Hello guys,

today’s post is going to be a Swing trade analysis. This means we will be looking at higher time frames – in this case, Daily time frame.

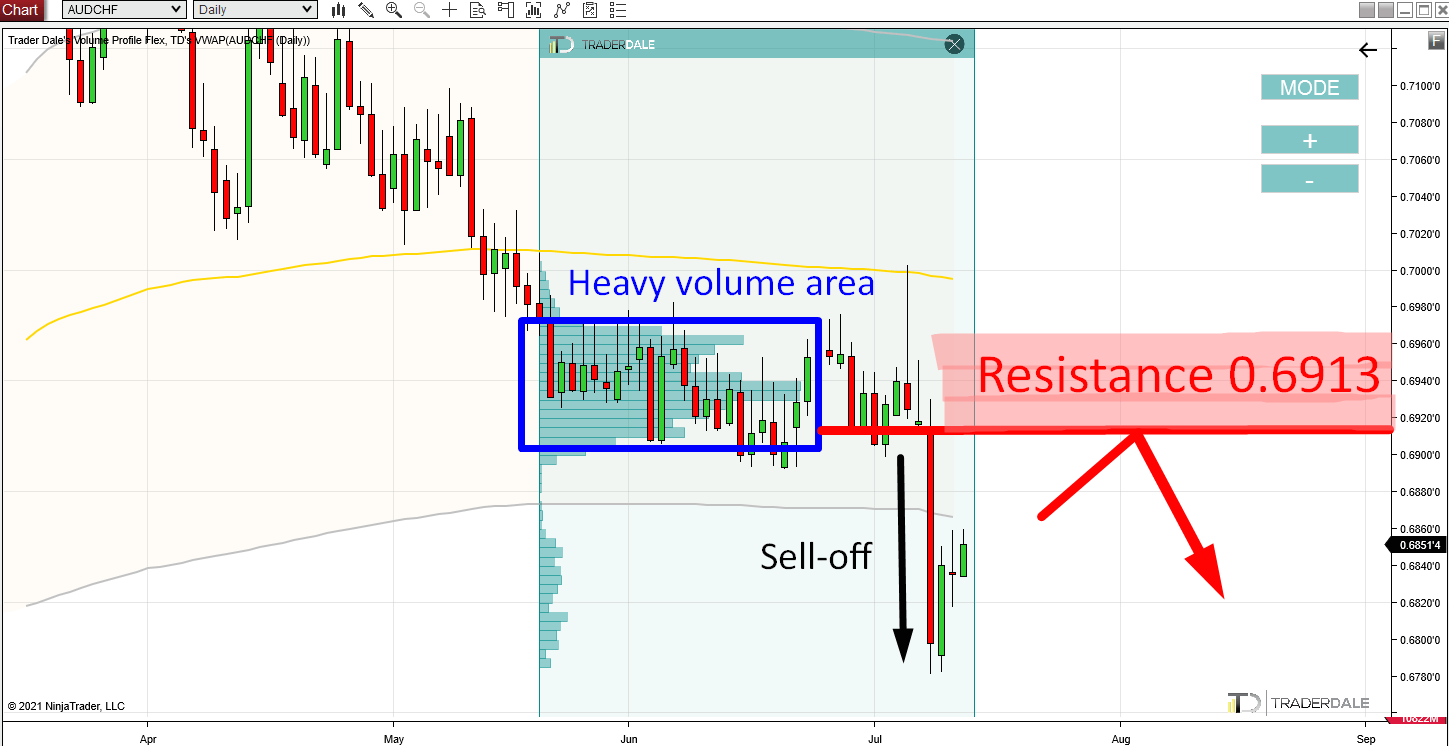

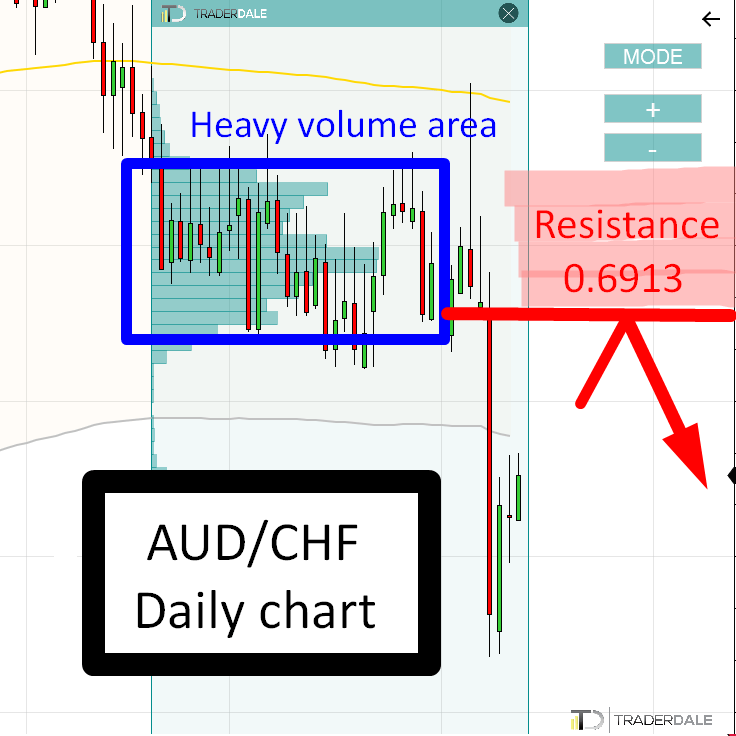

The pair I want to have a look at is the AUD/CHF.

Last week, there was a really strong sell-off on the AUD/CHF. The massive bearish Daily candle that formed on Thursday made over 100 pips in just one day. Such a huge daily range is not too common for the AUD/CHF!

What does such a strong sell-off mean? It means strong institutional Sellers!

Those Sellers were slowly accumulating their Short positions in the rotation that lasted the whole month of June.

You can see their heavy volumes in the June rotation by using my Flexible Volume Profile indicator.

AUD/CHF, Daily chart:

When the price makes it back into this heavy volume zone again, then the strong institutional Sellers are likely to defend it and push the price downwards again.

This zone is important for them, because they placed a lot of their Short positions there.

For this reason, the heavy volume zone (starting at 0.6913) should work as a Resistance. We just need to wait for a pullback…

This Volume Profile setup is called the “Volume Accumulation Setup“. It’s one of my most favorite trading setups!

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

P.S. If you would like to learn more about trading with Volume Profile, then this is your chance! There is currently a massive discount on my best educational & indicator pack – THE ELITE PACK. Check it out here:

Hi Dale! About Swing Trade how you manage the Stop? On Daily Levels Stop are quite big?

Stops are based on trading levels and other deciding parameters. An effective risk management plan is always there before decidind TP & SL

Dale have you checked the volume profile on trading view? Is it enough for identifying volume based support and resistance?