This article is a part of a four-part Beginners Guide to Stock Investing. Here are links to all parts:

Welcome to the Beginner’s Guide to Stock Investing!

Here, I will guide you through the most important aspects of picking the right stocks at the right time. But before that, I would like to talk about why we should even care about stock investing.

If you are a trader who is day-trading or swing trading then your focus is on faster time frames and on growing your account bit by bit. That’s completely fine and that’s what I also do and teach in my trading courses.

What I like though, is diversification. I like to get something from day trading, something from swing trading, and also something from long-term investments.

Money needs to be used to make more money. I hate having too much free capital in my bank account as it loses its value over time. This is called inflation.

Inflation

Inflation is basically a tax on people who save money. Now inflation is rising worldwide and consuming more and more of our real buying power.

The long-term average inflation worldwide is 5.4%. This is an average since 1981. This means that your real buying power decreases by 5.4% every year. In other words, your savings are worth less and less every year.

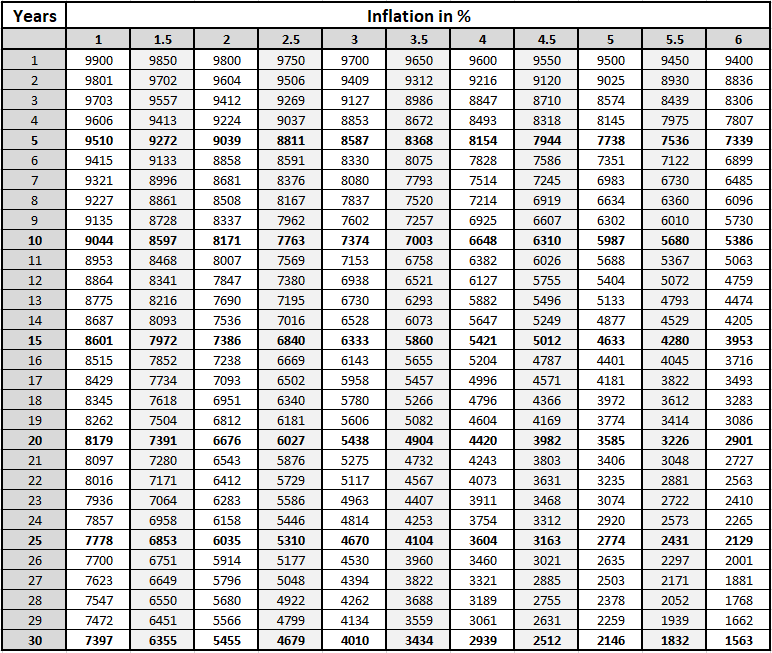

I would like you to check out this chart. It shows how $10.000 gets diminished by inflation over time. The top row shows inflation – from 1% to 6%. Below that you can see how much the inflation takes from an initial capital of $10.000.

Using a yearly inflation rate of just 2.5%, our original $10.000 would only buy $7.763 10 years later. Yes, you still have $10.000, but the real buying power is $7.763.

After 20 years (with inflation 2.5%) you only have $6.027.

Keep in mind that 2.5% is a very low inflation rate. If the inflation was for example 4%, which is not unrealistic at all – then $10.000 would be down to $6.648 after 10 years, and to $4.420 after 20 years.

Inflation is quite the killer, isn’t it? The worst thing is that you don’t even notice it because nominally you still have the same amount of money. It’s the real buying power that is dropping.

The inflation is a reason why it is so important to invest your money, not just sit on it.

Inflation-linked bonds

It is not actually that hard to beat the inflation, if it is within some relatively “normal” range. There are financial products that were made just for the purpose of beating the inflation.

Those are called “Inflation-Linked Bonds” or “Inflation-Protected Bond ETFs”.

Inflation-Linked Bonds are usually issued by governments. Those bonds are linked to inflation and their purpose is solely to protect you from inflation.

Here are two big ETFs to cover the inflation:

SPDR® Bloomberg 1-10 Year TIPS ETF: https://www.ssga.com/us/en/intermediary/etfs/funds/spdr-bloomberg-1-10-year-tips-etf-tipx

Schwab U.S. TIPS ETF: https://www.schwabassetmanagement.com/products/schp

Stock Indexes

If you want to get more than just to match the inflation rate, then the next step is investing in stock indexes.

A stock index is essentially a basket of stocks. In this basket, there are the biggest companies in the country or economy you choose (for example USA, Europe, Australia, …). When you buy the index, you don’t buy stocks of those companies separately. You buy the whole basket of stocks. This enables you to invest in a lot of companies really easily.

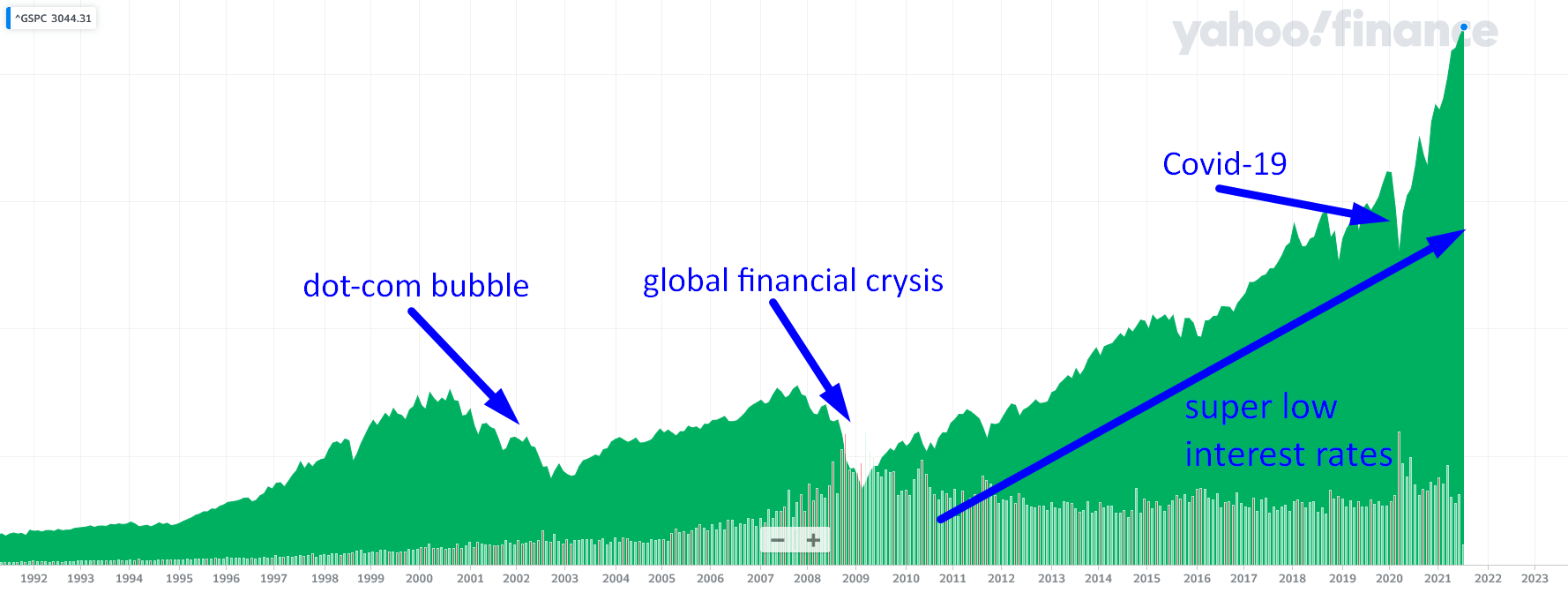

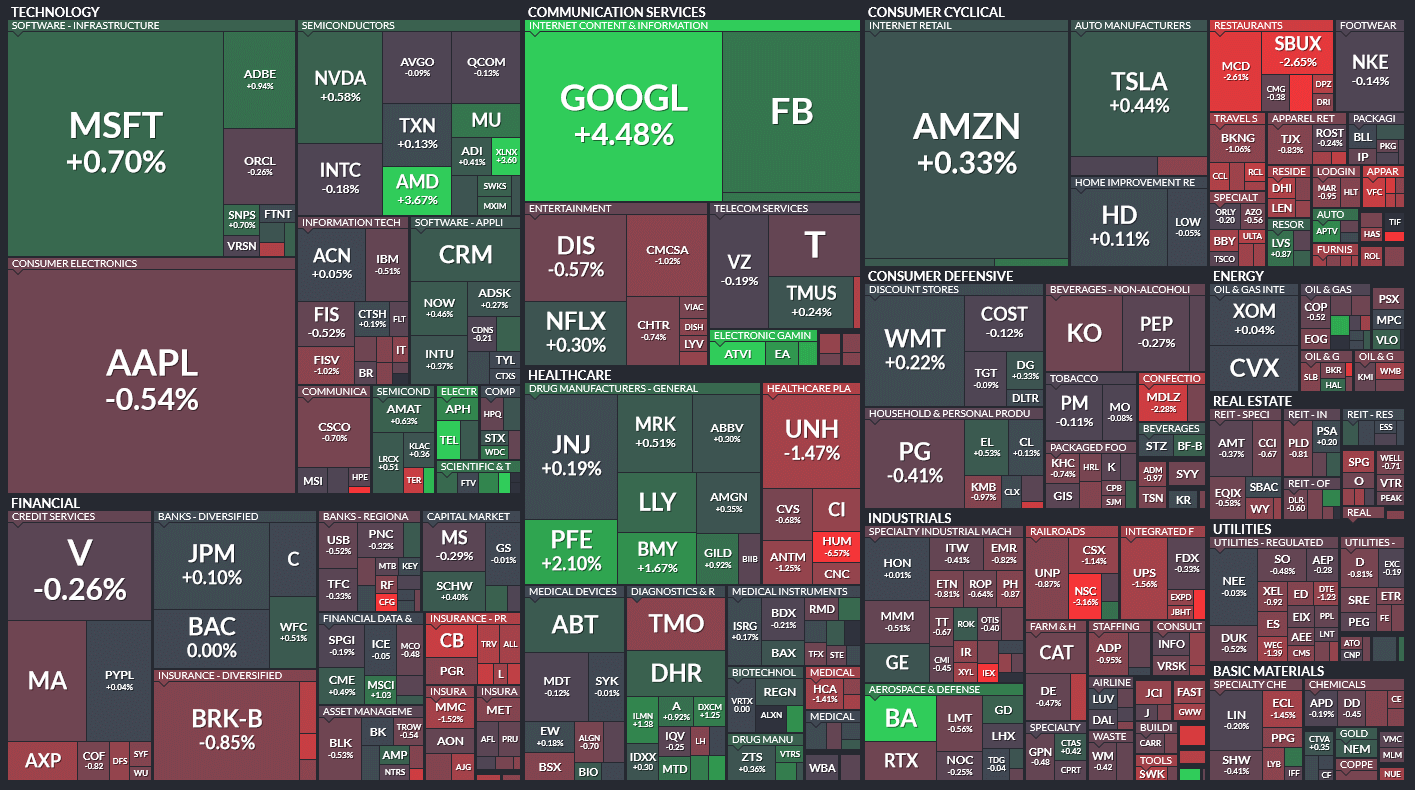

Below is a picture of the S&P 500 index – the most important index that gauges the US economy. This index comprises of 500 stocks like Apple, Microsoft, Amazon,…

When you invest in the index, you buy little parts of each company that is listed in that index. So, if you buy the S&P 500 index, then you have a little part of Apple, Microsoft, Amazon, … and many more stocks that are part of the S&P 500. All with one click. Easy.

Advantages of index investing

Index investing has a couple of advantages:

You don’t need to be an expert on picking stocks: When you buy an index, you simply buy every company that’s in the basket. There is no room for cherry picking.

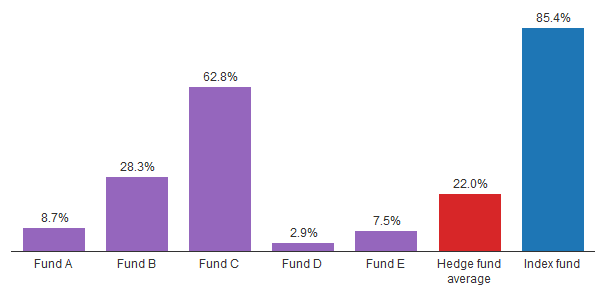

It’s better than investing with a fund: This is a sad fact, actually. Most of funds fail to outperform a simple stock index. Have you heard about the bet between Warren Buffet and a couple of hedge funds on who would perform better in 10 years? Whether actively managed fund or an index? This was the result:

As you can see a simple index outperformed all the funds dramatically.

No management fees: The standard price for an actively managed fund is 2% manager fee (you pay this every year no matter how the fund performs) plus 20% performance fee (paid from the gain they make). If you buy an index, this is money you save.

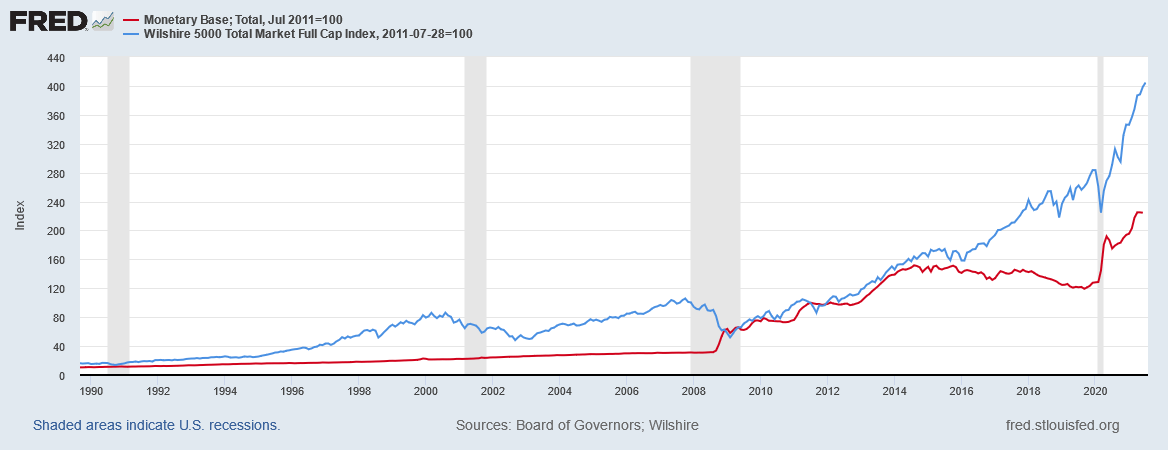

Indexes and stocks are a good protection against inflation: If you buy a stock of a company or a full basket of companies (an index), then you will be naturally protected against inflation. The reason is that stock prices are tightly connected and correlated with the amount of money that central banks print and pump into the economy.

Simply put: the more money gets pumped into economy (inflation), the more stock prices rise.

The chart below shows Monetary base (amount of money pumped into US economy) compared to US stock prices. It nicely demonstrates how closely linked those two are.

Disadvantage of index investing

There is one huge disadvantage to index investing. The thing is, that when you buy the basket of stocks (index), then there will inevitably be stocks which you don’t want.

It is not really about the number of stocks that you don’t want in your basket rather than their weight.

The thing is, that all stocks don’t have equal share in the basket. For example, if you invest into S&P 500 index, then your basket will inevitably have around 7% Apple stocks and 5.6% Microsoft stocks…

Just two biggest companies take over 12% of your basket of 500 companies! And both are from the “Technology” sector which is in my opinion very risky and very fragile.

If you buy the whole S&P 500 index, then roughly 25% of your investment will be in companies from that risky Technology sector. And then next 20% in a Financial sector, which I find the most risky and fragile sector of them all.

You can see the weight of the sectors in the picture below:

Do you see where I am going with this?

If you buy a whole index you will own many very risky stocks you would normally never have bought. This is what brings a lot of risk to your investment.

And this is what leads us to stock investing.

Stock investing

If we compare stocks and stock indexes, these are the advantages of individual stock investing:

Pick only stocks you like: The big advantage of stock investing compared to index investing is the ability to pick only the stocks we want. With index investing on the other hand, you always need to buy all stocks from the index. No cherry picking. You buy all of it, the good and the bad.

Outperform the index: If you pick the right stocks, then you can outperform the index. The goal to stock investing should always be to make more money than you would make if you just bought the whole stock index.

Endless opportunities: Another advantage to stock investing is that there is a huge amount of them to pick from. Hundreds and thousands of good quality companies! With this many stocks to pick from, you will never run out of opportunities.

What’s next?

In the next part of this beginner’s guide to stock investing, we are going to talk about economic sectors. Those massively impact the performance of stocks within each sector.

Choosing the right sector to pick your stocks from is absolutely crucial step that needs to be taken BEFORE you start picking individual stocks.

This article is a part of a four-part Beginners Guide to Stock Investing. Here are links to all parts:

Stock Investing Course

Want to get a complete A-Z course on stock investing? We’ve got you covered! In my brand new course, I will teach you everything you need in a series of 70 videos (15+ hours total) and give you all the indicators & tools you are going to need along the way!

I made a payment yesterday and I still haven’t gotten any feedback yet. Kindly reach out!