Hello guys,

September is over so it is time for the monthly statistics. Let’s start with the intraday trades:

INTRADAY TRADES

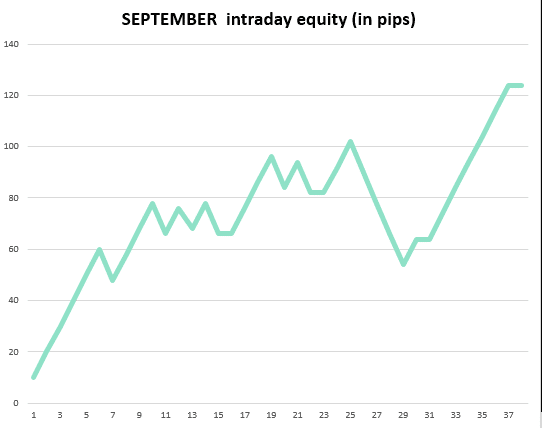

There were 38 trades in total, which is in average roughly 2 trades per day. There were 24 winning trades, 10 losing trades and 4 trades that ended around break even. The overall result was +124 pips profit.

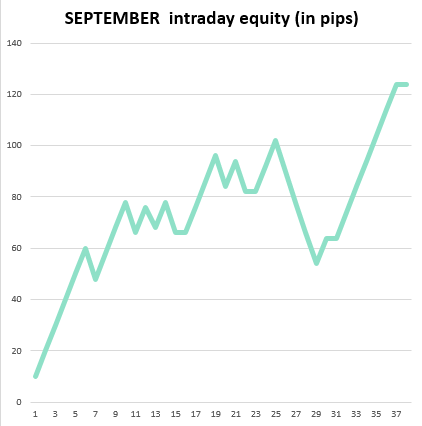

If you look at the equity curve you can see that there were 2 very nice winning streaks at the beginning and end of the month. The middle of the month was rather flat. You can see how important it is to take all the trades and not miss any period. If you, for example, missed just 3 days (27.9. – 29.9.) you would miss 6 winners in a row, which would really be a shame.

I am glad that asian session trades work really great even with simple stupid limit orders. There were 6 trades in asian session, 5 winners, and only one loser this month. This one loser was caused by unexpected news from North Korea (shame on you Kim). When I first started trading asian sessions I was a bit afraid because I wasn’t at my computer (asian session is when I sleep) and wasn’t able to watch the charts. Therefore, I had absolutely no control over my asian session trades. It took some time to gain confidence in trading like this but in the end, it is totally worth trading asian session this way. Asian session is usually calmer and doesn’t have too many news. For that reason, market reacts really nicely to key levels and very rarely runs through them.

Again, it proved pretty crucial to have a solid broker with tight spreads. There were some trades that would only be winners with tight spreads. If you are still struggling with your broker you may consider switching to one of my recommended brokers.

Here is a table and equity of all September intraday trades:

Results were generated using a Simulated Trading Account and are Hypothetical.

SWING TRADES

There were only 3 swing trading opportunities this month. My first level on aud/nzd got tested just a tiny bit sooner which is a shame since there was a really nice reaction to it. My first eur/gbp long level was a pretty quick loss. The market went straight through this strong long level and there was basically no way to prevent or avoid a loss there. After that, my swing trades went pretty smoothly with two winning trades on eur/gbp and aud/cad.

* I am using the ALTERNATIVE STOP LOSS APPROACH for my swing trades.

SUMMARY

After quite a tough August, September was a pretty good month. Sometimes a bit slow with not as many levels as usual but still the overall result was pretty nice.

Happy trading!

-Dale

PS. If you would like to trade with me every day, you are very welcome to join me here: DALE’S PRO FOREX COURSE

Keep it up with the consistent monthly updates for us who are yet to join the course. Good job you are doing Dale

just wondering as i have seen you’r videos why the loss in a single trade exceeds the win, i was of the opinion that you advocated a 2:1 stop loss to win ratio??

which by my reckoning means that your winning trades should have been returning 24 pips,

i take it that these intraday trades are not traded using the same system,

Hello Andy,

I didn’t advocate 2:1. I trade 10/12 for quite a long time. Some of the members also use different variations. For example this one: https://www.trader-dale.com/ziggys-easy-2020-method-66-68-strike-rate/

just curious why, when reporting profits, no one ever seems to take into account the commissions paid to the broker. In most cases if the spread is low (0.1pip) the commission is about 0.75 pip., roundtrip. So with 34 trades that comes to 25.5 pip. You still made profits but it does take a significant bite out of the total.

Hi Al,

sure you need to calculate costs. Problem is everybody has different costs so for that reason I publish the results without those. I also try to help people finding the best brokers so their costs are as low as possible. My commission for roundtrip is around $6-$7 and spreads 0, or really close to 0.

My friend Sterling helped me make a video about brokers. Check it out, I hope you will find it helpull:

https://youtu.be/ED0Rj9dvQC4