This article is a part of a four-part Beginners Guide to Stock Investing. Here are links to all parts:

Many beginner investors make one very serious mistake. They jump right into picking stocks without thinking about the broader context.

What do I mean by the “broader context”? By this, I mean the “SECTOR” to which a given company belongs.

The sector into which a company belongs hugely impacts how companies in that sector perform. In my opinion, choosing the right sector/sectors to invest in is equally important as picking the right stocks.

There are 11 Sectors

Stocks fall into 11 sectors and each has its specifics. The sectors are:

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Energy

- Financial

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

What I recommend is thinking very hard about your choice in which sector you are going to invest in. There are sectors I like – for example Basic Materials, Consumer Defensive, Healthcare, … as there are also sectors I avoid investing in – Financial, Technology,…

To be able to make a good decision about which sector to invest in and which to avoid, you need to know the specifics of each sector. In this article, I will list a couple of picked sectors and their most important specifics.

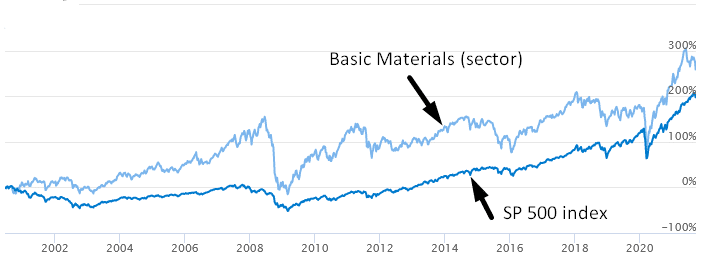

Basic Materials

Basic Materials sector includes companies that specialize in discovery, extraction, and processing raw materials. Raw materials are natural resources such as: Gold, Silver, Iron Ore, Coal, Oil, Natural gas, Stone, Wood, …

Leading companies are: Linde, BHP Group, Rio Tinto, …

Basic Materials: Sector Specifics

Sensitive to business cycle: Companies from this sector provide materials mostly for companies dealing in construction. Those companies thrive when the economy is doing good, but not so much when there is a recession. That’s why this sector is sensitive to the business cycle (to how the whole economy is doing overall).

Good Book Value: Companies in the Basic Materials sector need to own a lot of tangible and expensive assets to operate (machinery, buildings, land,…). This is sort of a universal fact in this sector. Having a lot of tangible assets means that the company has a good book value (“real value”).

A good book value is important, because it means that the company owns a lot of tangible assets. If the company went bankrupt then it can sell all those assets and use the money to pay off their debt and also pay the shareholders (you).

Consumer Defensive

This sector comprises of companies that provide essential products to retail customers. Products that people will always buy no matter the economic cycle – no matter if there is a depression or if the economy is booming. This makes the Consumer Defensive sector a very interesting choice!

Typical examples are companies that deal in: basic foods, beverages, household goods, hygiene products, alcohol, tobacco, …

Stocks in this sector are not too volatile, they pay regular dividends and have quite consistent growth which is not dependent on the economic cycle. Those are the reasons why I like investing in this sector.

An interesting fact is that this sector is the 2nd best performing sector in the long run (since 1962 until 2021). The average annual return was 8.20%. Slow and steady wins the race

Leading companies are: Walmart, Procter & Gamble, Coca Cola, …

Consumer Defensive: Sector Specifics

Not dependent on the economic cycle: Companies in this sector provide essentials that people buy no matter what. For this reason, the Consumer Defensive sector performs quite well even during recessions.

Stable & solid dividend: Because those companies don’t rely on the business cycle too much, they are able to pay stable dividends even in bad times. This makes them an interesting choice. Especially the tobacco companies, which have an average dividend of astonishing 6%!

Healthcare

This sector includes companies that manufacture drugs, provide medical devices and instruments, do medical research, companies who provide healthcare services, companies that focus in biotechnology, etc…

The Healthcare sector is one of the largest sectors in the US economy, making up to 18% of the whole Gross Domestic Product (GDP).

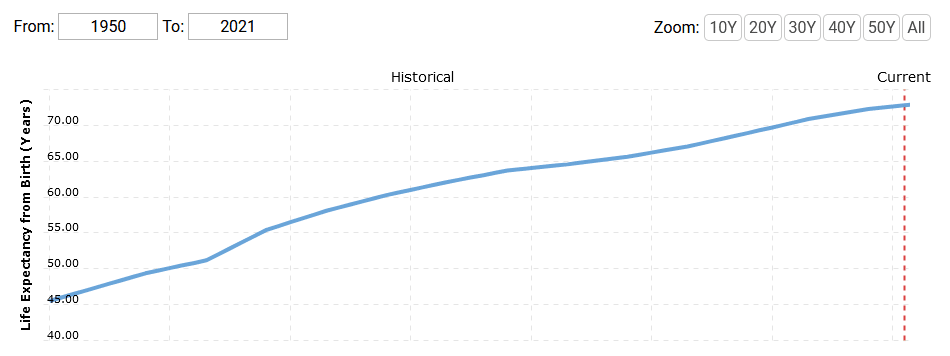

The reason I like investing in this sector is that I see bright future in it. There are more and more old people as life expectancy is rising all across the globe (see the picture below). And guess who uses the healthcare services & products the most? Yea – the old guys. And there is more and more of them!

Life expectancy worldwide, from 1950 to 2021:

I think that after the Covid-19 pandemic the overall trend in strong and growing Healthcare sector will continue and become even stronger. I think there will be even more emphasis on new drug development, vaccines, prevention, … All that will be helping the Healthcare companies thrive.

Leading companies: Johnson & Johnson , UnitedHealth, Pfizer, …

Healthcare: Sector Specifics

Patents: Biotechnology companies and companies that develop new drugs rely on patents and laws to protect their intellectual property. However, patents only last so long, so a company might benefit from a special drug they invented only for a limited time. Then the patent expires and the edge the company had is over.

It’s generally safer to invest in bigger companies, that have more products and projects going on rather than in a small company that relies on one patent.

Price inelastic demand: What I like about the Healthcare sector is that demand for those products is inelastic. This means that people will buy this stuff no matter what. No matter if the economy is doing well or no, no matter if people lost a job or have excess money, they will always buy drugs when they fall sick. That’s the beauty of this sector – it’s not as related to the economic cycle.

Technology

The Technology sector consists mostly of companies that develop software, manufacture computers, mobiles, televisions, other electronics, and semiconductors.

One of its main features is that it moves forward fast as new technologies are being constantly developed. New iPhone every year – that’s what I am talking about.

The Technology sector is very popular, fast growing, and as a result of this technology stock prices tend to shoot high. In my opinion, this sector is already very overpriced but in this case, sky is the limit I guess. There is no telling how much more the stock prices in this sector can be inflated.

The thing to keep in mind here is that inflated stocks drop fast and hard (remember the dot-dom bubble in 2000?) – and that’s why I mostly avoid this sector.

Leading companies: Apple, Microsoft, NVIDIA, …

Technology: Sector Specifics

Sensitive to Economic Cycles: Technology companies are very sensitive to economic cycles. The reason is that if there is trouble in the economy and people lose jobs or they face financial problems, then one of the first things they will stop buying is the new technology. If you are short on cash, then you won’t buy a new iPhone, Apple Watch, new laptop, new television, … No, you will keep your old one.

So, when there is an economic recession, the demand for technologies is significantly weakened. This results in dropping prices of such companies.

Risky stocks: If there is any economic problem, recession or crisis, then I expect those stocks to fall fast and hard.

There are three reasons:

1. Technology stocks are overpriced

2. They are closely bound to the economic cycle

3. The companies sell non-essential stuff

All this makes those companies very sensitive to any kind of problems. And if they crash, then very little will remain (they usually own very little in the way of tangible goods).

What’s next?

In the next part, we will talk about the most important stock fundamentals and how to use them to pick the right stocks!

I will also show you my favorite stock screener which I use to look for new potential investments!

This article is a part of a four-part Beginners Guide to Stock Investing. Here are links to all parts:

Stock Investing Course

Want to get a complete A-Z course on stock investing? We’ve got you covered! In my brand new course, I will teach you everything you need in a series of 70 videos (15+ hours total) and give you all the indicators & tools you are going to need along the way!