Hello guys,

today’s day trading analysis will be on AUD/CHF. But before we start here is some news for you:

Recently, I made a private Volume Profile webinar. You won’t find it available for public on YouTube or anywhere else, but you can get to it by clicking the gray banner at the top right of this page (saying Volume Profile Webinar, Watch Now). Enjoy!

Let’s get to the AUD/CHF analysis now!

A Rotation And A Trend

One of the first things I look for when going through the charts each morning is a “formation” where a rotation (price channel) breaks out into a new trend.

A rotation usually means heavy volumes. The reason is that the BIG trading institutions usually accumulate their trades in a rotation.

A trend that follows after a rotation is telling us that those BIG guys have entered their trades and are now manipulating the price to move.

This is quite a valuable piece of information because it tells us where the institutions were entering their trades – in other words: which place is important for them (rotation zones). And it also tells us whether those BIG guys were Sellers or Buyers (Uptrend = Buyers, Downtrend = Sellers).

In this case, it seems, that strong Sellers were building up their Short positions in the area around 0.6788 and then they manipulated the price to go downwards.

Volume Profile

What makes identifying the BIG guys easy is the Volume Profile indicator. If you look at it, then it tells you right away where the most important activity in the chart was.

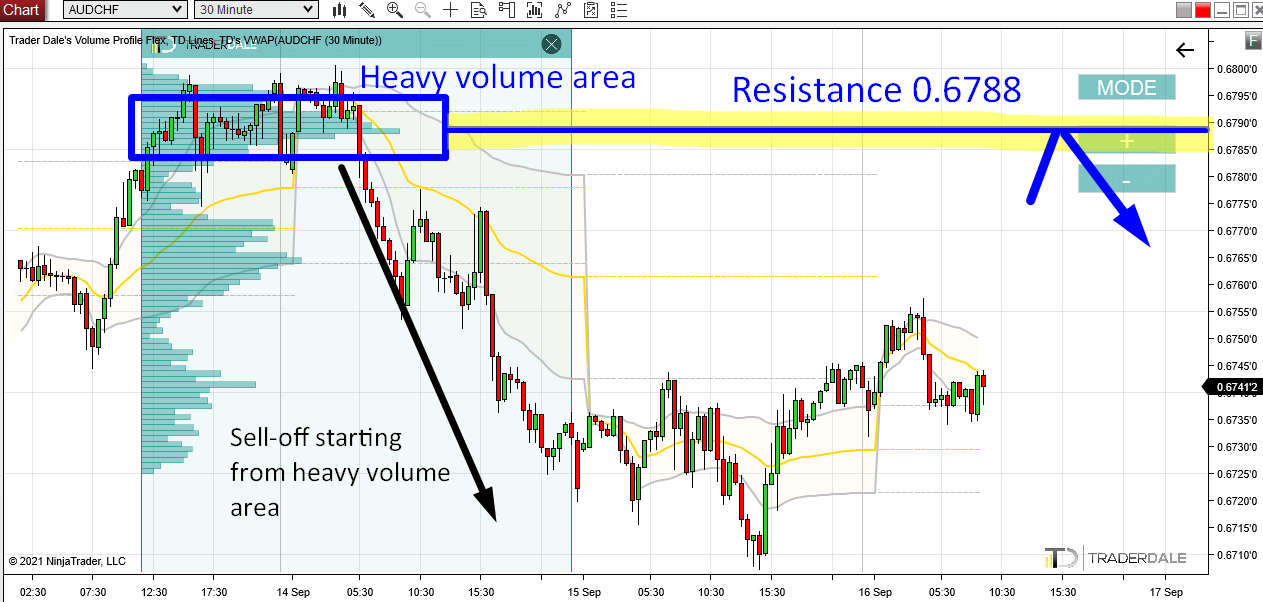

In the picture below, you can see the heavy volume area clearly stand out. This confirms that the heaviest volumes were accumulated in the rotation around 0.6788.

AUD/CHF, 30 Minute chart:

The picture above clearly shows that there was an important institutional zone around 0.6788.

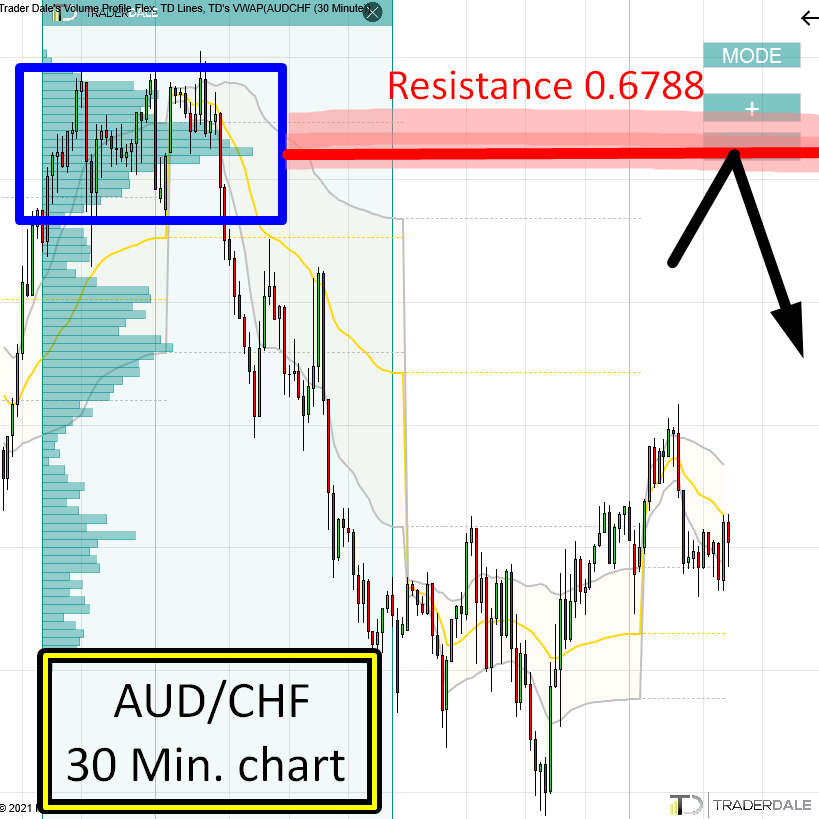

Wait For A Pullback

When the price makes it back into this zone again, then it is quite likely that the BIG institutional traders who placed their Shorts there will want to enter new Shorts in this area and manipulate the price downwards again. Or, that they are still in their Short trades and they will want to defend them – by manipulating the price downwards.

In either case, this heavy volume zone should represent a strong Resistance and when there is a pullback to it in the future, the price should react to it.

The Volume Profile setup I used here is called the “Volume Accumulation Setup“.

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

P.S. Recently, I made a private Volume Profile webinar. You won’t find it available for public on YouTube or anywhere else, but you can get to it by clicking the gray banner at the top right of this page (saying Volume Profile Webinar, Watch Now). Enjoy!

Good analysis, waiting for price to reach this zone

Hello sir,

I really want to buy the elite pack due the the currency difference between the euro and xaf its hard. any discounts please?

Hello Asaah,

For discount related inquires, please email me on contact@trader-dale.com