Hello guys,

This article will take a deeper dive into Market Orders as well as Limit Orders. I will break down how retail traders use them (that’s us) and how BIG trading institutions use them.

One could think that such info is useful only for day traders or people trading with Order Flow. This is, however very far from the truth! Understanding how Market and Limit Orders work and how to use them will help you to understand how the markets work overall. Not just on the faster time frames!

Market VS. Limit Orders - The Main Differences

MARKET ORDERS

Market orders are used by “aggressive market participants”. An aggressive market participant is anybody (you, me, an institution,…) who wants to enter their trade NOW.

A problem is that if you want to enter (or quit) your trade now, there may not be a counter party to your trading order (when you Buy, somebody needs to Sell it to you).

EXAMPLE: Imagine you want to Buy 10 Lots of the EUR/USD at 1.1900 but currently, there are not enough people willing to Sell at this price. As an example, let’s say that at 1.1900 there are only 5 Lots available. An additional 5 Lots are available, but only for a higher price – 1.1901.

If you enter with a Market Order, then you want to enter your whole trading position NOW. No matter what the price is! So, in this case, you Buy 5 Lots for 1.1900 and 5 lots for 1.1901.

Pros & Cons Of Market Orders

The upside of Market Orders: You enter your whole trade NOW.

The downside of Market Orders: If there is not enough liquidity, then you will have slippage. In other words, you will enter (or quit) your trade (or a part of it) for a worse price.

As a side note, this is also why it is critical to have a good broker with good liquidity!

LIMIT ORDERS

Limit orders are used by “passive market participants”. Again, this can be everybody – you, me, Goldman Sachs; anyone who enters their trade with a Limit (pending) order.

A Limit Order is considered passive because you place it and you wait until the price reaches it. You are passive. You don’t need to enter your trade now. You wait until the price comes to you – to a trading level where you are willing to Buy/Sell.

EXAMPLE: You want to Buy 10 Lots of the EUR/USD, and it is important for you that you buy it at 1.1900. You enter a Buy Limit Order for 10 Lots at 1.1900. Then you wait = you are passive.

When the price makes it to 1.1900 and there are enough people willing to sell for 1.1900, your order will be filled.

What can happen with a Limit Order is that when the price makes it to 1.1900, the Sellers will only be willing to sell 5 Lots. In this case, you will buy 5 lots and that will be it. You will need to wait again for the price to go to 1.1900 in order to get matched with some more sellers who will sell you the remaining 5 Lots.

See the difference? With Limit Orders, you don’t chase the market. You are only willing to trade at 1.1900. The risk here is that you will get filled only partly. Don’t think this happens only with big trading positions. This can happen also with smaller ones (even below 1 lot).

Pros & Cons Of Limit Orders

The upside of Limit Orders: You will get filled at EXACTLY the price you choose, no slippage.

The downside of Limit Orders: There may not be enough liquidity (counter party to your trade) at your price level and only a portion of your trade would be filled.

Should I Use Market Or Limit Orders?

So then, should you use limit or market orders? Like most things in trading there isn’t a set answer for everyone.

If you need to enter your trade NOW, then you should use a Market Order. Additionally, highly liquid pairs will tend to have less slippage thus taking away some of the risk of using a Market Order.

I personally prefer Limit Orders. The reason is that I have a complete control over the exact price where my trade gets filled.

An important thing is that I have a good broker with deep liquidity pool. This means that I don’t have problems finding Sellers when I want to Buy and Buyers when I want to Sell. This still holds true when trading less popular trading instruments.

Regardless of whether you choose to use Limit or Market Orders, having a good broker is crucial

If you are interested in who I trade with as well as why I trade with them, then you can check out my recommended broker by clicking the banner below:

Do BIG Trading Institutions Use Market Or Limit Orders?

Hedge funds, banks, pension funds… All those BIG institutions don’t use Market or Limit Orders exactly as retail traders do. Yes, the rules are the same for them but because they have enormous amounts of capital to allocate, they play the game a bit differently.

To put this very simply – institutions do two things:

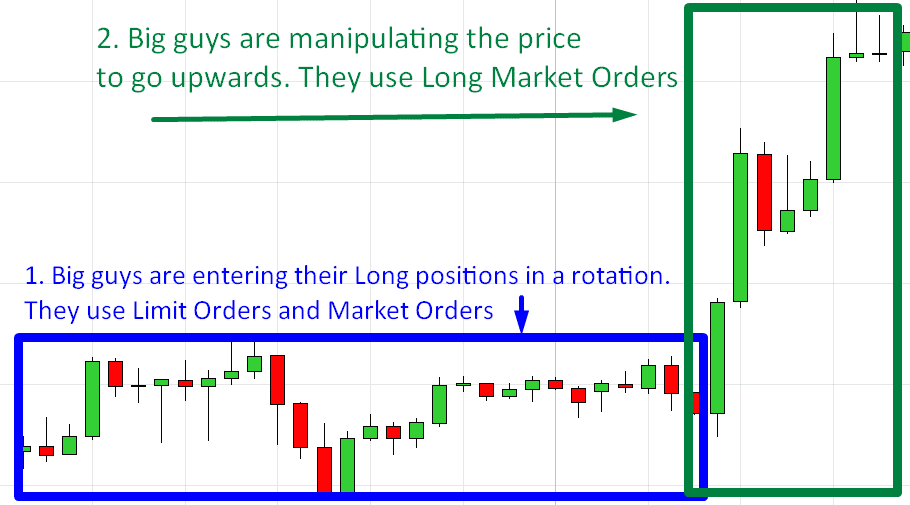

1. BIG Institutions Accumulate Their Trading Positions

Trade accumulation means that institutions are entering their huge trades slowly. It’s not a one-click situation for them (like it is for us). Instead they need time because their capital and trading positions are too big.

They are entering their trades slowly in areas where the price goes sideways (a rotation), in areas where the price doesn’t move too much. Why?

Because they need to enter their trades secretly. Goldman Sachs doesn’t want anybody to know that they are buying crazy amounts of the EUR/USD, right? This would start a trend and they wouldn’t be able to fully enter their trades before the market took off. Because of this they need to enter their trades unnoticed – in a rotation.

How do they do it? They have algorithms that are entering both Market Orders and Limit Orders automatically. Very often by just small 1-2 Lot amounts, but super fast (such orders are called the “Iceberg Orders”).

In a rotation it doesn’t really matter if they use Market or Limit Orders. The reason is that the price doesn’t move a great deal during these range bound periods of time. Why do they use both types of orders then? To mask their intentions!

A Little Extra

***WARNING: Only read this last part if you are ready for a headache. Otherwise, you can skip it :)***

When they enter a Limit Buy, then it gets filled at the Bid. When they enter Market Buy, then it gets filled at the Ask price.

So, if they Buy 1 Lot with Limit Buy, and then 1 Lot with Market Buy, then 1 Lot will show on Bid, 1 Lot on Ask (you can see this for example with Order Flow software). The funny thing is that the institution has just bought 2 Lots.

Confusing? Good. It should be confusing as they’re doing their best to hide their trading activity.

2. Big Institutions Manipulate The Price

After they have entered their huge trading positions, the institutions need to move the price in order to make some money with those positions.

If they had been accumulating a huge Long position on the EUR/USD, then they need to push it upwards – into an uptrend. This will make those positions profitable.

How do they start an uptrend? This is where Market Orders come into play! They will start placing a lot of Market Long Orders. This will start to move the price higher. You can imagine this as them shouting, “We are Buying all there is, we want it now!”

Other market participants will see all those aggressive Long orders and they will start to join in the party thus creating a snowball effect. This is how the manipulation works – through Market Orders.

A good time for this is during significant Macro news releases because during macro news this does not look like market manipulation but only as a reaction to macro news.

I hope you guys liked this article. There is a bit more to this topic so let me know if you found this interesting and if you want me to do a 2nd part 🙂

Happy trading,

-Dale

Sometimes I tried to understand if the lateral phase of the market is accumulation or distribution while it is forming by examining the cumulative delta. From this article I understood that Is it not possible to determinate it, by doing suh analysis. Is it so?

Great and very useful article!

Thank you very much Dale.

I’m not sure if I understand your question Glacomo, would you be so kind to reach me at contact@trader-dale.com with a bit further clarification? Sorry! 🙂

Thank you Dale. Limit orders on the bid side and market orders offer side. Two independent activities but both are reflected in the spread. Hopefully I got this right.

Thanks for the excellent explanation Dale.

You’re welcome Elizabeth

Thank you T.Dale to share your expertise, the article is great… Please do a part 2… 🙂

You’re welcome Jean, thank you!

Dale,

I have enjoyed this article, which I call a lecture and am thirsty for part 2 of this. This is really great and I say: “Forward ever, Sir!

Thank you David!

thank u so mush

i hope u read the 2 article about how we enter the position in orderflow trading fore but analyse in future so ther is some diffrent time between them and we lost couple of pip

My pleasure James. I actually did that already, have a look: https://www.trader-dale.com/order-flow-volume-profile-live-trading-usd-cad-futures/

It’s not hard to calculate levels from futures to spot fx, I explained that in both of my video courses.

Thanks Dale. This article is paramount for traders. It helped open my eyes to what I witnessed in the market but failed to understand. The extent of manipulation in the market seems to be limitless for institutions. Are there any limitations that we can take advantage of when the market makers intent is disguised?

It’s a superb article, enjoy learning. Thanks for sharing, looking forward to part 2.

Thanks Nelson!

Nothing is more enjoyable. Have seen the big guys manipulate the price on several occasions, esp during red news releases like you said, e.g there was a market manipulation on the Eurusd on Tuesday during US CPI data release at 12:30 GMT . Looking to trade from there ??. BTW, can’t wait for the second part. Very insightful as usual!

Thank you Tim! 😀

Thank you dale .. I’m waiting for 2nd part

Thank you Ahmed!

Thanks dale..lets see the next part please!

Thanks Sami!

More please ??

Always Tom! 🙂

Interesting! Informative! Insightful!

Please do part 2.

Thank you Tikesh!

Very GOOD!

Thanks Dale!

Waiting for the part 2….

See you

Thank you Francesco!

Thank you Dale for all your books, honesty and knowlegde you are sharing.

There is noone like you which is so straight forward in sharing value without exagerating or promoting anything false promises. Its all probabilities but your knowlegde is the part most are missing.

To all the traders:

This exact knowlegde is why you can trade Breakout Rotation setups.

You can trade them in a trend or at unfair/low volume areas at the extremes (best with the kontext).

Mark your accumulation (rotation) Zone, wait for it to breakout and retest and off it goes.

If it comes back into the accumulation zone and closes there, setup is invalid. After the breakout, the next candle can retest but must close outside for you to make the trade.

Happy trading

Thank you for your kind feedback and valuable insights Tschi, cheers!

A great detailed explanation of something that most traders simply gloss over thinking that as long as we know how to enter/exit, that’s all what is needed. Understanding the logic and mechanics behind the action can definitely have a positive impact on one’s trading – thanks for the information and certainly a 2nd part will be welcome!

Thank you Avi!

Very helpful, definitely part 2… every article you post is like one step closer to success for me…thank you very much

Thank you Spiros!

Hi Dale, Great article looking forward to part 2!!!

Thank you Shahan!

HI Dale , really enjoyed the artical really set me straight on this topic and would love to hear more ?, Cheers

Thank you Gavin!

Is your order flow software compatible w think or swim

Hello KAZI

I am sorry, it is not compatible with TOS

Dale, It is so eyes-opening article!!! Thank you very much for that

Thanks Dale,

I found your article very enlightening and look foward to your second.

John B

yes absolutely more of this please, its funny you say read the extra if you want a headache, but the real reality is when you try this trading game without all this information THATS A REAL HEADACHE, that is what i was doing for all these years, so thank you Dale, this is EXTREMELY helpful , just to know the WHY behind these moves in the price, extremely helpful