This article is a part of a four-part Beginners Guide to Stock Investing. Here are links to all parts:

In the previous article, we were talking about basic fundamentals, and how to use them to pick the right stocks.

Picking the right stock is not all you need to do to become a successful investor though. You also need to pick a good time to buy that stock. It’s no use buying the best company if it’s overpriced, right? You need to buy the right company at the right time.

What I am about to show you is how to pick the right time for buying your stocks.

We are going to need only one, simple but effective tool – Volume Profile.

Volume Profile

Volume Profile is an indicator that shows Volume at Price. It helps to identify where the BIG financial institutions put their money and helps to reveal their intentions. Volume Profile reveals strong Support zones which are places where the stock price is very likely to stop falling and start rising again. Our main intention when using Volume Profile is to find such Support and buy our stocks there.

What Does Volume Profile Look Like?

Volume Profile can have many shapes depending on how the volumes get distributed. It is created using horizontal lines (it is a histogram). The wider the profile is the more volume was traded at the given level.

We are going to focus mostly on areas where the Volume Profile is the widest as those areas represent places where the BIG guys were active the most. Those places are strong Supports and we will want to place our trade entries there.

Here is an example of what Volume Profile can look like:

What I am going to show you next is how you can use Volume Profile to pick good Support levels.

The Main Logic Behind my Setups is:

- Never ever buy a stock when it is at its historical highs – maximum price ever. That’s simply crazy and smart investors don’t do that. What you need to do is wait for the stock price to drop, then buy it! But drop where? See step two…

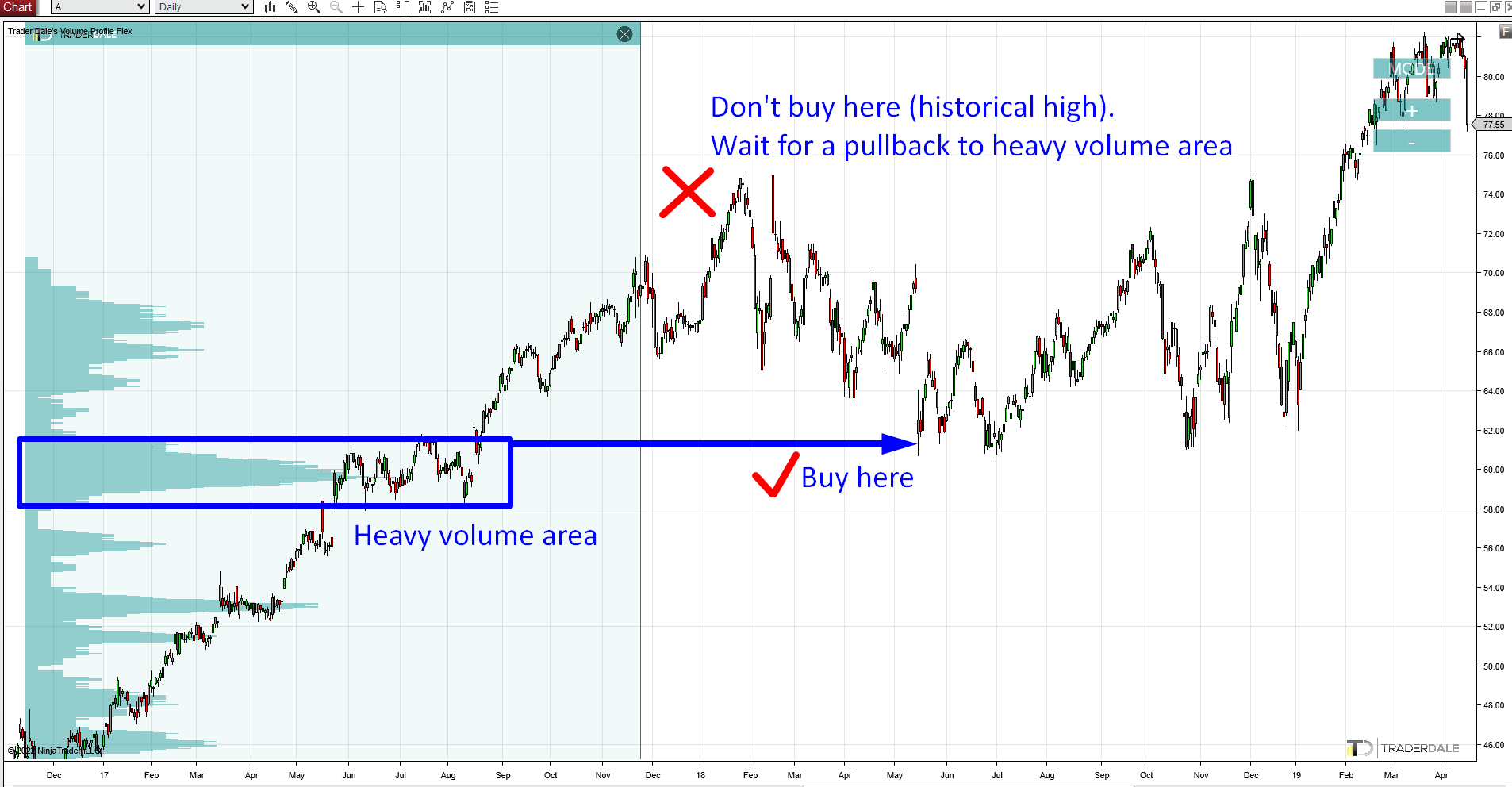

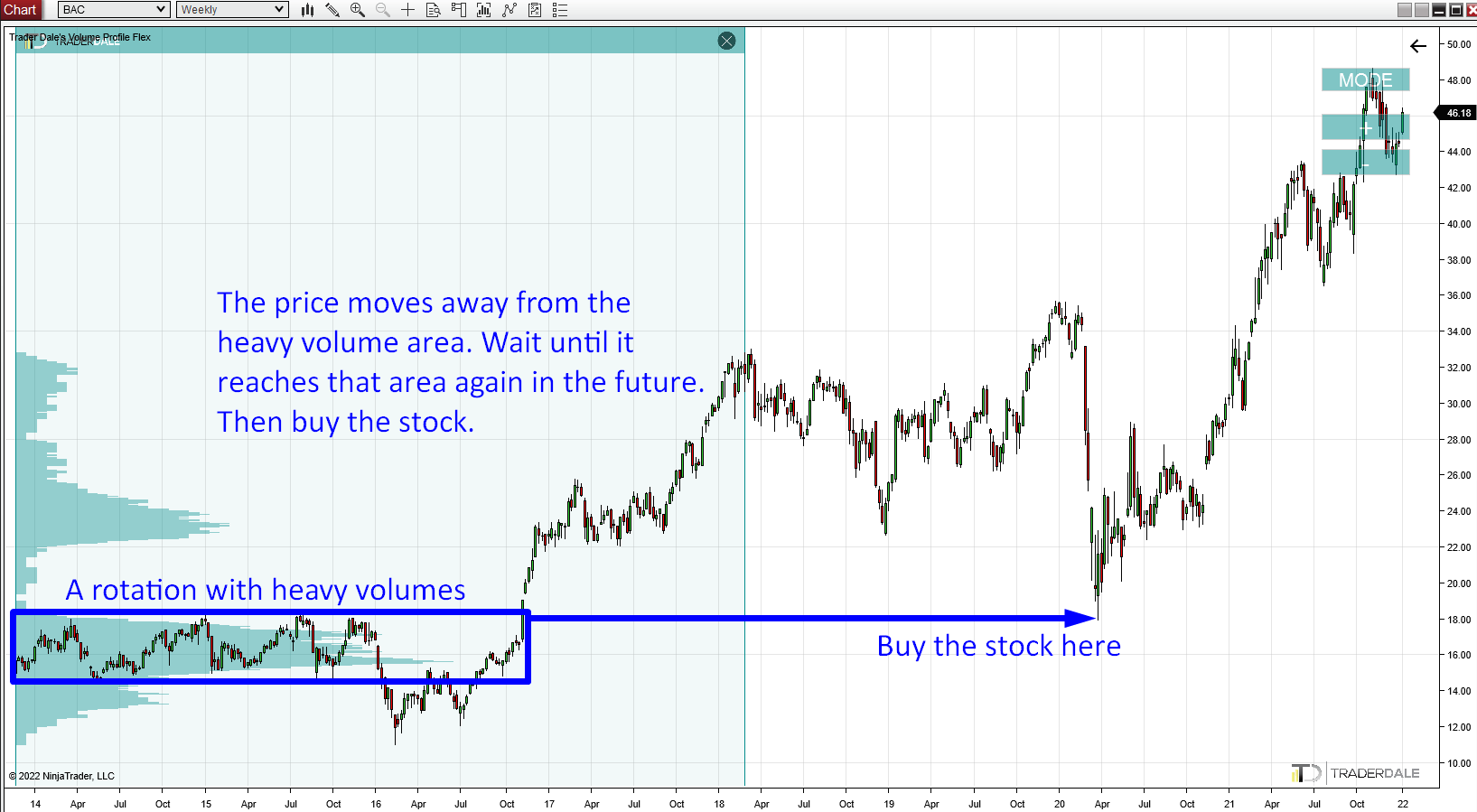

- The best places to enter your investment trade is in heavy volume areas. You simply wait until your desired stock drops to such heavy volume area, and then you buy it. Like in the example below:

The Daily chart above shows the stock of a company called Agilent Technologies (A). A stock I randomly picked to show you how we will go about this. As you can see, the price was rising and creating new highs. Your risk is significantly higher if you were to buy the stock as it was rising up and up. It’s better to wait for a pullback (a discount).

In this example, I used Volume Profile to identify a place where heavy volumes were traded – in other words where trading institutions placed a lot of their trades. This area represents a good place to buy the stock. You only need to be patient enough to wait for the price to drop back to this price level. In this case, it took almost a year for the price to return back to this heavy volume zone. Still, it was worth the wait.

Volume Profile Setup #1: Volume Accumulation Setup

This is my favorite setup. I use it not only for stock investing but also for my intraday and swing trading (I teach this in my Elite Pack course).

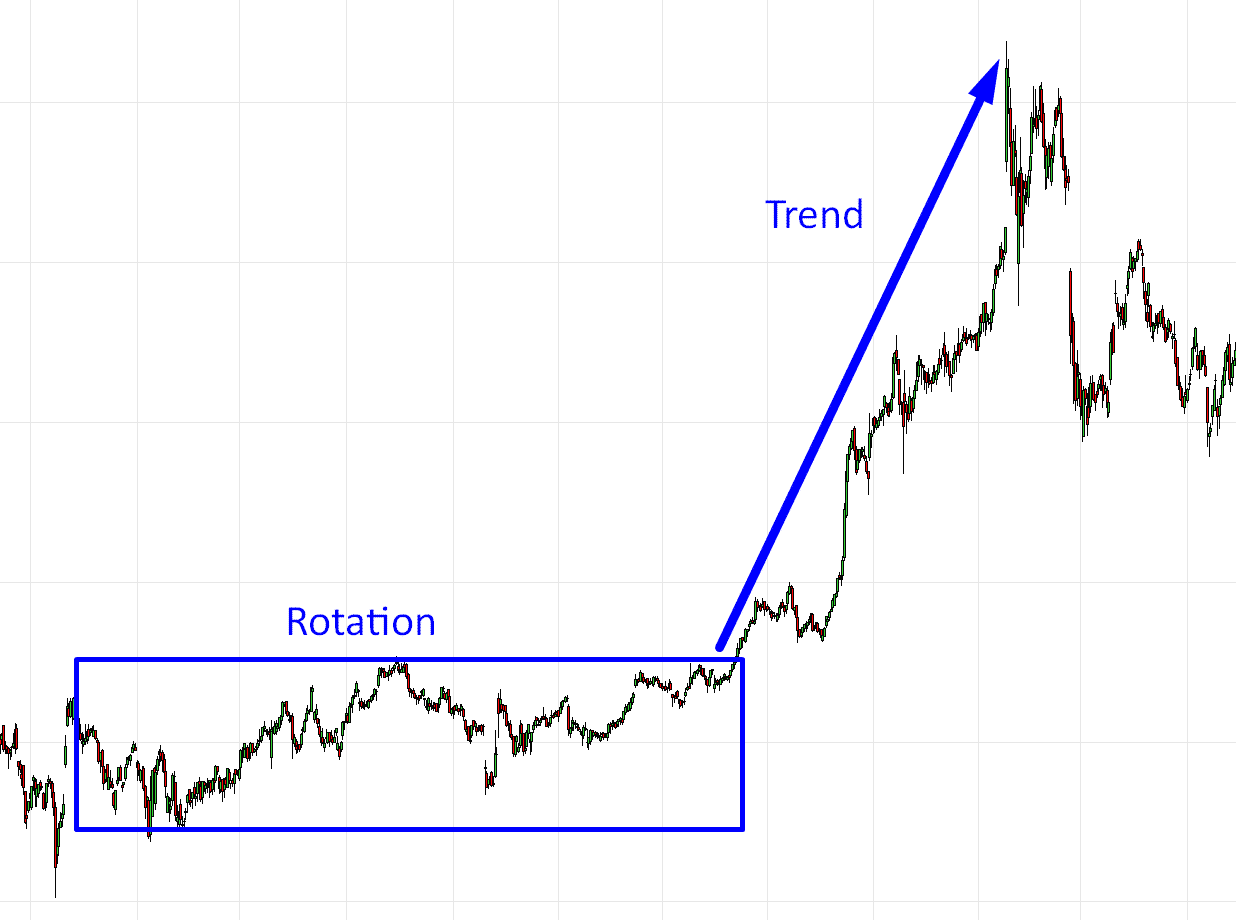

It is based on the fact that the BIG trading institutions first need to enter their huge trading positions before manipulating the market into a new trend. They enter their huge positions in a rotation. This is the only place where they can accumulate such a large volume without being seen and without their intentions being recognized.

Exact Steps to Volume Accumulation Setup

1. Look for a price rotation/tight channel that is followed by a strong uptrend. What happens in such a formation is that the BIG institutions are accumulating their trading positions (in the rotation) and then they start the trend.

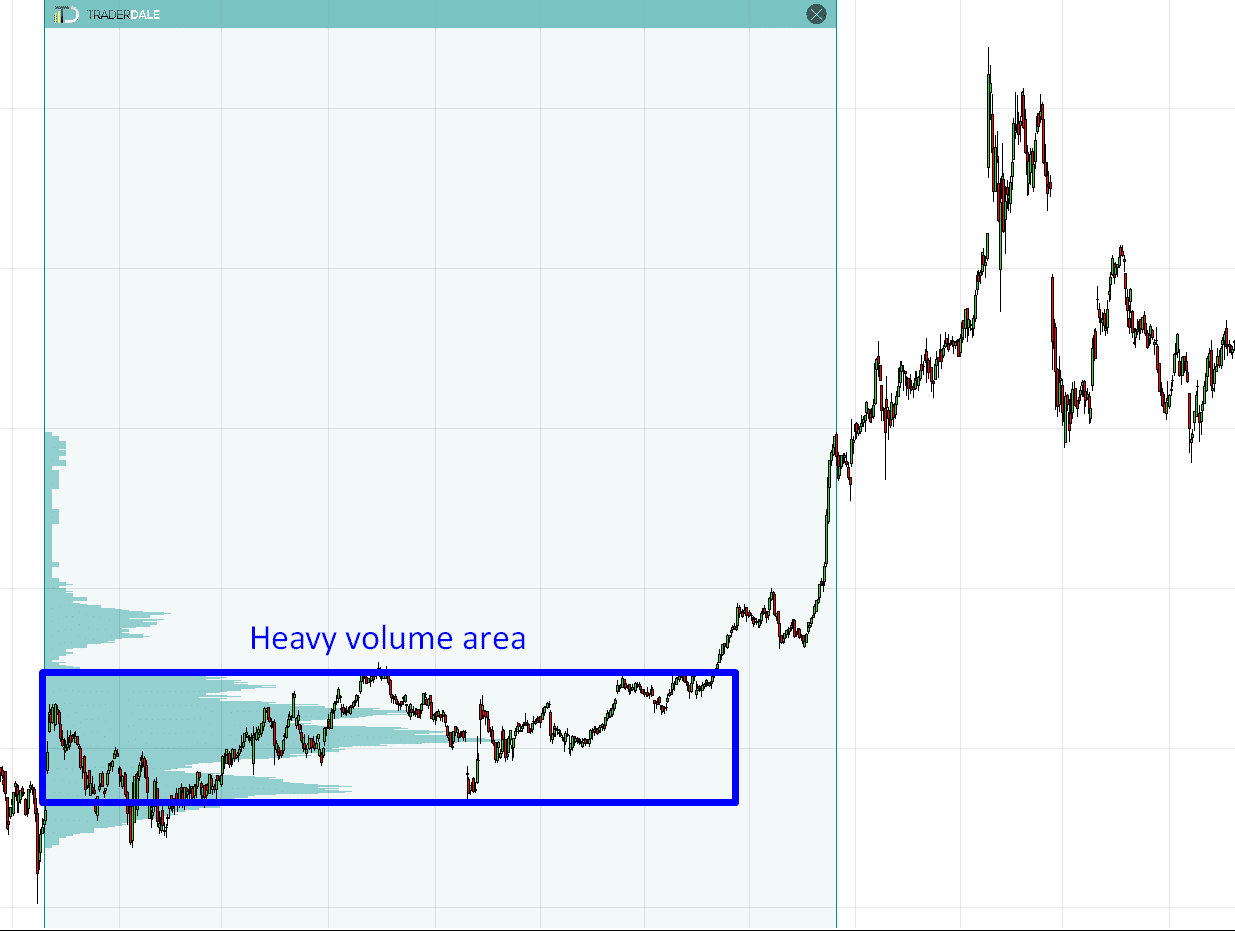

2. Use Volume Profile in the rotation area to identify where the heaviest volumes were. The area where the heaviest volumes got traded is a strong Support.

3. Wait for the price to make it back into the heavy volume area again and buy your stock there.

You need to be patient. Sometimes this will take months, even years for the price to make it back. It doesn’t really matter how long it takes though. Markets have a great memory. You only need to set an alert or a limit order there so you don’t miss the opportunity.

You should have a watchlist with for example 30-50 stocks with limit orders like this, so it’s not going to be like you’re waiting a year for a single investment opportunity.

Here is one more example of the Volume Accumulation setup:

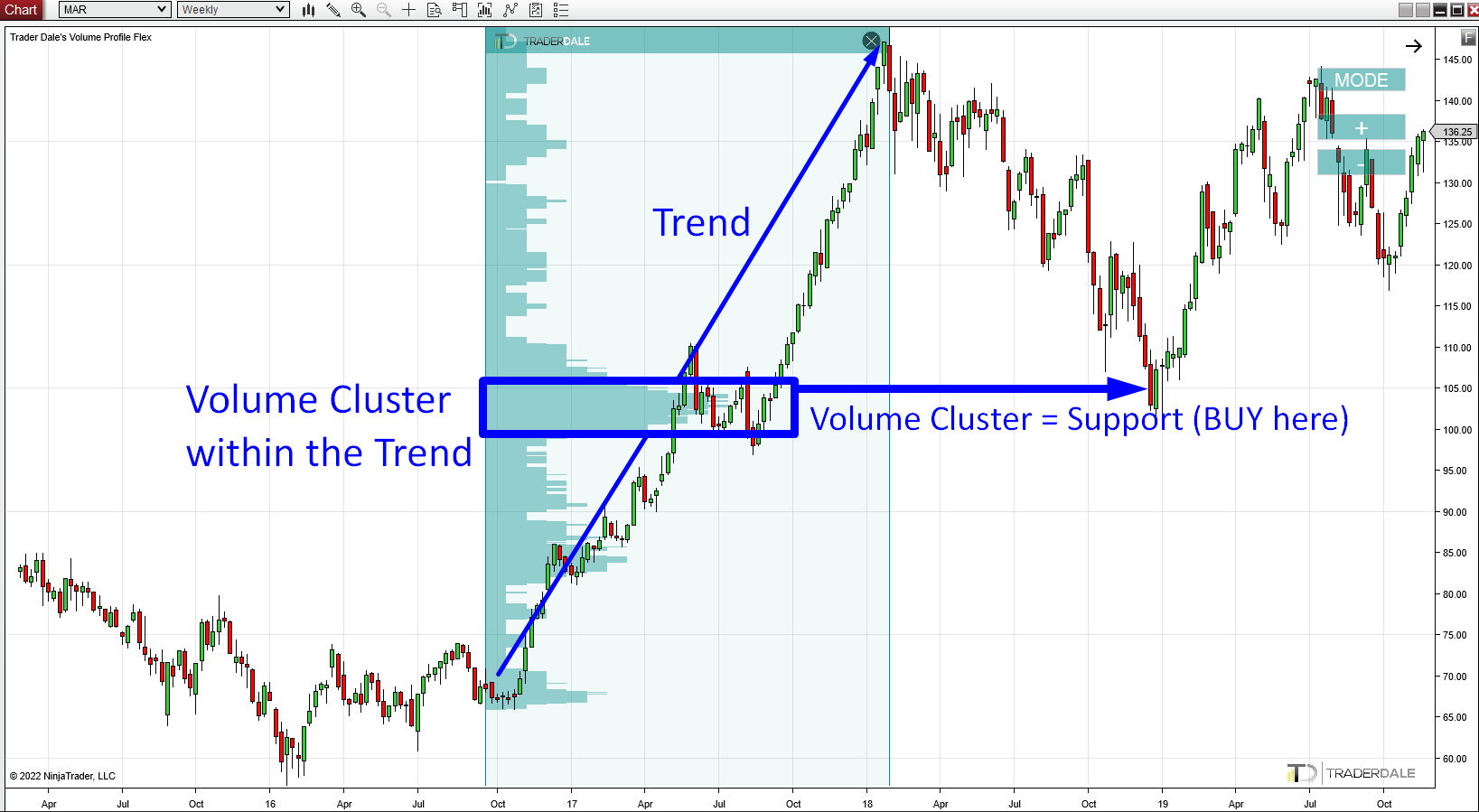

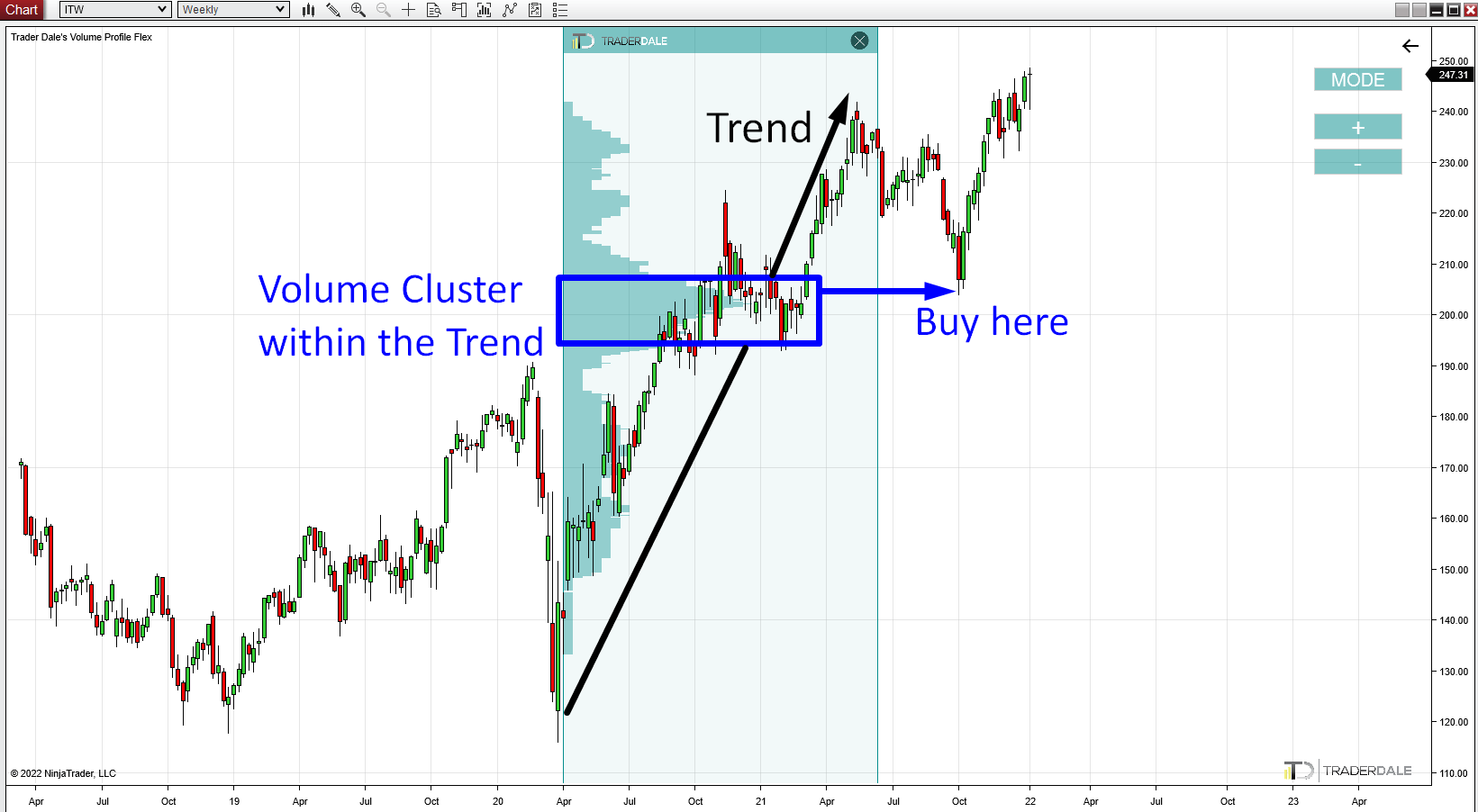

Volume Profile Setup #2: Trend Setup

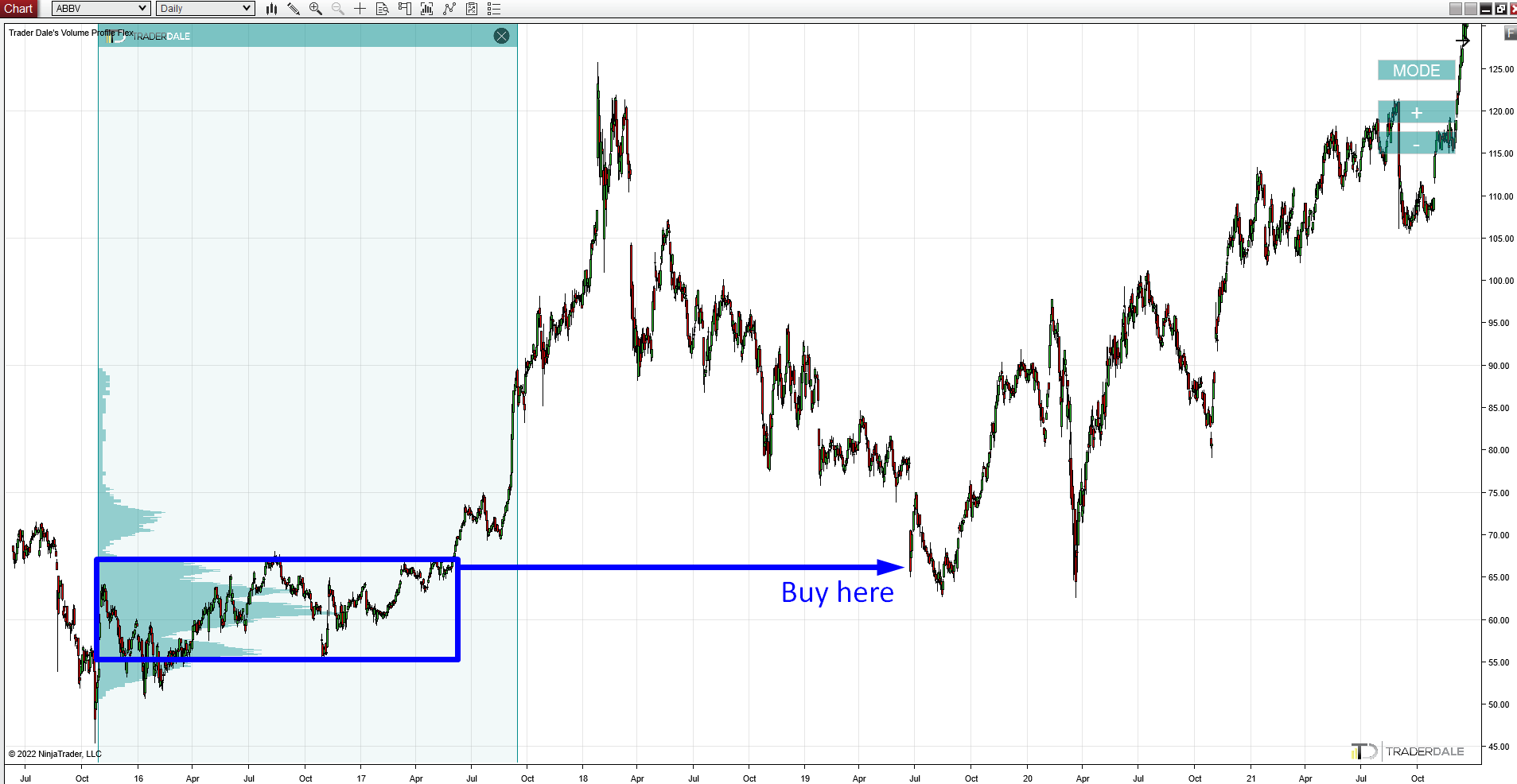

This setup is based on the fact that there is not much time for buying huge amounts of stocks when there is a trend – as we said earlier, the BIG guys need time to allocate their money. But, sometimes, the trend movement halts for a bit, and the BIG guys have some time to buy bigger amounts of stocks.

Such areas show as a little “bump” on the otherwise thin Volume Profile. Those “bumps” are called Volume Clusters. Volume Clusters often work as strong Support zones. The price tends to react to them and bounce off them. That’s why such places are ideal for buying your stocks.

Exact Steps to the Trend Setup

- There needs to be a clear and strong uptrend. It needs to be easy to see and easy to identify. Ideally on a Daily or Weekly chart.

- When you have found that uptrend, use the Volume Profile indicator to look into the volume distribution within the uptrend.

- Look for a significant Volume Cluster (or more Volume Clusters) that were created within the trend. The Volume Cluster represents a place where huge volumes were traded, and where institutions bought most of their stocks.

- Then you wait for a pullback. Ideally set a Limit order so you don’t miss your opportunity. When the price drops and hits the area where the Volume Cluster was, then you buy your stocks.

Platform & Data

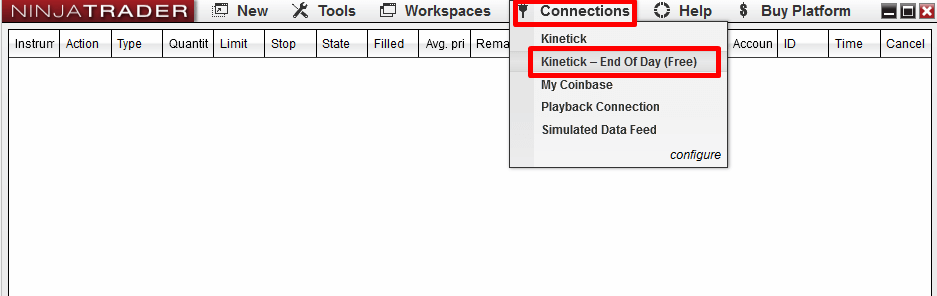

The platform I use to do Volume Profile analysis on stocks is called NinjaTrader 8. It is a free platform. They have a paid version of it, but you don’t need it. The free version has all the functions we need.

You can get the platform here: NinjaTrader 8 platform (free)

Getting the stock data there is simple as NinjaTrader 8 provides free End-Of-Day data (which is all you need as there is no need for more detailed data). Simply go to the platform control center, go to Connections, and connect to the End-Of-Day Datafeed there.

Where to Get the Volume Profile Indicator?

Volume Profile is not a standard indicator and you won’t find it among indicators that any standard (or free) platform provides.

You can get my custom-made Volume Profile indicator by getting any of my trading courses.

It is also included in my new course – Stock Investing With Volume Profile

Stock Investing Course

Want to get a complete A-Z course on stock investing? We’ve got you covered! In my brand new course, I will teach you everything you need in a series of 70 videos (15+ hours total) and give you all the indicators & tools you are going to need along the way!

This article is a part of a four-part Beginners Guide to Stock Investing. Here are links to all parts:

Your Volume Profile teachings have changed my outlook on trading forex currencies completely.

In recent times I noticed a vast improvement and a reduction in losses as I am following every little bit of information on your daily video guides as well as your free books that I downloaded.

As I am trading forex only at this stage I would like to get hold of your articles on Beginners Guide to Stock Investing asap.

Thank you for sharing your in-depth knowledge of Volume Profile with us…absolutely great information.

“I always thought I knew a lot about the stock market, but despite trading currencies in the forex market, it was very difficult to win a fair battle against the market. These lessons, including the combo I bought here, have opened my eyes to the realities of trading in the real world. For the first time in my life, I am truly profitable with no significant trading inconveniences. Although I still occasionally lose a trade, most trades are now profitable, which reassures me in the long term. If this were not the case, I would mention it in my comments. Giving credit where credit is due is the least we can do.”