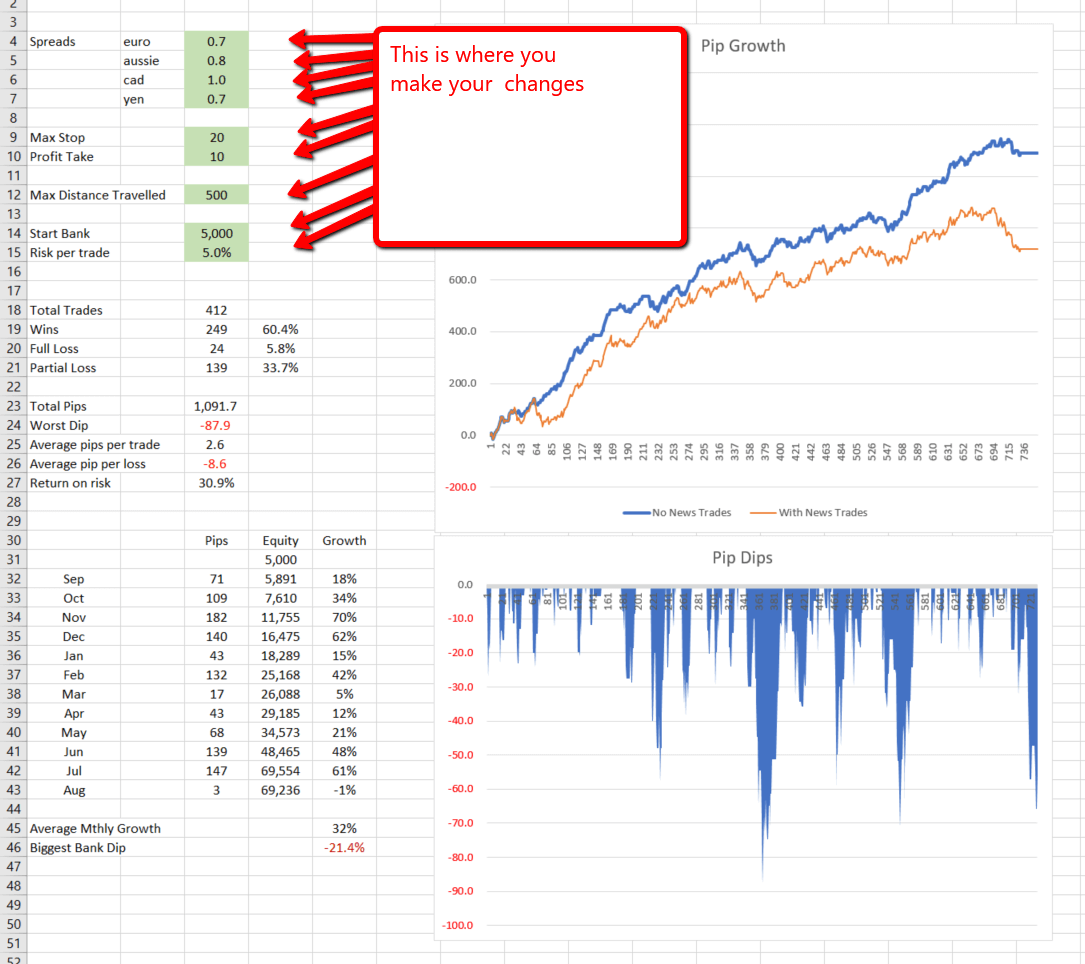

Anyone who has seen my past spreadsheet will know they can become highly convoluted if you add too many things to analyze. In this spreadsheet, I have stripped out all unnecessary “stuff” which leaves you with something I hope you can follow. It will open at a criteria tab, on which you will be able to make any changes you wish for the spread, maximum stop loss, take profit, trading account size, and the amount you risk per trade. You will then see the result in figures, including each months result. You will also see a pip growth chart, in addition to a chart which shows any drawdowns through that same period.

This is what the spreadsheet looks like and where you make your changes. The one thing you need to do is input your own spreads.

You will see an input for Max Distance Traveled (MDT). I made MDT an input in case you want to restrict the distance price has moved away from the level before considering it invalid. I initially set this up because I was concerned that some levels were “too close” to be valid. With that being said, I have found that the age of a level makes very little difference to the results.

I am very well aware that without fixed rules there will be variations in results. I’m not suggesting you change how you trade. I’m only sharing with you how I manage my trades and giving you the past results of managing your trades this way.

Obviously, different profit targets give different results, but strangely enough not in a huge way. I would encourage you to test that for yourself as well! The real difference comes from the size of the initial risk and how that risk is managed throughout the trade. By decreasing your average loss size, you will by default increase your reward to risk ratio of closed trades. The R/R ratio of CLOSED TRADES is by far the most important measure of reward to risk.

On my analysis, only 6% of trades go to a full 20 pip loss using this style trade management with an initial 20 pip stop loss and 15 pip take profit. Based on those numbers, the average loss ends up being around 8 pips. If all winning trades are closed for 15 pips, and all losing trades averaged 8 pips, then you have an ACTUAL reward to risk ratio of nearly 2 to 1. That is after starting out with a reward to risk ratio of less than 1 to 1!!

This is why I say ACTUAL reward to risk is far more important than INITIAL reward to risk.

Cheers Ziggy (long time member)